Konsep dan Penghitungan PPh Pasal 23

Summary

TLDRThis video provides a comprehensive overview of Indonesia's PPh pasal 23 income tax, detailing its definition, applicable income types, and rates. It explains the roles of withholding agents, including government entities and businesses, in collecting the tax on passive and active income such as dividends, interest, and royalties. The tax rates vary, with 15% for dividends and interest, and 2% for rental income. Additionally, it covers exemptions and the processes for payment and reporting, making it essential viewing for anyone involved in tax compliance or financial management in Indonesia.

Takeaways

- 😀 PPh Pasal 23 is an income tax in Indonesia, applied to both domestic individuals and entities, as well as permanent establishments on specific types of income like dividends, royalties, and rental income.

- 😀 The tax rates for PPh Pasal 23 are 15% for dividends, interest, and royalties, and 2% for rental income and services.

- 😀 Individuals and entities appointed by the Director General of Taxes (DJP) are responsible for withholding PPh Pasal 23 tax, with legal entities being the primary tax withholding agents.

- 😀 Only passive income like dividends, royalties, and interest are subject to PPh Pasal 23 for individuals, whereas active income for entities may also be taxed under this article.

- 😀 Certain dividends are exempt from PPh Pasal 23 and are taxed under PPh Final (Article 17). These include dividends received from retained earnings by companies with significant ownership stakes.

- 😀 Interest from loans, discounts, premiums, and debt guarantees are taxable under PPh Pasal 23, but some interest types (e.g., from bank deposits and bonds) are subject to PPh Final instead.

- 😀 Royalties from intellectual property rights, such as copyrights, patents, and trademarks, are taxable under PPh Pasal 23, and specific reporting codes are required for payments.

- 😀 Payments for rental income (e.g., vehicles, machinery, property) are taxable under PPh Pasal 23, but rental for land and buildings may be subject to PPh Final at a different rate (10%).

- 😀 Services such as technical, management, and consultancy services performed by Indonesian residents or entities are subject to PPh Pasal 23, provided they meet the specified criteria.

- 😀 The tax is due when income is paid or made available for payment, and monthly tax returns (SPT Masa) must be filed by the 20th of the following month to report the tax withheld.

Q & A

What is the definition of PPh pasal 23?

-PPh pasal 23 is a tax imposed on domestic taxpayers and permanent establishments based on income from capital investments, physical and financial assets, participation in work or activities, and provision of certain services.

Who are the parties responsible for deducting PPh pasal 23?

-The parties responsible for deducting PPh pasal 23 include government bodies, event organizers, company representatives, other domestic tax subjects, and certain individuals designated by the Directorate General of Taxes (DJP).

What types of income are subject to PPh pasal 23?

-Income subject to PPh pasal 23 includes passive income such as dividends, interest, royalties, and rent, as well as active income like awards or services provided according to specific regulations.

What are the tax rates for different types of income under PPh pasal 23?

-The tax rates under PPh pasal 23 are 15% for dividends, interest, royalties, and awards, and 2% for rent and certain services. If the income recipient does not have a tax identification number (NPWP), a higher rate of 100% may apply.

What is considered passive income under PPh pasal 23?

-Passive income under PPh pasal 23 includes dividends, interest, royalties, and rents. Individuals may only be taxed on passive income, while corporate entities can be taxed on both passive and active income.

What is the significance of the NPWP in the context of PPh pasal 23?

-The NPWP is crucial because if the income recipient does not possess one, they are subject to a higher tax rate of 100% instead of the standard rates.

What types of royalties are taxed under PPh pasal 23?

-Royalties subject to PPh pasal 23 typically relate to intellectual property rights, including copyrights in literature, art, and scientific works, as well as fees for the use of equipment or knowledge.

What are the obligations regarding payment and reporting of PPh pasal 23?

-The obligation to pay PPh pasal 23 arises at the time the income is paid. The payment and reporting deadlines are set for the 10th of the month following the payment, with the annual report due by the 20th of the following month.

What is the role of PMK 141/PMK.03/2015 in the context of PPh pasal 23?

