Boot Camp Day 16: FVG Pt. 2

Summary

TLDRIn this video, the speaker, despite being sleep-deprived, dives into the concept of 'fair value gaps' in trading. They explain these gaps as areas of market imbalance with no resting orders, creating opportunities for price movement. The speaker outlines the three-candle pattern to identify fair value gaps and emphasizes their use for retracements, not reversals. Viewers are tasked with identifying 10 such gaps and hypothesizing trade strategies, highlighting the importance of patience and confirmation before trading.

Takeaways

- 😴 The speaker is extremely tired, having had zero hours of sleep and is currently in Miami.

- 📚 The video is part of a series, specifically 'Fair Value Gaps Part Two', focusing on identifying fair value gaps in trading.

- 🔍 Fair value gaps are areas in the market with a lack of liquidity, where there are no resting orders in the opposite direction of the price movement.

- 📈 Fair value gaps are used for retracements and continuations in the market, not for reversals.

- 🐂 In a bullish market, traders look for bullish fair value gaps for retracements and continuations, not for bearish reversals.

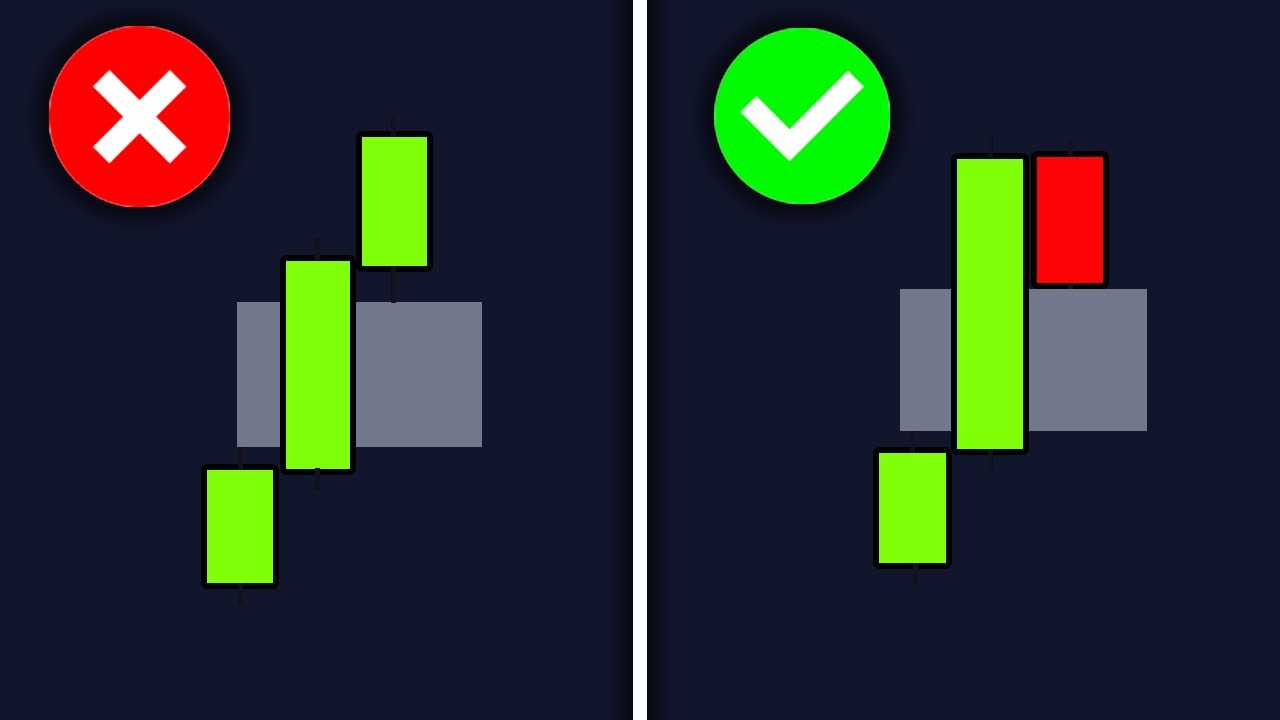

- 📊 Fair value gaps are identified by a three-candle pattern: the first and third candles' wicks do not fill the second candle's body, indicating a lack of resistance.

- 📉 To identify a bearish fair value gap, measure from the bottom wick of the first candle to the top wick of the third candle.

- 📌 Traders should wait for a reaction or confirmation on a lower time frame before entering trades based on fair value gaps.

- 🚫 Not all fair value gaps will result in profitable trades, so patience and confirmation are crucial.

- 🏡 The homework for viewers is to identify 10 fair value gaps in the market and hypothesize how they would trade them.

Q & A

What is the main topic of the video?

-The main topic of the video is identifying fair value gaps in trading, which is part two of a series.

What is the significance of fair value gaps in trading?

-Fair value gaps are significant in trading as they represent areas of the market where there is a lack of liquidity, potentially leading to price reactions and opportunities for trades.

What is the difference between fair value gaps and reversals?

-Fair value gaps are not reversals. They are used for retracements and continuations, not for turning the market trend around.

