LAPORAN LABA RUGI PADA PERUSAHAAN DAGANG

Summary

TLDRThis tutorial explains how to prepare an income statement for a trading company, covering key formulas and the step-by-step process. It outlines how to calculate net sales, gross profit, operating profit, and net profit. The process begins with calculating net sales by subtracting sales returns and discounts from total sales. Then, it moves on to calculating gross profit by subtracting the cost of goods sold (COGS) from net sales. Operating expenses are deducted from gross profit to find operating profit, and non-operating income and expenses are factored in to determine the final net profit. The tutorial offers practical examples to guide users through the calculations.

Takeaways

- 😀 To create a profit and loss statement for a trading company, we need to understand key formulas for calculating gross profit, operating profit, and net profit.

- 😀 Gross profit is calculated by subtracting the cost of goods sold (HPP) from net sales, where net sales are total sales minus sales returns and discounts.

- 😀 The formula for operating profit is: Operating profit = Gross profit - Operating expenses such as salaries, rent, utilities, and insurance.

- 😀 The net profit formula is: Net profit = Operating profit + Other income (e.g., interest income) - Other expenses.

- 😀 To calculate net sales, subtract sales returns and sales discounts from total sales.

- 😀 The cost of goods sold (HPP) is deducted from net sales to determine gross profit.

- 😀 After calculating gross profit, subtract operating expenses (e.g., salaries, rent, electricity) to get operating profit.

- 😀 Ensure not to double-count certain costs like purchase shipping, which should already be included in the cost of goods sold.

- 😀 When calculating net profit, add any other income (e.g., interest) and subtract other non-operating expenses.

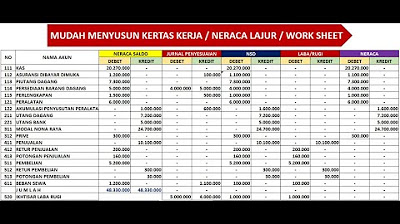

- 😀 In this example, the net sales were calculated as 102.5 million, the gross profit was 78.5 million, and the final net profit was 72 million.

- 😀 A clear understanding of how to break down the profit and loss statement into its components—net sales, gross profit, operating profit, and net profit—is essential for accurate financial reporting.

Q & A

What is the first step in creating an income statement for a trading company?

-The first step is to calculate the gross profit, which is obtained by subtracting the Cost of Goods Sold (HPP) from net sales.

How do you calculate net sales in the income statement?

-Net sales are calculated by subtracting sales returns and sales discounts from the total sales.

What is the formula for calculating gross profit?

-The formula for gross profit is: Gross Profit = Net Sales - Cost of Goods Sold (HPP).

Why is HPP important in the calculation of gross profit?

-HPP (Cost of Goods Sold) represents the direct costs incurred in producing the goods sold, and is subtracted from net sales to determine the gross profit.

How is operating profit calculated in the income statement?

-Operating profit is calculated by subtracting operating expenses from the gross profit. The formula is: Operating Profit = Gross Profit - Operating Expenses.

What kind of expenses are included in operating expenses?

-Operating expenses include salaries, rent, utilities, and insurance, which are necessary for the company's day-to-day operations.

What should not be included in operating expenses, and why?

-Purchase shipping costs (or freight) should not be included in operating expenses because they are already factored into the HPP, to avoid double counting.

What is the final step in calculating net profit?

-The final step is to add non-operating income (such as interest income) and subtract any non-operating expenses from the operating profit to obtain the net profit.

What are examples of non-operating income in a trading company?

-Non-operating income in a trading company can include earnings from interest, dividends, or other non-core business activities.

How is the net profit derived if there are no non-operating expenses?

-If there are no non-operating expenses, the net profit is simply the operating profit plus any non-operating income (e.g., interest income).

Outlines

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنMindmap

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنKeywords

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنHighlights

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنTranscripts

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنتصفح المزيد من مقاطع الفيديو ذات الصلة

5.0 / 5 (0 votes)