Chapter - 5 One Shot | Class 10 FMM | Derivatives | #class10 #finance #cbse

Summary

TLDRThe script is an educational lecture on derivatives, focusing on their nature as contracts with determined terms between a buyer and seller. It covers different types, including futures and options, and their trading on commodity exchanges. The lecture distinguishes between commodity and financial derivatives, highlighting the need for physical storage in commodities contrasting with the cash settlement of financial assets. It also touches on the importance of quality and the impact of factors like weather on commodity derivatives, urging viewers to like, share, subscribe, and ask questions for further clarification.

Takeaways

- 📝 Derivatives are contracts based on an underlying asset, with agreed-upon terms between two parties, a buyer and a seller.

- 🌐 Commodity derivatives involve trading in agricultural products, metals, and energy sources, which are physical and storable assets.

- 📉 Financial derivatives, on the other hand, involve trading based on cash or securities and do not require physical storage.

- 🔄 The difference between commodity and financial derivatives lies in the nature of the assets involved and the process of settlement.

- 📋 Forward contracts are a type of derivative where the terms of trade are decided upon now, but the transaction occurs at a future date.

- 📈 Futures are standardized contracts traded on an exchange, with terms set by the exchange, unlike forward contracts which can be customized.

- 🔖 Options are contracts that give the right, but not the obligation, to buy or sell an underlying asset at a specified price before a certain date.

- 📊 The commodity exchange is a platform where commodities are traded, and it operates under a formal structure with rules set by the exchange.

- 💹 The concept of 'going long' or 'going short' in derivatives signifies taking a position that anticipates an increase or decrease in the price of the underlying asset, respectively.

- 💵 The settlement of commodity derivatives often requires physical delivery, while financial derivatives are settled in cash.

- ⏰ The premium paid in options is paid upfront and serves as a form of insurance for the seller against potential losses if the buyer exercises the option.

Q & A

What is the primary subject discussed in the transcript?

-The primary subject discussed in the transcript is derivatives, specifically focusing on what they are, the types of derivatives, and the difference between commodity and financial derivatives.

What is the definition of a derivative as explained in the transcript?

-A derivative is defined as a contract based on an underlying asset, where two parties agree on certain terms and conditions and settle the contract at a future date.

What are the key components included in a derivative contract?

-The key components included in a derivative contract are the asset price, quantity of the asset, and the time at which the trade will occur.

What is a forward contract and how does it differ from a futures contract?

-A forward contract is a customized contract between two parties where they can decide the terms like quantity, time, and price themselves. A futures contract is similar but is standardized and traded on an exchange with specific guidelines and is more formal.

What is the difference between a commodity exchange and a financial derivatives market?

-A commodity exchange is where physical goods or commodities are traded, while a financial derivatives market involves trading contracts that derive their value from underlying financial assets.

What are options in the context of derivatives?

-Options are contracts that give the right, but not the obligation, to buy or sell an underlying asset at a specified price on or before a certain date.

What are the two types of options mentioned in the transcript?

-The two types of options mentioned are calls and puts. A call option gives the right to buy an asset, while a put option gives the right to sell an asset.

What is the significance of the option premium in the context of the transcript?

-The option premium is the price paid to acquire the rights granted by an option contract. It serves as a payment made upfront when entering into an option agreement.

How are the terms of a futures contract determined?

-The terms of a futures contract are determined by the exchange where they are traded and include standardized details such as the quality and quantity of the asset, and the delivery date and location.

What is the role of the exchange in a futures contract?

-The exchange in a futures contract provides a standardized and regulated marketplace for trading, ensuring that the contracts are formal and transparent.

How does the quality of a commodity affect its trade in the derivatives market?

-The quality of a commodity can significantly affect its trade in the derivatives market because it determines the value and price of the commodity being traded.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

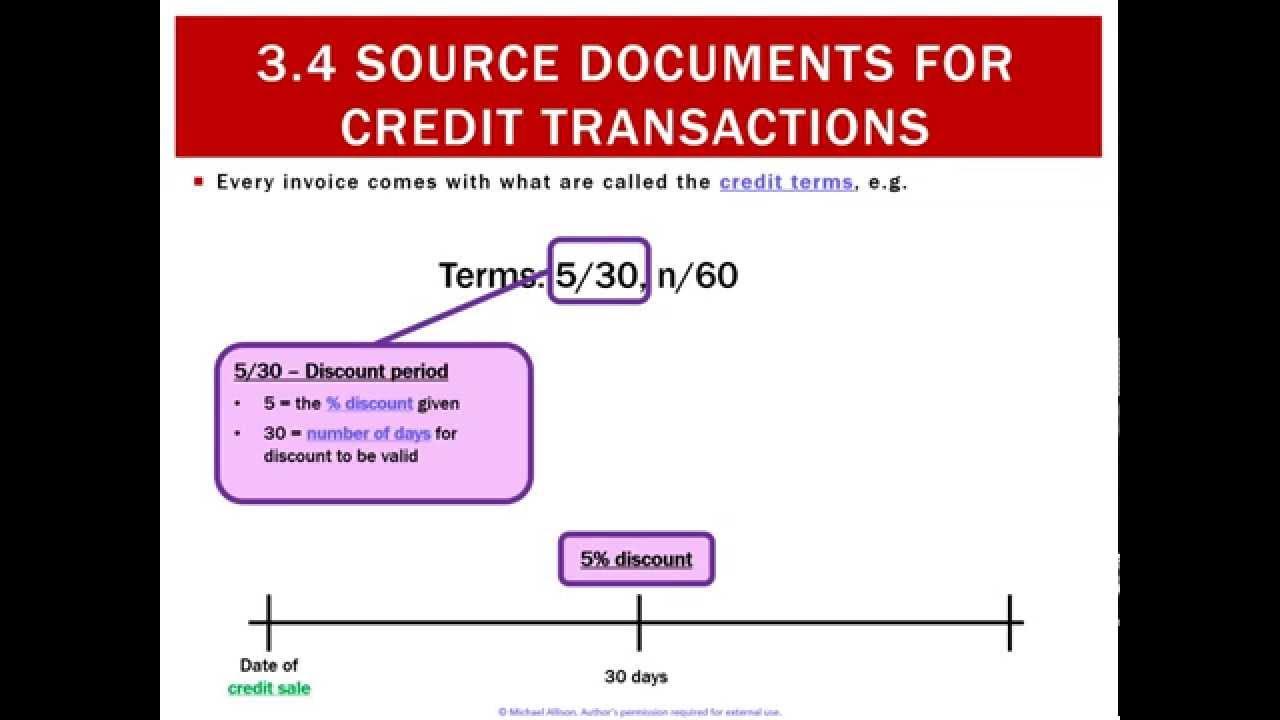

3.4 Source Documents for Credit Transactions

WHAT IS CALL OPTION ? | CONCEPT & EXAMPLES | CMA US, CFA, ACCA

Differences between Purchase Order and Invoice.

Fiqh al-Muamalat | Topic 37: MURABAHAH (2) (Components of Muarabahah - Contracting Parties)

Jurnal Perusahaan Dagang | Pengantar Akuntansi | Tutor Aja

Core Concepts in Marketing

5.0 / 5 (0 votes)