Video Pembelajaran Akuntansi : Jurnal Penyesuaian (Perusahaan Dagang)

Summary

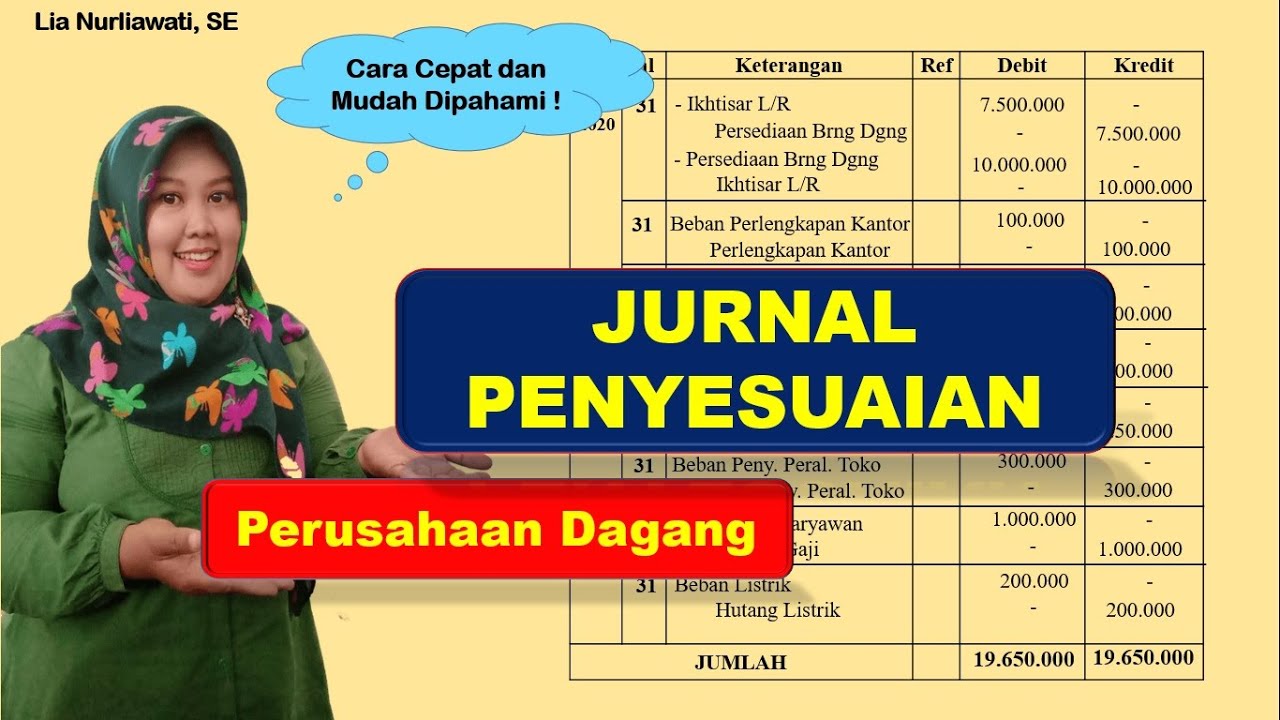

TLDRThis video tutorial explains how to prepare adjustment journals for a trading company at the end of a financial period. It covers essential adjustments such as inventory, office and store supplies, prepaid advertising, depreciation, salaries payable, and electricity expenses. The presenter walks through each adjustment step, providing detailed journal entries for each transaction. The process ensures accurate financial reporting by debiting and crediting accounts based on the provided data. The tutorial concludes with a balanced trial adjustment, confirming the correctness of the financial statements for the period.

Takeaways

- 😀 Adjusting journal entries are critical for ensuring that financial statements are accurate and reflect the true financial position of a business.

- 😀 The first step in preparing adjustment journal entries is to list the company's name and create columns for date, description, reference, debit, and credit.

- 😀 The date for journal adjustments is typically the last day of the accounting period, such as December 31st, for year-end adjustments.

- 😀 Inventory adjustments involve removing the initial inventory value from the balance sheet and adjusting to the new ending inventory value to avoid repetition in future reports.

- 😀 For office supplies, the used amount is calculated by subtracting the remaining supplies from the initial value, and the expense is recorded accordingly.

- 😀 Store supplies that have already been used are directly recorded as an expense without needing to subtract the used portion since it's already stated in the problem.

- 😀 Prepaid advertising costs need to be adjusted by recognizing the portion used during the period, such as recording 1/3 of a three-month prepaid ad cost for the month of December.

- 😀 Depreciation of office equipment and store equipment must be recorded as expenses at the end of the period, based on the calculated depreciation value.

- 😀 Salaries that are due to be paid after the period (accrued salaries) need to be recorded as a liability (salaries payable) and an expense in the adjustment journal.

- 😀 Unpaid utility expenses, such as electricity, are recorded as liabilities (utilities payable) with an offsetting expense entry at the end of the period to accurately reflect the outstanding obligations.

Q & A

What is the first step in creating adjustment journals for a trading company?

-The first step is to write the company's title and create columns with date, description, reference, debit, and credit.

Why is the date of December 31, 2020, used in the adjustment journals?

-December 31, 2020, is used because adjustment journals are made at the end of the period, which is typically the last day of the accounting period.

What should be done when the opening inventory figure appears in the trial balance?

-The opening inventory should be removed from the trial balance to avoid it appearing repeatedly in the worksheet, then the final inventory figure is added.

How is the journal entry for removing the opening inventory recorded?

-The journal entry is made by debiting the 'Cost of Goods Sold' account and crediting the 'Inventory' account to remove the opening inventory.

How should the journal entry for final inventory be recorded?

-The journal entry for final inventory is made by debiting the 'Inventory' account and crediting the 'Cost of Goods Sold' account.

What is the correct way to handle the office supplies that are left over at the end of the period?

-The supplies that are used up should be calculated by subtracting the remaining supplies from the amount initially recorded, then a journal entry is made debiting 'Supplies Expense' and crediting 'Supplies'.

Why is it unnecessary to subtract when recording used supplies for store supplies?

-It is unnecessary to subtract because the figure in the problem already represents the amount that has been used or consumed, so it can be recorded directly.

How do you adjust for prepaid advertising expenses?

-For prepaid advertising, the portion that applies to the current period (in this case, December) is calculated and then recorded as an expense, with the rest remaining as a prepaid expense.

How is depreciation for office equipment recorded in the adjustment journal?

-Depreciation for office equipment is recorded by debiting 'Depreciation Expense' and crediting 'Accumulated Depreciation'.

What is the correct way to adjust for salaries owed but not yet paid by the end of the period?

-For salaries owed, the journal entry is made by debiting 'Salaries Expense' and crediting 'Salaries Payable' to record the liability.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Jurnal Penyesuaian Perusahaan Dagang

Jurnal Penutup, Buku besar setelah penutupan, Neraca saldo setelah penutupan | PART 3

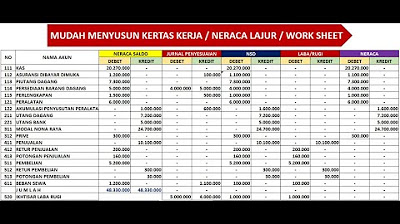

KERTAS KERJA - NERACA LAJUR - WORK SHEET - PERUSAHAAN DAGANG

Cara Menyusun Jurnal Penyesuaian

Latihan Soal Pembuatan Jurnal Penutup Perusahaan Jasa Lengkap

Jurnal Penyesuaian Perusahaan Dagang

5.0 / 5 (0 votes)