MyInvois Portal User Guide (Chapter 8) - Taxpayer Profile Management

Summary

TLDRThis video guides users through the process of accessing and managing taxpayer profiles on the MyInvoice portal. It explains how users can view, edit, and update their taxpayer information, such as SST registration numbers and MSIC codes. The script also highlights features like managing notification profiles, switching between different taxpayer profiles without logging in and out, and the role of intermediaries and representatives. Overall, it simplifies the portal's use, enhancing the user experience for directors, representatives, and intermediaries.

Takeaways

- 😀 Taxpayer profiles are unique to each company or organization, while user profiles are specific to each user of the My Invoice portal.

- 😀 Users can access multiple taxpayer profiles if their organization rules permit, including those assigned to different organizations.

- 😀 A taxpayer profile contains essential information like taxpayer's name, MSIC code, SST, and tourism tax registration number.

- 😀 Directors, user representatives, and intermediaries have access to taxpayer profiles to manage company or organization information.

- 😀 To view your taxpayer profile, click the 'Profile' drop-down menu at the top right corner and select 'View Taxpayer Profile'.

- 😀 The general information tab includes details such as the taxpayer's name, tax identification number, MSIC code, and SST registration number.

- 😀 Users can edit their taxpayer profile by clicking the 'Edit' button, allowing changes to fields like SST registration number and tourism tax registration number.

- 😀 After making changes, remember to click 'Save' to ensure that the updates are stored.

- 😀 The taxpayer profile also contains details on notifications, digital profiles, intermediaries, and representatives.

- 😀 Users can switch between different taxpayer profiles within the My Invoice portal without needing to log in and out using separate credentials.

- 😀 To switch profiles, click the 'Profile' drop-down, select 'Switch Taxpayer', choose the profile from the list, and click 'Switch' to be redirected to the new profile.

Q & A

What is the difference between taxpayer profiles and user profiles in the My Invoice portal?

-Taxpayer profiles are unique to each company or organization and contain information such as the taxpayer's name, MSIC code, SST, and tourism tax registration numbers. User profiles, on the other hand, are unique to each individual using the My Invoice portal and determine access to multiple taxpayer profiles based on the rules set by the organization.

Can a user access multiple taxpayer profiles on the My Invoice portal?

-Yes, a user can access multiple taxpayer profiles if they have rules within different organizations they are assigned to.

What kind of information does a taxpayer profile contain?

-A taxpayer profile contains details such as the taxpayer's name, MSIC code, SST registration number, tourism tax registration number, and other relevant company or organization information.

Who can access taxpayer profiles in the My Invoice portal?

-Taxpayer profiles can be accessed by directors, user representatives, and intermediaries of the company or organization.

How do you view your taxpayer profile in the My Invoice portal?

-To view your taxpayer profile, go to the My Invoice landing page, click the profile dropdown in the top right corner, and then select 'View taxpayer profile'.

What information is displayed when you first access your taxpayer profile?

-Upon accessing the taxpayer profile, you will first see the taxpayer's identification number and name, followed by general information such as the MSIC code, SST registration number, and tourism registration number.

How do you edit information in your taxpayer profile?

-To edit your taxpayer profile, click the 'Edit' button in the top right corner of the profile page. This allows you to make changes to fields like the SST registration number, tourism registration number, and other information.

What should you do after editing your taxpayer profile information?

-After making changes to your taxpayer profile, make sure to click the 'Save' button to store the changes.

What additional details are included in the taxpayer profile besides basic information?

-In addition to basic information, the taxpayer profile also contains details on notifications, digital profiles, intermediaries, and a table of representatives.

How do you switch between different taxpayer profiles in the My Invoice portal?

-To switch between taxpayer profiles, click the profile dropdown at the top right corner and select 'Switch taxpayer'. Then, choose the desired taxpayer profile from the dropdown list and click 'Switch'. This will redirect you to the selected taxpayer profile.

Outlines

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenMindmap

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenKeywords

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenHighlights

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenTranscripts

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenWeitere ähnliche Videos ansehen

Cara Login CORETAX Setelah Melakukan Aktivasi Akun Wajib Pajak Orang Pribadi

MyInvois Portal User Guide (Chapter 1) - First Time Log In

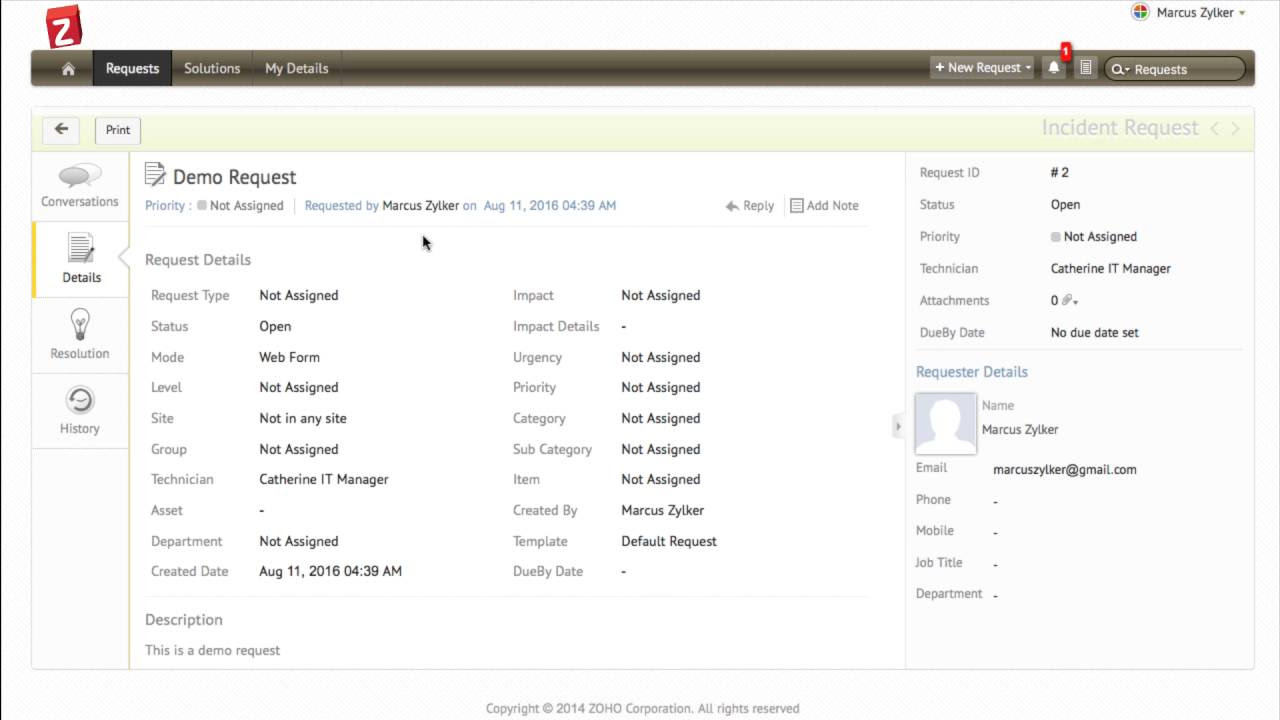

Self service portal in ServiceDesk Plus Cloud

MyInvois Portal User Guide (Chapter 4) - Submissions Management

Add a RFIdeas PCProx Reader to a Thin Client

Tutorial Login dan Edit Profil Aplikasi RHA

5.0 / 5 (0 votes)