Contoh Perhitungan PPh Pasal 23 atas Penghasilan Royalti & Penghasilan Sewa

Summary

TLDRThis video discusses the calculation of Article 23 Income Tax (PPh 23) on royalty and rental income. It explains the nature of PPh 23, which is imposed on various income types, including dividends, royalties, and rental payments. The presenter provides practical examples, including how to compute tax liabilities for individuals with and without a Taxpayer Identification Number (NPWP). Specific rates, such as 15% for royalties and 2% for rental income, are detailed. The video concludes with a case study on rental income, showcasing the tax implications for PT Nusantara Tour, making the complex topic of taxation accessible and understandable.

Takeaways

- 📜 PPh 23 is a tax imposed on income from capital, services, interest, dividends, royalties, and other awards.

- 💰 The tax is withheld by the income provider when making payments to taxpayers.

- 📊 Key objects of PPh 23 include dividends (15%), interest (15%), royalties (15%), and rental income (2%).

- 👥 Tax rates vary based on whether the taxpayer has a NPWP (Taxpayer Identification Number) or not.

- 📝 For royalty payments, if the recipient lacks a NPWP, a 20% additional tax is applied.

- 📅 Example calculations demonstrate the impact of having or not having a NPWP on the total tax owed.

- 🏢 PT Penerbit Airlangga paid royalties to multiple authors, showing varying tax implications based on NPWP status.

- 🚍 PT Nusantara Tour's rental income example illustrates how to calculate PPh 23 for rental payments over a set period.

- 🔍 The importance of proper documentation and adherence to tax laws is emphasized for businesses to ensure compliance.

- 💡 Understanding PPh 23 calculations helps businesses manage their tax liabilities effectively and plan financially.

Q & A

What is PPh 23?

-PPh 23 is an income tax in Indonesia imposed on income from capital, services, awards, interest, dividends, royalties, and other forms of income, excluding those taxed under PPh 21.

Who is responsible for withholding PPh 23?

-The income provider is responsible for withholding PPh 23 when making payments for dividends, interest, royalties, rental income, and services to taxpayers or permanent establishments.

What are the key objects of PPh 23?

-The key objects of PPh 23 include royalties, dividends, interest, rental income, and payments for certain services such as technical, management, and consultancy services.

What is the tax rate for royalties under PPh 23?

-The tax rate for royalties under PPh 23 is generally 15% of the gross amount paid or owed.

How is the tax calculated for individuals without a Tax Identification Number (NPWP)?

-For individuals without an NPWP, an additional 20% penalty is added to the calculated PPh 23, increasing the total tax owed.

How is the rental income from businesses taxed under PPh 23?

-Rental income is taxed at a rate of 2% of the gross rental income received.

What are some examples of services that fall under PPh 23?

-Examples of services under PPh 23 include technical services, management services, consultancy services, cleaning services, and catering services.

What happens if a taxpayer has an NPWP?

-If a taxpayer has an NPWP, they are taxed at the standard rates without any additional penalties applied.

How are the total revenues from royalties and rentals calculated?

-Total revenues are calculated by summing all royalty or rental payments received, then applying the relevant PPh 23 tax rates to determine the tax owed.

Can land and building rentals be included in PPh 23 calculations?

-No, rental income from land and buildings is not included in PPh 23 calculations.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级浏览更多相关视频

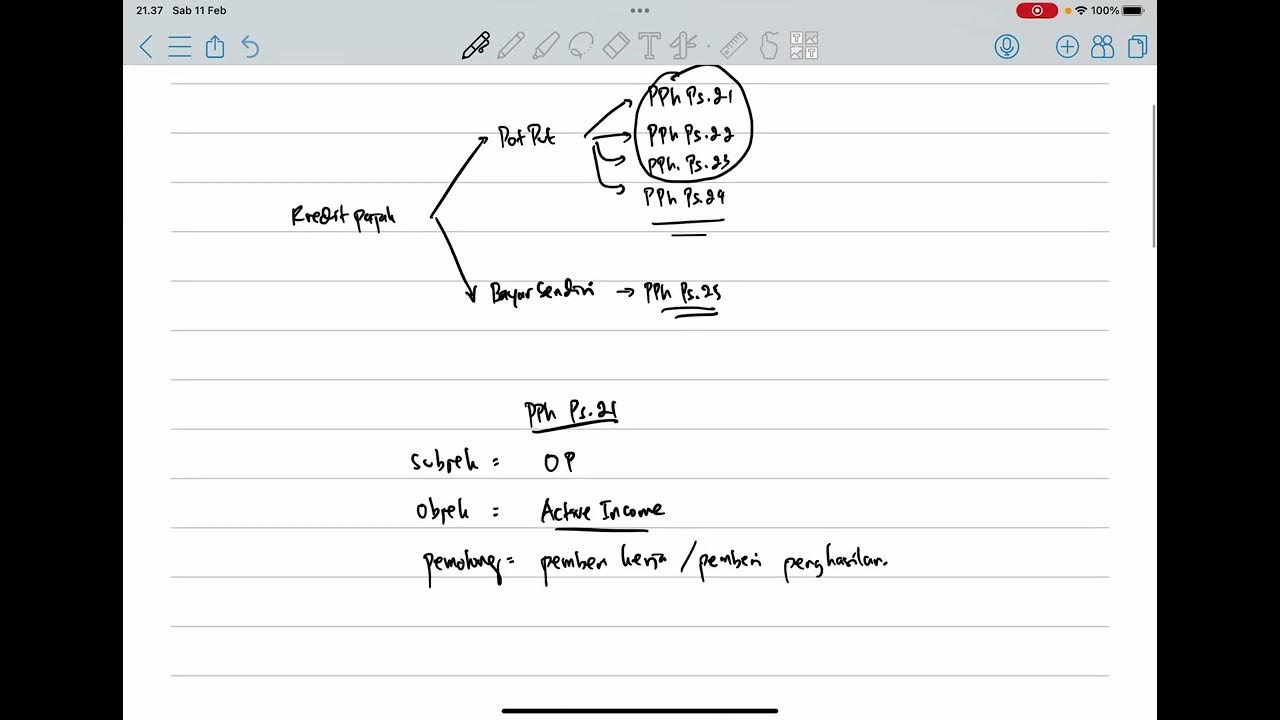

PPh Orang Pribadi (Update 2023) - 5. Kredit Pajak

Tips memahami apa saja jenis pajak perusahaan yang harus Anda laporkan

Konsep dan Penghitungan PPh Pasal 23

PPh Orang Pribadi (Update 2023) - 13. Panduan Pengisian SPT 1770 (Status KK)

Apa itu Pajak Final? Apa bedanya PPh Final dan PPh Non-Final? | #Paham Pajak

Aspek Pajak Koperasi (Part 2)

5.0 / 5 (0 votes)