Prof Prabina Rajib (Commodity Derivatives and Risk Management) - Lecture 3

Summary

TLDRThis session on commodity derivatives and risk management explores key aspects of futures contract specifications. The discussion covers the roles of commodity exchanges, clearing houses, and trading members, with examples from the Indian Commodity Exchange (MCX). It explains important terms such as novation, margin calculations, contract expiration, and delivery processes. The example of cotton futures provides a detailed understanding of contract standardization, price limits, and settlement procedures. The session concludes with a focus on how clearing houses manage counterparty risks and ensure smooth transaction settlements.

Takeaways

- 📈 The session focuses on futures contract specifications and the entities involved in commodity exchanges, including the regulatory body SEBI.

- 🏢 Commodity exchanges like MCX and NCDEX are mentioned, along with the roles of clearing houses, clearing banks, and warehouses in facilitating trades.

- 👤 Traders must go through trading members, such as brokers, to engage in derivatives contracts on an exchange platform.

- 🔄 Clearing members play a crucial role in ensuring trades are cleared smoothly and are part of the clearing house's structure.

- 💼 The clearing house acts as a facilitator for processing delivery and payment, mitigating counterparty risk in futures contracts.

- 📋 The script outlines the responsibilities of trading and clearing members, highlighting the differences in their roles within the commodity exchange ecosystem.

- 📊 The concept of novation is introduced, where the clearing house becomes the counterparty to each buyer and seller, reducing risk.

- 💵 The clearing house maintains a Settlement Guarantee Fund to cover potential defaults by trading parties.

- 📝 The session discusses the standardization in futures contracts, including quality, quantity, maturity date, and delivery margin.

- 📉 The script provides an example of a cotton futures contract, detailing its specifications such as trading unit, maximum order size, tick size, and daily price limits.

Q & A

What is the role of the Securities Exchange Board of India (SEBI) in commodity exchanges?

-SEBI acts as the regulator for commodity exchanges, having merged with the Forward Markets Commission. It oversees the functioning and ensures compliance with regulations.

What are the key entities involved in a commodity exchange ecosystem?

-The key entities involved in a commodity exchange ecosystem include commodity exchanges, clearing houses, clearing banks, warehouses, trading members, and clearing members.

How do trading members function in the context of commodity exchanges?

-Trading members function as brokers, facilitating the buying and selling of derivatives contracts on behalf of buyers and sellers. They are the intermediaries through which trades are channelized.

What is the primary responsibility of a clearing house in a commodity exchange?

-The primary responsibility of a clearing house is to act as a facilitator for processing delivery and payment between clearing members, trading members, and participants, ensuring timely payments and reducing counterparty risk.

What is the concept of Novation in the context of commodity derivatives?

-Novation is a process where the clearing house becomes the counterparty to each buyer and seller in a derivatives contract, thereby taking away the counterparty risk and ensuring the smooth execution of trades.

Why is the Settlement Guarantee Fund important for clearing houses?

-The Settlement Guarantee Fund is important for clearing houses as it serves as a financial buffer to cover potential defaults by any of the counterparties, ensuring the stability and integrity of the market.

