Warren Buffett Just Sold $100 Billion Worth of Stock.

Summary

TLDRDer Video-Skript beleuchtet Warren Buffetts Aktionen im Jahr 2024, insbesondere die Verkäufe von Aktien im Wert von 97 Milliarden US-Dollar. Buffett, der früher für sein Halten von Aktien bekannt war, hat nun aufgrund des steigenden Aktienmarkts und möglicher zukünftiger Steuererhöhungen eine enorme Menge an Bargeld von 276 Milliarden US-Dollar angehäuft. Dies hat Anleger besorgt, da Buffetts frühere Aktionen vor Aktienmarktkrisen ein Zeichen für eine bevorstehende Korrektur waren. Der Aktienmarktwert in Bezug auf die US-Wirtschaft (Buffett-Indikator) ist aktuell höher als je zuvor, was auf eine mögliche Blase hindeutet und erklärt Buffetts Zurückhaltung bei neuen Investitionen.

Takeaways

- 💼 Warren Buffett hat im ersten halben Jahr 2024 einen erstaunlichen Verkauf von 97 Milliarden Dollar an Aktien durchgeführt, was auf eine mögliche Bewertung der US-Aktienmärkte hindeutet.

- 📉 Buffett hat in der Vergangenheit erfolgreich große Mengen an Bargeld angehäuft, bevor Aktienmärkte einbrachen, um dann günstig einzusteigen.

- 📈 Die Aktien von Apple, ein Unternehmen, das Buffett zuvor für immer halten wollte, wurden im ersten halben Jahr 2024 im Wert von etwa 90 Milliarden Dollar verkauft.

- 💰 Buffetts Aktienverkauf ist auf steigende Steuersätze zurückzuführen, was jedoch nur eine Oberflächenbegründung sein könnte.

- 🔍 Buffett hat in früheren Jahren die Aktien von Apple als Teil der sogenannten 'Big Four' von Berkshire Hathaway bezeichnet, was auf deren Wichtigkeit für das Unternehmen hindeutet.

- 🚨 Buffetts aktuelles Verhalten, große Mengen an Aktien zu verkaufen und keine neuen Investitionen zu tätigen, lässt auf eine mögliche Überbewertung des Aktienmarktes schließen.

- 📊 Der 'Buffett-Indikator', der den Wert des US-Aktienmarktes in Relation zur Wirtschaftsgröße misst, zeigt derzeit ein Rekordhoch, was auf eine mögliche Blase hindeutet.

- 🌐 Die US-Schulden haben ein historisches Hoch erreicht, was die Notwendigkeit von höheren Steuern in der Zukunft nahelegt.

- 💡 Buffett betont, dass er keine Ideen hat, wie er das verfügbare Bargeld effektiv nutzen könnte, was darauf hindeutet, dass er die aktuellen Investitionsmöglichkeiten als unattraktiv erachtet.

- 📚 Buffetts jährliche Briefe an die Aktionäre von Berkshire Hathaway sind für Investoren von großem Interesse und enthalten wertvolle Erkenntnisse über sein Investment-Philosophie.

Q & A

Wie hoch lag die Aktienverkäufe von Warren Buffett im ersten halben Jahr 2024?

-Warren Buffett verkaufte im ersten halben Jahr 2024 einen erstaunlichen Betrag von 97 Milliarden US-Dollar an Aktien.

Was ist der sogenannte 'Buffett-Indikator' und wie wird er berechnet?

-Der 'Buffett-Indikator' ist ein Maß für die Beurteilung von Aktienmarktbewertungen, der durch Warren Buffett geprägt wurde. Er wird berechnet, indem der Gesamtwert des US-Aktienmarktes durch das Bruttoinlandsprodukt (BIP) der USA dividiert wird.

Was zeigt der Buffett-Indikator für den Stand des US-Aktienmarktes zum Zeitpunkt der Videoerstellung?

-Der Buffett-Indikator zeigte zum Zeitpunkt der Videoerstellung einen Wert von 202%, was auf ein historisch hohes Niveau des US-Aktienmarktes hinweist.

Warum hat Warren Buffett im Jahr 2024 eine große Menge an Aktien verkauft?

-Buffett hat im Jahr 2024 eine große Menge an Aktien verkauft, weil er glaubt, dass der US-Aktienmarkt in einem massiven Blase ist und er auf der Suche nach attraktiven Investitionsmöglichkeiten ist, die seine hohen Standards erfüllen.

Wie hoch lag der Cash-Bestand von Berkshire Hathaway nach der Aktienverkaufsrunde von Buffett?

-Nach der Aktienverkaufsrunde von Buffett lag der Cash-Bestand von Berkshire Hathaway bei einem erstaunlichen Betrag von 276 Milliarden US-Dollar.

Was hat Warren Buffett über die Steueraspekte seiner Aktienverkaufstätigkeiten gesagt?

-Buffett argumentierte, dass er eine große Anzahl von Aktien verkaufte, weil er mit einer möglichen Erhöhung der Steuern rechnet, was die Einnahmen aus den Gewinnen der Verkaufsaktivitäten beeinträchtigen könnte.

