Accounting for Merchandising Operations

Summary

TLDRThis video discusses accounting for trading companies, focusing on key concepts such as sales revenue, cost of goods sold, and operating expenses. It explains the differences between perpetual and periodic inventory systems, illustrating how to record transactions related to purchases, sales, and returns. The video also covers specific scenarios involving discounts and freight costs under different shipping terms, providing practical examples to enhance understanding. By breaking down the accounting processes, it aims to equip viewers with essential knowledge for managing financial transactions in trading operations.

Takeaways

- 📊 Takeaway 1: The main focus is on accounting principles for trading companies, including the distinction between sales revenue and service revenue.

- 💼 Takeaway 2: Trading companies generate income primarily through the buying and selling of inventory, categorized under sales revenue.

- 📉 Takeaway 3: Cost of Goods Sold (COGS) represents the total expenses for inventory sold during an accounting period, impacting gross profit.

- 💵 Takeaway 4: Operating expenses include salaries, utilities, rent, and advertising, which are detailed in the income statement.

- 🔄 Takeaway 5: Two inventory recording systems are discussed: the perpetual inventory system and the periodic inventory system.

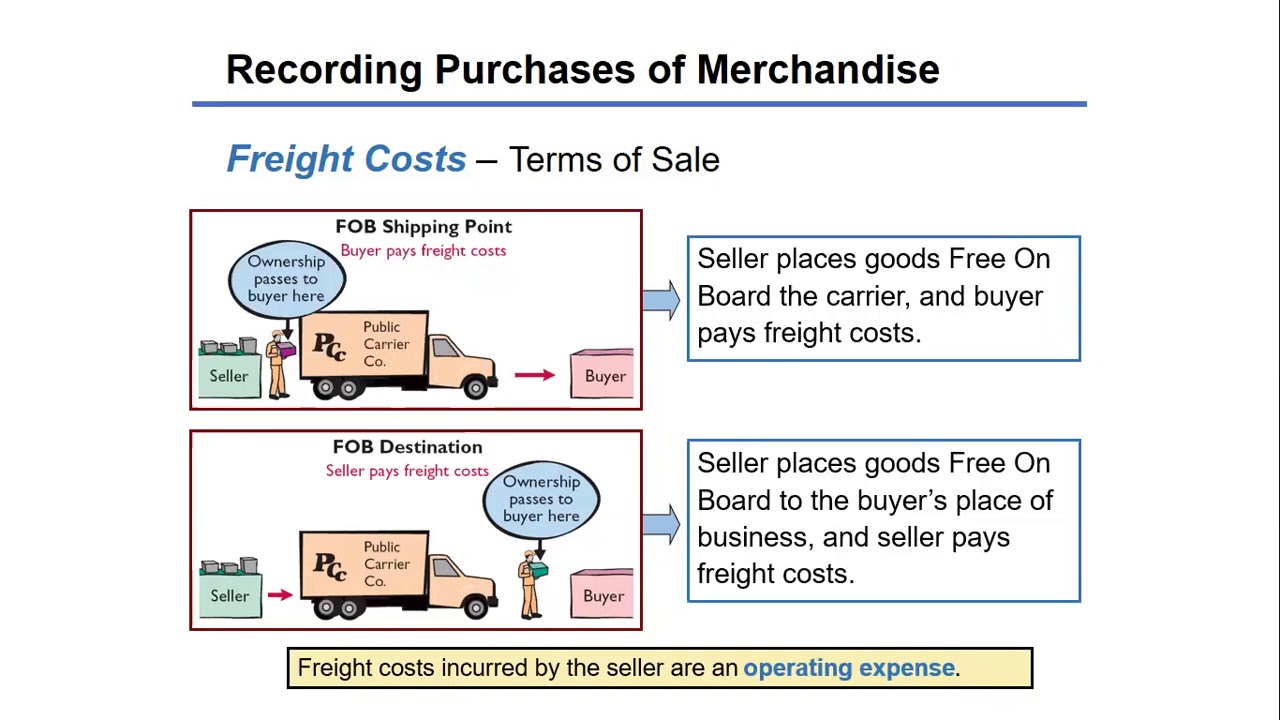

- 🚚 Takeaway 6: Ownership transfer conditions (FOB shipping point vs. FOB destination) dictate who bears shipping costs.

- 📝 Takeaway 7: Journal entries differ between perpetual and periodic inventory systems, especially in recording purchases and sales.

- 🔄 Takeaway 8: Sales returns and allowances require different journal entries depending on the inventory system used.

- 💳 Takeaway 9: Discounts on sales transactions can affect journal entries and the cash received by the company.

- 🗓️ Takeaway 10: The process of settling accounts payable involves consideration of purchase returns and the timeline for discounts.

Q & A

What are the main differences between trading companies and service companies?

-Trading companies generate revenue primarily from buying and selling inventory, recording it as sales revenue. In contrast, service companies earn revenue from providing services, which is recorded as service revenue.

What are the two main categories of expenses for trading companies?

-The two main categories of expenses for trading companies are Cost of Goods Sold (COGS), which includes the total cost of inventory sold during an accounting period, and operating expenses, which cover ongoing costs like salaries, utilities, and advertising.

How does the perpetual inventory system differ from the periodic inventory system?

-The perpetual inventory system continuously updates inventory records with each transaction, making it suitable for high-value items. The periodic inventory system updates records only at the end of an accounting period.

What does FOB shipping point mean regarding inventory ownership transfer?

-FOB shipping point means that ownership of the goods transfers from the seller to the buyer as soon as the goods leave the seller's warehouse, and the buyer is responsible for the shipping costs.

What is the accounting treatment for inventory purchases under the perpetual inventory system?

-Under the perpetual inventory system, inventory purchases are recorded by debiting the inventory account and crediting either cash or accounts payable, depending on whether the purchase was made in cash or on credit.

How are sales transactions recorded in the periodic inventory system?

-In the periodic inventory system, sales transactions are recorded with a single journal entry that debits accounts receivable or cash and credits sales revenue, without affecting the inventory account at the time of sale.

What are the journal entries for recording a sales return in a perpetual inventory system?

-In a perpetual inventory system, a sales return requires two journal entries: one debiting the sales returns account and crediting accounts receivable, and another debiting inventory and crediting COGS for the cost of the returned goods.

What happens to accounts payable when a company receives a return of goods purchased on credit?

-When a company receives a return of goods purchased on credit, accounts payable is debited to decrease the liability, while the return account is credited to reflect the reduction in the amount owed.

How is a discount recorded when a customer pays their account early?

-When a customer pays their account early and qualifies for a discount, the discount is recorded by debiting the sales discount account and crediting accounts receivable, reflecting the reduced amount collected.

What is the effect of not applying a discount within the specified period?

-If a customer fails to apply a discount within the specified period, they must pay the full invoice amount, which will be recorded as a debit to cash and a credit to accounts receivable.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

5.0 / 5 (0 votes)