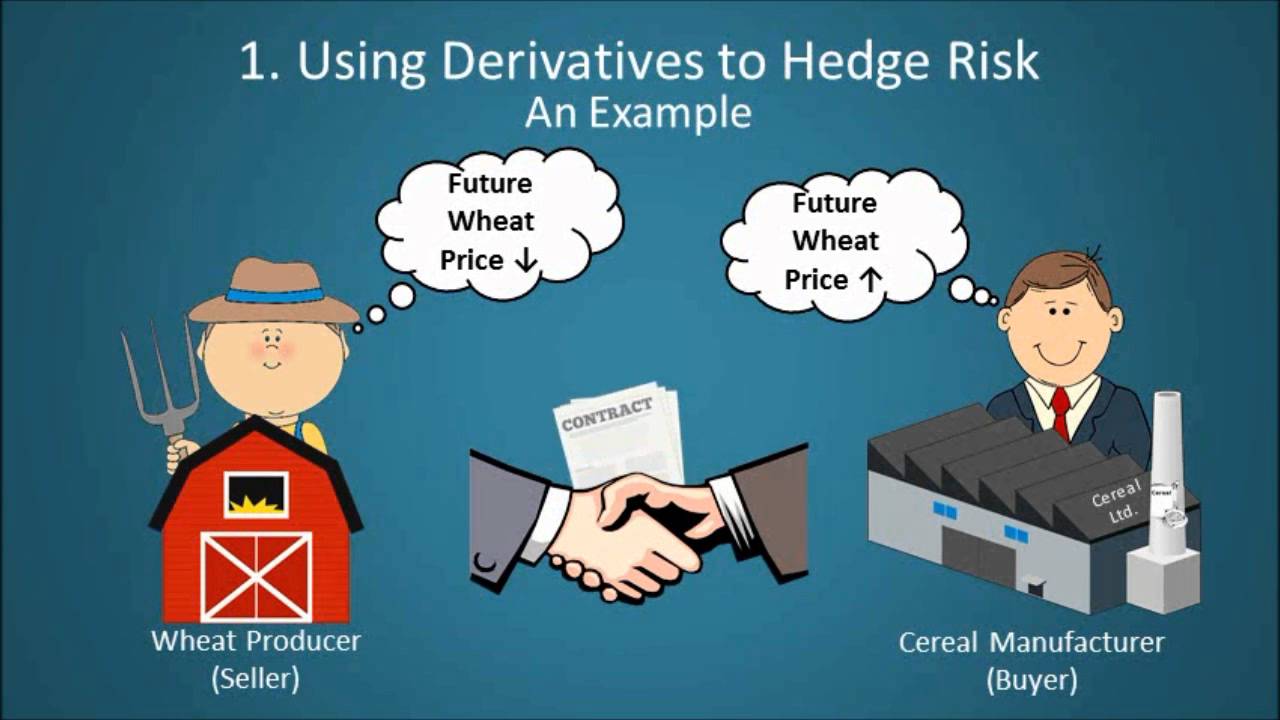

What are the differences between forward contracts and futures contracts as discussed in the script?

-Forward contracts are non-standardized, bilateral agreements with flexibility in terms of underlying, quantity, delivery date, and location, but they carry counterparty risk. Futures contracts, on the other hand, are standardized and traded on exchanges, with the clearing house managing counterparty risk.

What is a contract launch calendar and how does it relate to futures trading?

-A contract launch calendar is a schedule that outlines the availability of contracts for trading based on their maturity dates. It allows traders to enter into contracts that mature on specific dates, providing a structured framework for trading.

What is the significance of the trading unit in a futures contract specification?

-The trading unit specifies the minimum quantity of the underlying asset that must be traded in a single contract. For example, in the case of cotton futures, the trading unit is 25 bales, which sets the standard quantity for trading.

How are daily price limits (DPL) applied in futures contracts, and what is their purpose?

-Daily price limits are set to restrict the fluctuation of futures prices within a certain percentage range to prevent extreme market volatility. They act as circuit breakers to maintain market stability.

What is the purpose of initial margins in futures trading, and how are they calculated?

-Initial margins are required deposits by traders when entering into a futures contract to cover potential losses. They are calculated as a percentage of the total contract value and serve as a form of risk management.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级浏览更多相关视频

#1 PROP FIRM TRADER REVEALS SECRETS | TRADER KANE INTERVIEW

Chapter - 5 One Shot | Class 10 FMM | Derivatives | #class10 #finance #cbse

Financial Derivatives Explained

Financial Derivatives Unit 2 Part 2 | Hedging Meaning | Market Index Application | Future Contract

Derivatives and Risk Management - Constructed Response Set - James King - CFA® Level III

Apa itu Instrumen Keuangan? - Dr. Erwinna Chendra

5.0 / 5 (0 votes)