Ekonomi Kelas XII Bab 3: Siklus Akuntansi Perusahaan Jasa Tahap Pencatatan (Part 1)

Summary

TLDRThis educational video explains the basics of accounting for a service company, specifically focusing on the accounting cycle. It covers the essential stages of transaction analysis, journalizing, and posting to the general ledger. Using the example of a laundry business, the script demonstrates how to handle common transactions such as capital contributions, purchases, expenses, and withdrawals. The video also emphasizes the importance of accurate record-keeping, ensuring that debits and credits balance, and provides practical insights into organizing financial data for effective reporting. It's a comprehensive guide for understanding the financial operations of service-based businesses.

Takeaways

- 😀 A service company provides intangible products, unlike trading companies that deal with tangible goods.

- 😀 Common examples of service companies include auto repair shops, salons, and consulting firms.

- 😀 The accounting cycle for a service company involves three main steps: recording transactions, summarizing, and preparing financial reports.

- 😀 The first step in the accounting cycle is analyzing financial transactions using evidence like invoices and receipts.

- 😀 When recording transactions, accounts affected by the transaction must be identified (e.g., Cash, Supplies, or Equity accounts).

- 😀 After analyzing, journal entries are created where debit and credit amounts are recorded, ensuring they balance.

- 😀 The general ledger is updated from the journal, summarizing each account's activity over time.

- 😀 Transactions must be analyzed based on whether they increase or decrease specific accounts, such as assets, liabilities, or equity.

- 😀 In journal entries, assets and expenses increase on the debit side, while liabilities, equity, and income increase on the credit side.

- 😀 The journal and ledger must remain balanced to ensure accurate financial reporting and avoid errors.

- 😀 A practical example in the script shows how to record transactions for business activities, such as receiving investment, purchasing supplies, and borrowing money.

Q & A

What is a service company in accounting?

-A service company is a business that provides intangible products or services. Unlike manufacturing or trading companies, it doesn't produce or sell physical goods, but instead offers services that customers can experience and benefit from, such as car repair services or salon treatments.

What are the three main stages of the accounting cycle for a service company?

-The three main stages of the accounting cycle for a service company are: 1) Recording transactions (journals), 2) Summarizing transactions (trial balance and adjustments), and 3) Preparing financial statements (balance sheet, income statement, and cash flow statement).

Why is it important to understand the rules of transaction recording?

-Understanding the rules of transaction recording is essential because they help ensure accurate financial reporting. Transactions must be recorded in the correct debit and credit columns to maintain the balance between assets, liabilities, and equity.

What happens in the 'analysis' step of recording transactions?

-In the analysis step, each transaction is reviewed to determine which accounts are affected and how they are impacted. For example, if a company receives cash from a customer, it affects both the 'cash' and 'revenue' accounts.

What is the role of a 'general journal' in the accounting cycle?

-A general journal serves as the primary record where all business transactions are initially documented. Each entry includes the date, accounts affected, and the amounts to be debited or credited.

How do you know which side of the journal entry (debit or credit) to use?

-The rules of accounting determine which side to use. For example, when assets increase, they are recorded as debits, while liabilities or equity increases are recorded as credits. It's essential to follow these rules to maintain the balance between the debit and credit sides.

Can you explain what is meant by a 'trial balance' in the accounting cycle?

-A trial balance is a list of all accounts and their balances at a specific point in time. It ensures that the total of all debits equals the total of all credits, which helps to detect any errors in the accounting records.

What does it mean to 'post' transactions to the general ledger?

-Posting refers to transferring the information from the journal entries into the general ledger, where transactions are grouped by account. This step helps to organize the financial data and prepare for creating the financial statements.

Why is the balance between debit and credit crucial in accounting?

-The balance between debit and credit ensures the integrity of the accounting records. According to the double-entry bookkeeping system, every debit must have an equal and opposite credit to maintain financial accuracy and avoid errors.