Welche Rolle spielt die Bewertung von Apple-Aktien im Verkaufsentscheidungsprozess von Buffett?

-Die Bewertung von Apple-Aktien hat eine wichtige Rolle gespielt, da Buffett beobachtet hat, dass der Kurs-Gewinn-Verhältnis (PE-Verhältnis) von Apple signifikant gestiegen ist und er möglicherweise eine Überbewertung schätzt.

Warum hat Buffett seine Haltung an Apple-Aktien im ersten halben Jahr 2024 reduziert?

-Buffett hat seine Haltung an Apple-Aktien reduziert, weil er annimmt, dass die Aktien möglicherweise überbewertet sind und er die Steueraspekte der Verkäufe als Grund für die Reduktion angegeben hat.

Was sagt Buffett über die aktuelle Situation des US-Aktienmarktes und seine Investitionsstrategie?

-Buffett sagt, dass er und seine Teammitglieder keine effektive Verwendung für den Cash-Bestand finden konnten, was darauf hindeutet, dass sie die aktuellen Investitionsmöglichkeiten als unattraktiv erachten.

Wie hoch ist die US-Schuldenquote im Vergleich zum BIP und was bedeutet das für Buffetts Investitionsentscheidungen?

-Die US-Schuldenquote im Vergleich zum BIP ist historisch hoch, was darauf hindeutet, dass die US-Regierung möglicherweise Steuern erhöhen muss, was wiederum Buffetts Entscheidungen beeinflusst, Aktien zu verkaufen und auf der Suche nach attraktiven Investitionsmöglichkeiten zu sein.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级浏览更多相关视频

Warren Buffett Sold 50% Of His Portfolio

Buffett: Das ist JETZT sein wichtigster Kauf!

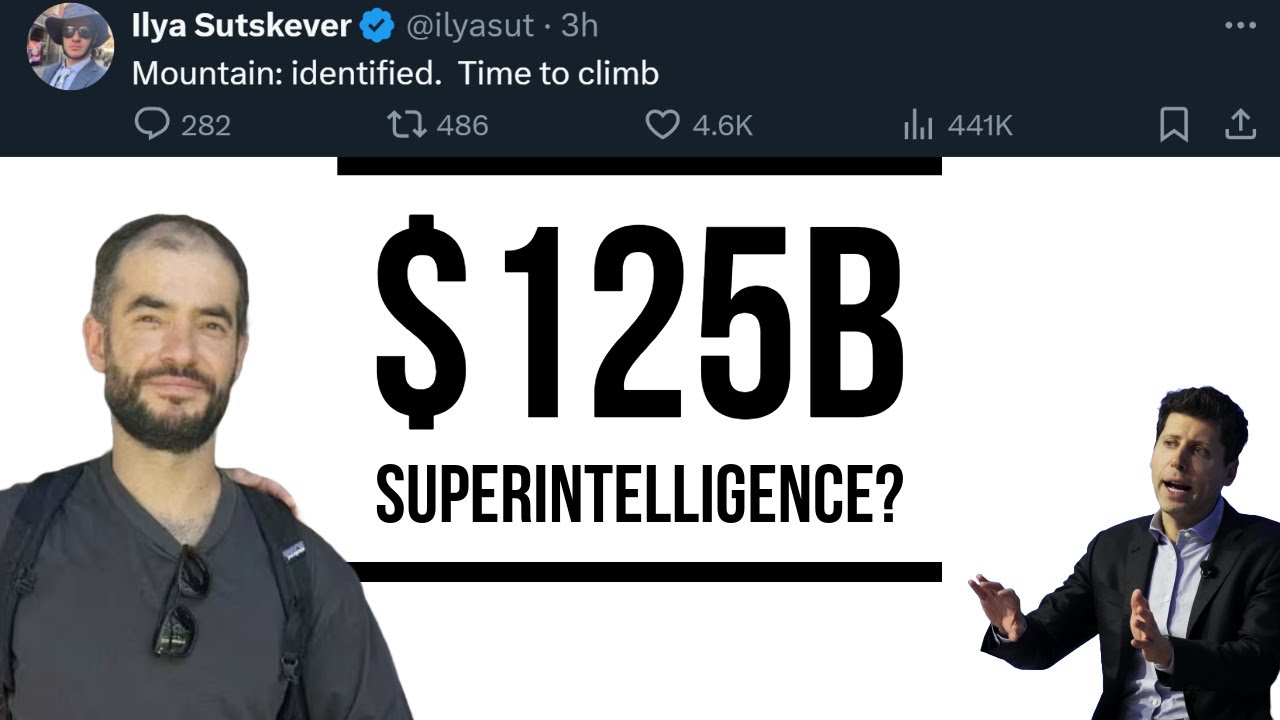

$125B for Superintelligence? 3 Models Coming, Sutskever's Secret SSI, & Data Centers (in space)...

Nasdaq, Bitcoin, Ethereum: Neues Allzeithoch?

WARREN BUFFETT BOUGHT THIS 5 TIMES LAST WEEK!

Cosmos ATOM Crypto Price ➡️➡️➡️ $0

5.0 / 5 (0 votes)