-PMK 141/PMK.03/2015 outlines the specific regulations and classifications of services and income subject to PPh pasal 23, serving as a guide for tax deductions.

Are there any exemptions from PPh pasal 23?

-Yes, there are exemptions from PPh pasal 23, including income paid to banks, certain dividends not subject to tax, and income from partnerships under specific conditions.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

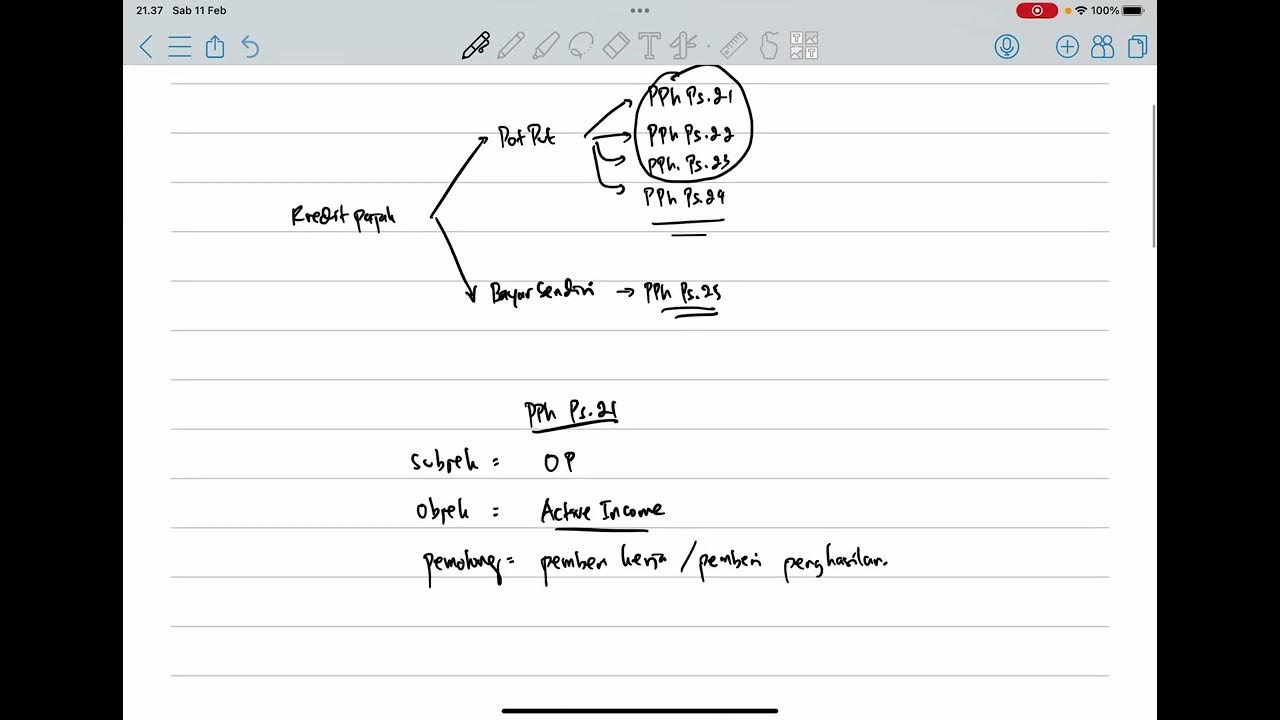

PPh Orang Pribadi (Update 2023) - 5. Kredit Pajak

Tips memahami apa saja jenis pajak perusahaan yang harus Anda laporkan

Contoh Perhitungan PPh Pasal 23 atas Penghasilan Royalti & Penghasilan Sewa

2 PPh Pasal 4 ayat 2 : Objek, Pelunasan, Pelaporan

MENGENAL PPH 21 LEBIH DEKAT AGAR TIDAK SALAH PAHAM DENGAN PERUSAHAAN ANDA

Perbedaan Pemotongan & Pemungutan Pajak || Withholding Tax #tutorialpajak

5.0 / 5 (0 votes)