ACCA I Strategic Business Reporting (SBR) I IAS 20 - Govt Grants & Govt Assistance - SBR Lecture 11

Summary

TLDRLecture 11 of SBR covers IAS 20, focusing on accounting for government grants and disclosure of government assistance. The lecture explains key concepts such as government grants, which are recognized when certain conditions are met, and government assistance, which is not recognized due to its non-monetary nature. It details different accounting treatments for grants related to assets and income, and the conditions for recognizing, repaying, and disclosing grants. The video concludes with a practical example on how to account for a grant used to purchase a building.

Takeaways

- 📜 IS20 covers two main topics: government grants and government assistance.

- 🏛️ Government grants are recognized when specific conditions are met, usually in cash form, and can be reliably measured.

- ⚖️ Assistance from the government that cannot be valued is excluded from government grants.

- 💰 There are two types of grants: income-based and capital-based grants, each with distinct recognition methods.

- 🏢 Capital-based grants can either be deducted from the asset’s cost or treated as deferred income, spread over the asset's life.

- 💼 Income-based grants should be matched with the related expenses, especially if the grant is aimed at achieving non-financial goals.

- 🔄 Repayment of government grants is treated as a change in accounting estimates, as outlined in IS8.

- 💸 If repayment of a grant occurs, for income-based grants, it is debited to liabilities, while excess repayment is charged to profit.

- 🏗️ Government assistance that cannot be reliably valued (such as advisory services) is not recognized in financial statements but can be disclosed.

- 📝 Disclosure requirements for IS20 include accounting policies, presentation methods, and details about any unfulfilled conditions related to recognized grants.

Q & A

What is the main topic covered in the lecture on IS20?

-The main topic is accounting for government grants and the disclosure of government assistance as per the IS20 standard.

How does IS20 define government grants?

-IS20 defines government grants as transfers of resources to an entity in exchange for past or future compliance with certain conditions. They are typically given in the form of cash and exclude assistance that cannot be valued or that involves normal trade with the government.

What are the two conditions required for recognizing government grants under IS20?

-The two conditions are: (1) compliance with the conditions related to the grant and (2) reasonable assurance that the grant will be received.

How should income-based government grants be matched according to IS20?

-Income-based government grants should be matched with the related expense, especially when the grant is intended to subsidize specific expenditures.

What are the two types of grants related to assets as per IS20?

-The two types of grants related to assets are: (1) deducting the grant from the cost of the asset and depreciating the net cost, or (2) treating the grant as deferred income and releasing it over the life of the asset.

What happens if a government grant becomes repayable under IS20?

-If a government grant becomes repayable, it is accounted for as a revision of an accounting estimate. The repayment is treated similarly to changes in accounting estimates as outlined in IS8.

How is repayment handled for income-based grants under IS20?

-For income-based grants, repayment is debited to any liability for deferred income, and any excess repayment is charged to profit immediately.

What is the accounting treatment for capital-based grants when they are deducted from the cost of the asset?

-When a capital-based grant is deducted from the cost of the asset, the asset's cost increases upon repayment, leading to higher depreciation charges, which should be recognized immediately.

Why are government assistance programs not recognized in financial statements under IS20?

-Government assistance programs are not recognized in financial statements because it is often impossible to reliably place a value on the assistance provided, such as advice or infrastructure support, which cannot be measured in monetary terms.

What are the key disclosure requirements under IS20?

-The key disclosure requirements under IS20 include: (1) the accounting policy and presentation method for government grants, (2) the nature of the government grant, and (3) any unfulfilled conditions related to the grant that has been recognized.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级浏览更多相关视频

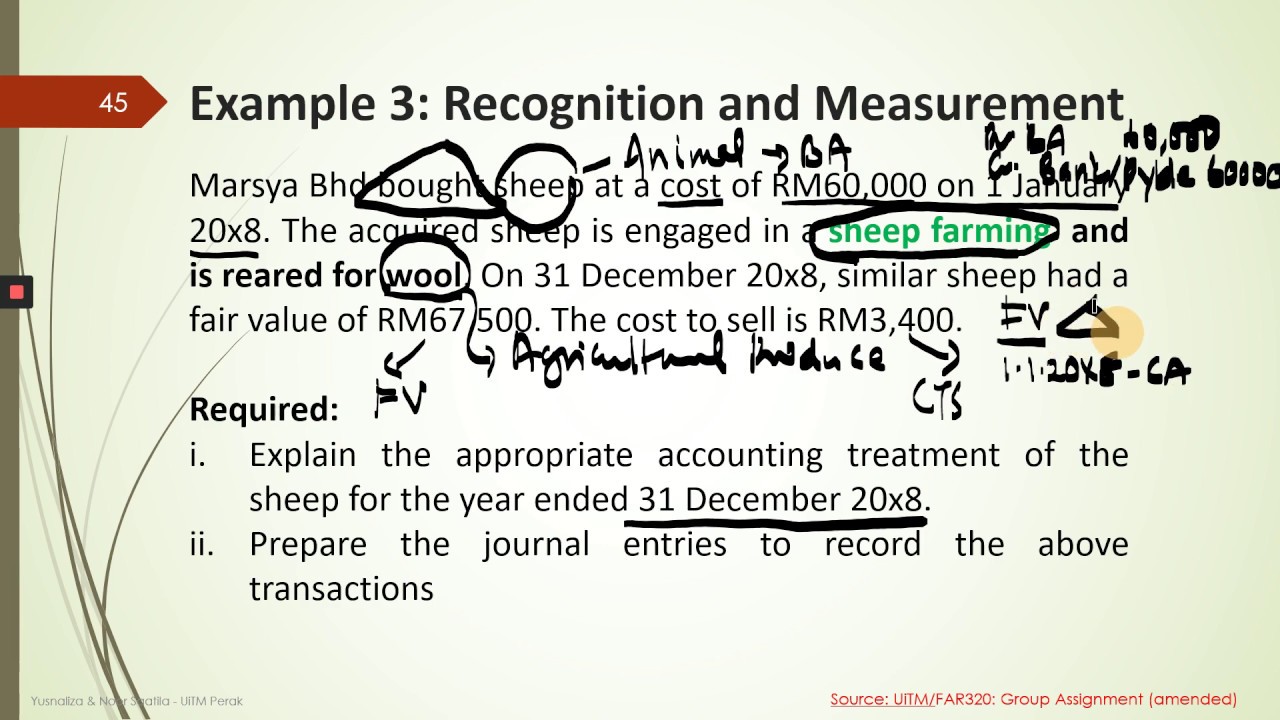

LECTURE 4/4 : MFRS 141/ IAS 41 AGRICULTURE (BIOLOGICAL ASSETS) : FAR320 TOPIC 2-PART 4

Materi Akuntasi Pemerintah Daerah Kelas 11 Praktikum Akuntansi Lembaga

[MEET 9] AKUNTANSI SEKTOR PUBLIK - AKUNTANSI PEMBIAYAAN

Pengantar Akuntansi Pemerintah Kelas XI SMK

Praktikum Akuntansi Instansi/Lembaga Pemerintah XI AKL (Transaksi Pendapatan dan Belanja Daerah)

IAS 41 Agriculture summary - applies in 2024

5.0 / 5 (0 votes)