How are fair value gaps typically identified in the market?

-Fair value gaps are typically identified as a three-candle pattern where the second candle creates an imbalance with no resistance from the first and third candle's wicks.

What is the purpose of identifying fair value gaps in a trading strategy?

-Identifying fair value gaps helps traders to find potential retracement points and continuations, which can be used to set up trades based on market reactions.

Why is it important to wait for a reaction when trading fair value gaps?

-Waiting for a reaction is important because not all fair value gaps will lead to successful trades. A reaction, such as a bullish or bearish candle, confirms that the market is reacting as expected.

What is the homework assignment given in the video?

-The homework assignment is to identify 10 fair value gaps in the market on a chosen trading pair and create hypothetical trading strategies based on those gaps.

How does the speaker describe the process of identifying a fair value gap?

-The speaker describes identifying a fair value gap by looking for a three-candle pattern where the second candle shows a significant imbalance compared to the first and third candles, with no wicks filling the price range.

What is the role of liquidity in the formation of fair value gaps?

-Liquidity plays a crucial role in the formation of fair value gaps. A lack of liquidity, indicated by no resting orders in the opposite direction of the price movement, creates these gaps.

How can traders use fair value gaps in their trading strategies?

-Traders can use fair value gaps as retracement tools to find trades off of retracements. They should look for confirmations such as a change in market structure or a reaction on a smaller time frame before entering a trade.

What is the speaker's advice on executing trades based on fair value gaps?

-The speaker advises being patient and waiting for confirmation, such as a reaction or a break of structure on a lower time frame, before executing trades based on fair value gaps.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

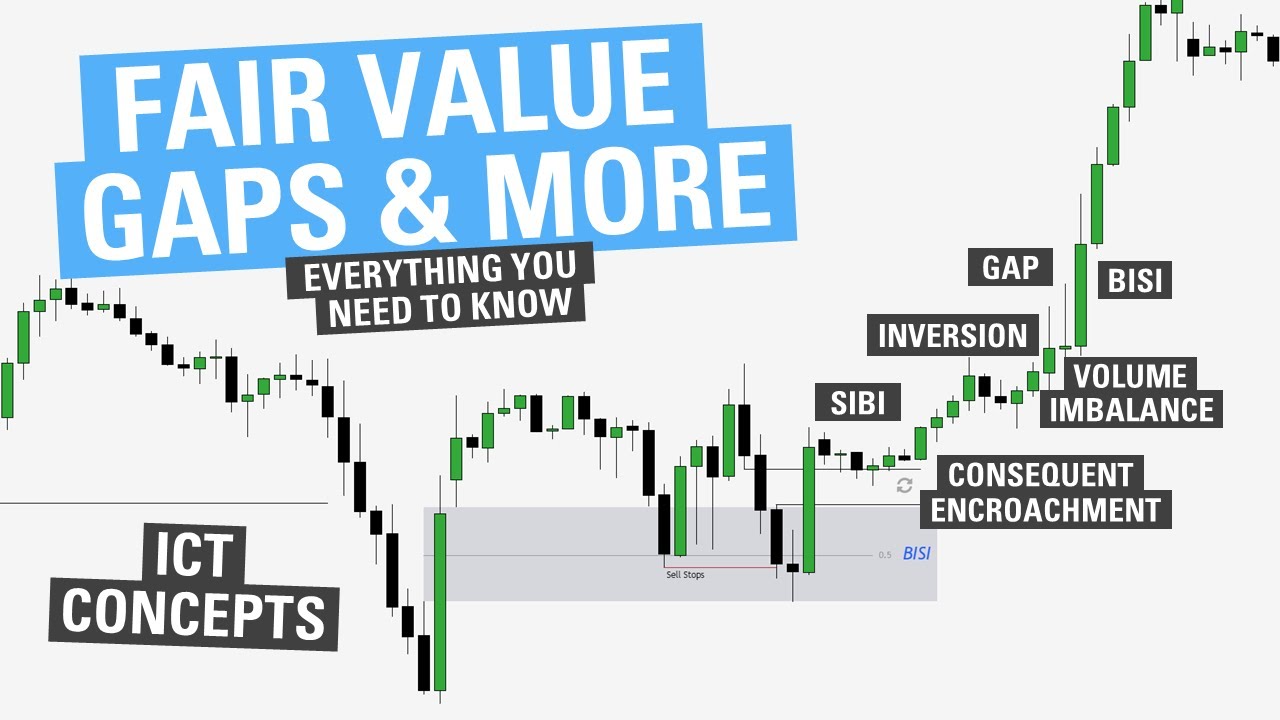

Understanding Fair Value Gaps (FVG) - ICT Concepts

Fair Value Gap (FVG) Explained: 3 Best Strategies Revealed

The Secret FVG that we don’t trade back into: BreakAway Gap

I Found A Secret To Fair Value Gaps

Everything you need to know about Fair Value Gaps.

ICT Concepts - Immediate Rebalance (Strongest Signature) 🤫

5.0 / 5 (0 votes)