LAPORAN KEUANGAN PERUSAHAAN DAGANG

Summary

TLDRThis educational video guides viewers through the process of preparing financial statements for a trading company. It covers the core concepts of the accounting cycle, focusing on the creation of the income statement, statement of changes in equity, and balance sheet. Key topics include calculating net sales, cost of goods sold, gross profit, operating expenses, and net profit. The video also emphasizes the importance of using work papers for accuracy and provides step-by-step instructions, with practical examples from a sample company. It's an essential resource for understanding financial reporting in business accounting.

Takeaways

- 😀 The importance of financial statements in assessing the financial position of a business, including the profit and loss statement, balance sheet, and statement of changes in equity.

- 😀 A clear breakdown of how to calculate net sales by subtracting sales returns and sales discounts from gross sales.

- 😀 The process of calculating net purchases, which involves adding freight-in costs and subtracting purchase returns and purchase discounts from total purchases.

- 😀 Explanation of the formula to calculate the cost of goods sold (COGS) using the formula: Goods Available for Sale - Ending Inventory.

- 😀 How to calculate gross profit by subtracting the cost of goods sold from net sales.

- 😀 A step-by-step guide on how to prepare a profit and loss statement, showing sales, purchases, gross profit, and operating expenses.

- 😀 The importance of accurately filling out the statement of changes in equity, considering initial and ending capital, and adding or subtracting profits or losses.

- 😀 The structure of a balance sheet, which lists assets (activa) and liabilities and equity (pasiva), ensuring that total assets balance with total liabilities and equity.

- 😀 How to ensure the accuracy of the final financial statements by cross-checking data and reconciling discrepancies between the profit and loss and balance sheet.

- 😀 A practical example from a fictional company, 'Raya Indah', to demonstrate how to apply the formulas and concepts in a real-world context.

- 😀 The significance of ensuring that all financial data is accurately transferred from the work papers into the final financial reports to avoid errors.

Q & A

What is the main focus of the lesson in the video?

-The main focus of the lesson is on how to prepare financial statements for a trading company, specifically the income statement, changes in equity, and the balance sheet.

What is the significance of financial statements in a company?

-Financial statements, such as the income statement and balance sheet, are crucial because they provide insights into the company's financial position, helping stakeholders understand its profitability and financial health.

What is the purpose of a worksheet (kertas kerja) in financial reporting?

-The worksheet helps organize and summarize financial data, making it easier to prepare accurate financial statements by providing the necessary information for the income statement, balance sheet, and equity changes.

How do you calculate net sales according to the script?

-Net sales are calculated by subtracting returns and sales discounts from total sales.

What formula is used to determine gross profit in the lesson?

-Gross profit is determined by subtracting the cost of goods sold (HPP) from net sales.

What is the importance of understanding the concept of net income in financial reporting?

-Net income is crucial as it represents the company's profitability after all expenses, taxes, and costs have been deducted from total revenue, providing an overview of the company’s financial success.

How do you calculate the gross profit margin based on the script?

-Gross profit margin can be calculated by dividing the gross profit by net sales, providing a percentage that reflects the efficiency of the company in producing its goods.

What is the role of taxes in calculating net income as explained in the video?

-Taxes are deducted from pre-tax income to calculate the net income after taxes, which reflects the company's final profit after accounting for government obligations.

Why is the balance sheet divided into assets (aktiva) and liabilities + equity (pasiva)?

-The balance sheet is divided into assets and liabilities + equity to ensure that the company’s total assets are financed by either debt (liabilities) or owner’s equity, maintaining the accounting equation: Assets = Liabilities + Equity.

What does the script say about checking the accuracy of financial statements?

-The script emphasizes the importance of cross-checking the accuracy of financial statements by comparing figures in the worksheet with those in the income statement and balance sheet. Any discrepancies or imbalances may indicate errors in the reports.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Cara Buat Laporan Laba Rugi, Neraca, dan Perubahan Modal - Siklus Akuntansi 4

2 Konsep Dasar Akuntansi Keuangan 1

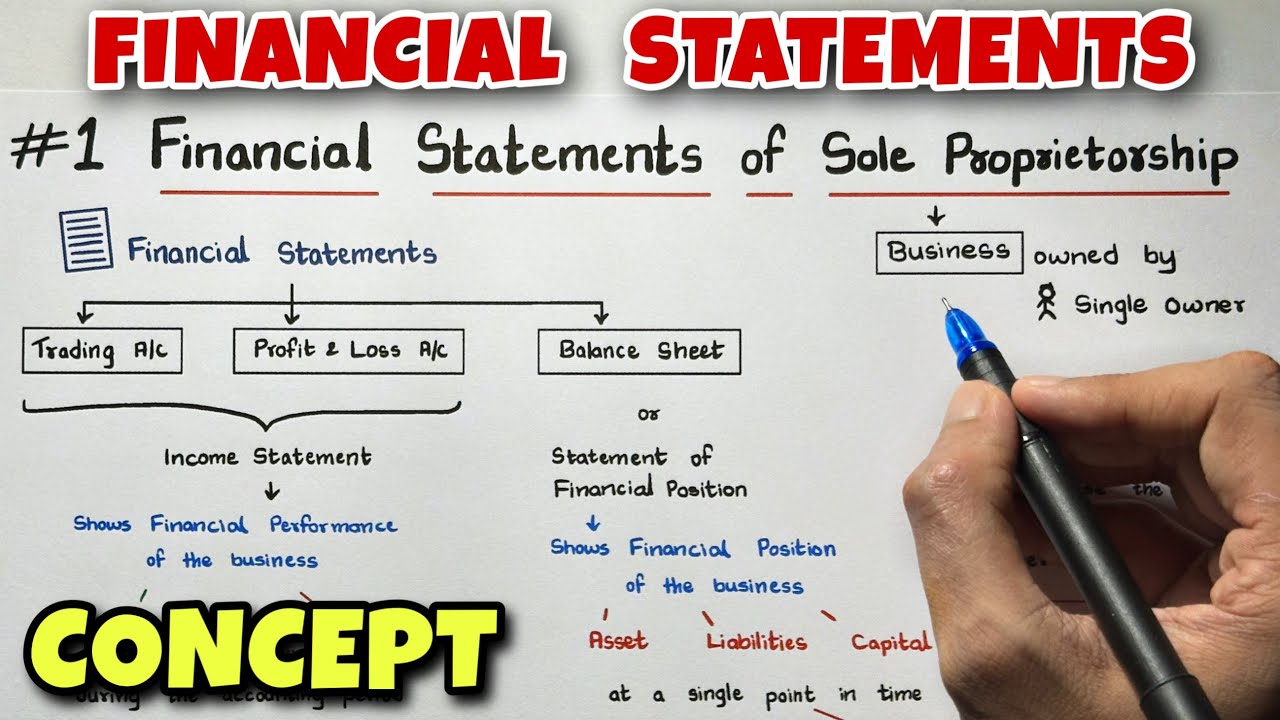

#1 Financial Statements - Concept - Easiest Way - Class 11 - By Saheb Academy

Basic Financial Statements

BELAJAR ACCURATE ONLINE 1 - MENYIAPKAN DATA USAHA PERUSAHAAN DENGAN ACCURATE ONLINE

mgt201 short lectures || vu mgt201 short lectures || Mgt201 vu guess paper || vu mgt201 mcqs

5.0 / 5 (0 votes)