What is the difference between a general journal and a general ledger?

-The general journal is where transactions are initially recorded in chronological order, while the general ledger organizes and categorizes these transactions by account, providing a detailed view of each account's balance over time.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级浏览更多相关视频

BELAJAR AKUNTANSI DASAR SAMPAI PAHAM! Langsung Jago Akuntansi

2 Konsep Dasar Akuntansi Keuangan 1

PENJELASAN MUDAH!!!! SIKLUS AKUNTANSI PERUSAHAAN DAGANG BAGIAN 1 (KELAS 12)

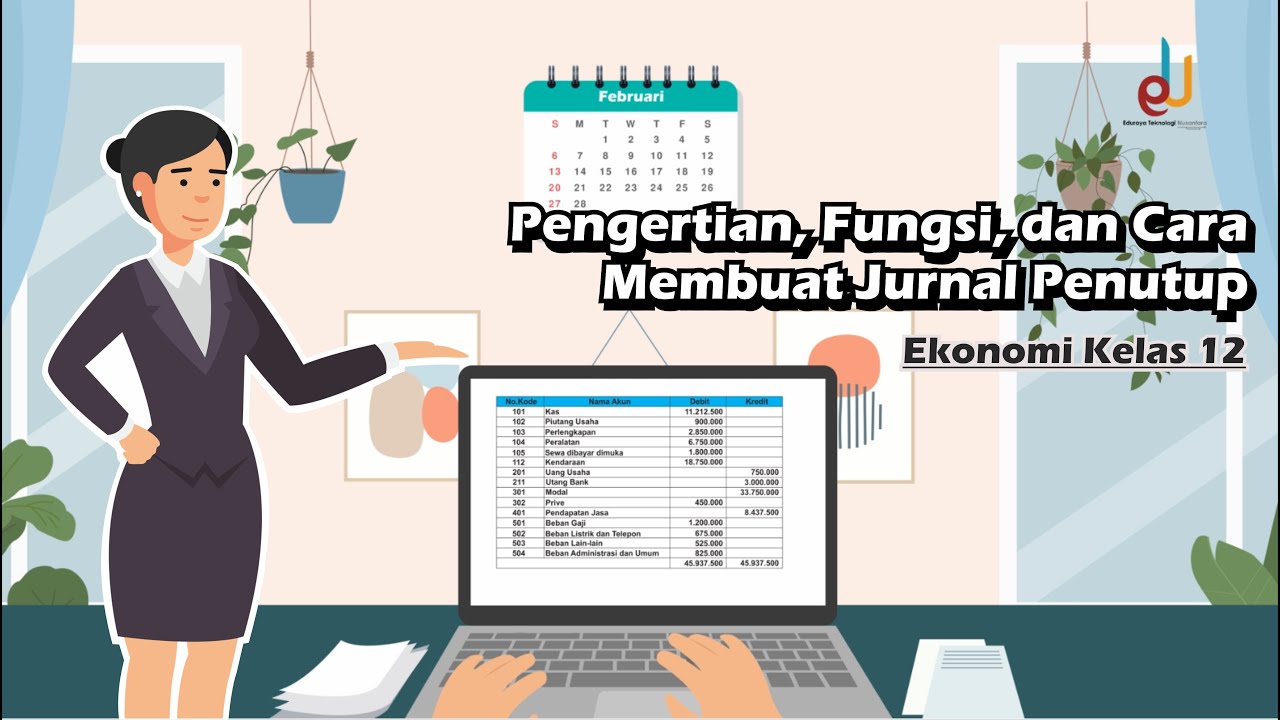

Pengertian, Fungsi, dan Cara Membuat Jurnal Penutup | Ekonomi Kelas 12 - EDURAYA MENGAJAR

The Accounting System (Revision)

Jurnal Penutup, Buku besar setelah penutupan, Neraca saldo setelah penutupan | PART 3

5.0 / 5 (0 votes)