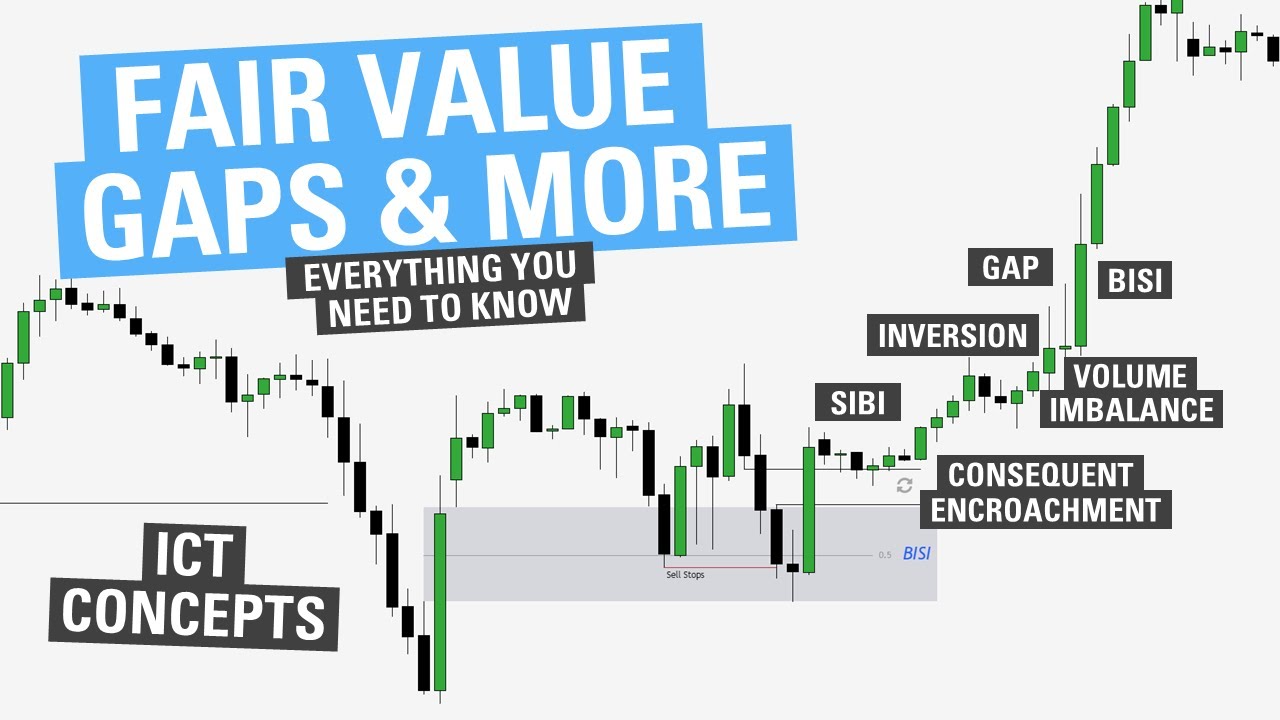

Everything you need to know about Fair Value Gaps.

Summary

TLDRThis video script delves into the concept of Fair Value gaps in trading, distinguishing between good and bad gaps and their implications for profit. It emphasizes the importance of understanding targets, unmitigated opposing PD arrays, and the strength indicated by different types of gaps. The script guides traders on identifying the 'perfect' fair value gap for trading, suggesting case studies for practical understanding and highlighting the nuances of entry confirmation and risk management.

Takeaways

- 📈 Fair Value Gaps can be profitable but require understanding of their types and characteristics.

- 🔍 The direction of trade is determined by the first line of defense, ideally the fair value gap at the time of retracement.

- 🎯 Identifying the 'Target' is crucial; it's on the left side of the chart and trading occurs from the right, focusing on the most recent price action.

- 🏁 Fair Value Gaps are created at unmitigated opposing PD arrays, indicating areas of resistance or support that have not yet been traded into.

- 💪 Fair Value Gaps signify strength and intention in the market, showing the direction larger entities are moving the market.

- 🌟 The type of Fair Value Gap is determined by the third candle's action: a rejection, consolidation, or expansion indicates varying market strength.

- ❌ Rejection Fair Value Gaps (RFG) show significant opposing strength and require more confirmation before trading.

- ✅ Perfect Fair Value Gaps (PFG) display a balance of strength, indicating minimal opposing force and are ideal for trading.

- 🚀 Breakaway Gaps show strong bullish or bearish strength without a retracement, making them more challenging for entry and risk management.

- 🔑 Entry confirmation is vital, especially with RFGs, and involves looking at lower time frames for additional signals.

- 📚 Conducting a case study on various instruments and time frames to understand which Fair Value Gaps hold and which don't is recommended for gaining experience.

Q & A

What is the main topic of the sixth video in the MMC series?

-The main topic of the sixth video in the MMC series is understanding Fair Value gaps and the different types of Fair Value gaps in trading.

What is the significance of the first line of defense in the context of the video?

-The first line of defense refers to the initial point of resistance or support when creating a retracement, ideally being the fair value gap that traders are looking to trade from.

What is meant by 'Target' in the script?

-The 'Target' in the script refers to a specific price level on the left side of the chart that traders aim to reach, using the most recent price action and fair value gaps on the right side for trading decisions.

How are fair value gaps created according to the video?

-Fair value gaps are created at unmitigated opposing PD arrays, which are areas of price resistance or support that have not been traded into before.

What does 'unmitigated' mean in the context of fair value gaps?

-'Unmitigated' means that the price level has not been traded into or tested by the market since the fair value gap was created.

What is the difference between a good and bad fair value gap?

-A good fair value gap is one that shows strength and intention from larger market entities, while a bad fair value gap may indicate a lack of strength or a false signal that could lead to a loss in trading.

What is an 'expansion phase candle' in the context of fair value gaps?

-An 'expansion phase candle' is the second candle in a fair value gap formation that closes above the high of the first candle, creating the potential for a fair value gap.

What are the three types of third candles that determine the quality of a fair value gap?

-The three types of third candles are the rejection third candle, the consolidation third candle, and the expansion third candle, each showing different levels of market strength and intention.

Why are rejection fair value gaps (RFGs) considered the worst to trade from?

-Rejection fair value gaps (RFGs) are considered the worst to trade from because they show too much bearish strength after the creation of a fair value gap, indicating a high probability of the market continuing in the opposite direction.

What is a 'perfect fair value gap' (PFG) and why is it considered the best to trade from?

-A 'perfect fair value gap' (PFG) is a fair value gap with a consolidation third candle, showing a balance between bullish and bearish strength, making it the best to trade from as it indicates a high probability of the market continuing in the intended direction.

What is a 'breakaway gap' and how is it different from other fair value gaps?

-A 'breakaway gap' is a type of fair value gap characterized by an expansion third candle, showing strong bullish or bearish strength without a retracement. It is different because it often occurs when the market has not yet reached a significant resistance or support level (PD array), suggesting further price movement before a retracement.

Why is it recommended to do a case study on fair value gaps?

-A case study on fair value gaps is recommended to gain a deeper understanding of which gaps hold and which do not, and to practice identifying and labeling different types of fair value gaps in various market conditions.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Understanding Fair Value Gaps (FVG) - ICT Concepts

The Secret FVG that we don’t trade back into: BreakAway Gap

The “Sharp Turn” Entry Model

Complete Fair Value Gap Guide ( Noob To Expert )

Fair Value Gap (FVG) Explained: 3 Best Strategies Revealed

ICT Mentorship Core Content - Month 04 - ICT Fair Value Gaps FVG

5.0 / 5 (0 votes)