Trick to save taxes | Tax planning | Pay 0 taxes on rental Income

Summary

TLDRThis video script discusses how to make zero tax on rental income and monitoring office 26. It covers the basics of rental income tax in India, objectives, and steps to understand the tax implications. It also touches on property benefits, medical benefits, and interest benefits, aiming to educate viewers on tax-saving strategies.

Takeaways

- 😀 The video discusses how to make zero tax on rental income and monitoring the office.

- 🏠 It explains the concept of rental income tax in India and how to handle it.

- 🎬 The video will cover MP4 movie format and provide examples of rental income.

- 🔔 Encourages viewers to subscribe to the channel and turn on notifications for timely updates.

- 💡 Discusses the importance of proof mixture and examples of life after screen total rental income.

- 📈 Provides an explanation of the 126 rupees now, indicating a specific amount related to rental income.

- 🏡 Mentions not having any property as part of the discussion.

- 💼 Highlights recent activities and how one can take benefits related to medical, benefits of the employer, and third party in family.

- 💰 Also touches on the benefits of having a loan against property and more.

- 📊 The first 10 minutes are crucial for understanding the younger age group, suggesting a focus on the younger demographic.

- 👨👩👧👦 Discusses the benefits of the husband and wife in the house, indicating a focus on family benefits.

Q & A

What is the main topic discussed in the video by Neha Gupta?

-The main topic discussed is how to reduce or eliminate taxes on rental income in India.

What does Neha Gupta suggest viewers do to receive notifications for future videos?

-Neha Gupta suggests viewers subscribe to her channel and press the bell icon to receive notifications.

What example does Neha Gupta use to illustrate rental income?

-Neha Gupta uses the example of a total rental income amounting to 126 rupees.

What benefit does Neha mention that can be taken advantage of in terms of family?

-Neha mentions that medical benefits, such as Mediclaim, can be taken advantage of for family members.

What financial benefit can be obtained against property according to the video?

-A loan against property can be obtained, providing financial benefits.

Who does Neha Gupta suggest needs to pay taxes?

-Anyone taking a home loan or possessing property needs to pay taxes.

What is the specific interest benefit amount mentioned by Neha Gupta for a home loan?

-Neha Gupta mentions an interest benefit amount of 2.25, though the exact currency or context isn't clear.

What does Neha advise about subscribing to her channel?

-Neha advises viewers to subscribe to her channel to stay updated with all the information and videos.

What example does Neha use to illustrate tax benefits?

-Neha uses the example of Mr. Nashamukt and his wife to explain the division of tax benefits in a household.

What additional benefits does Neha mention related to home loans?

-Neha mentions that besides tax benefits, one can also take advantage of benefits related to interest on home loans.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Do This to Legally Pay LESS TAXES in Canada

Contoh Perhitungan PPh Pasal 23 atas Penghasilan Royalti & Penghasilan Sewa

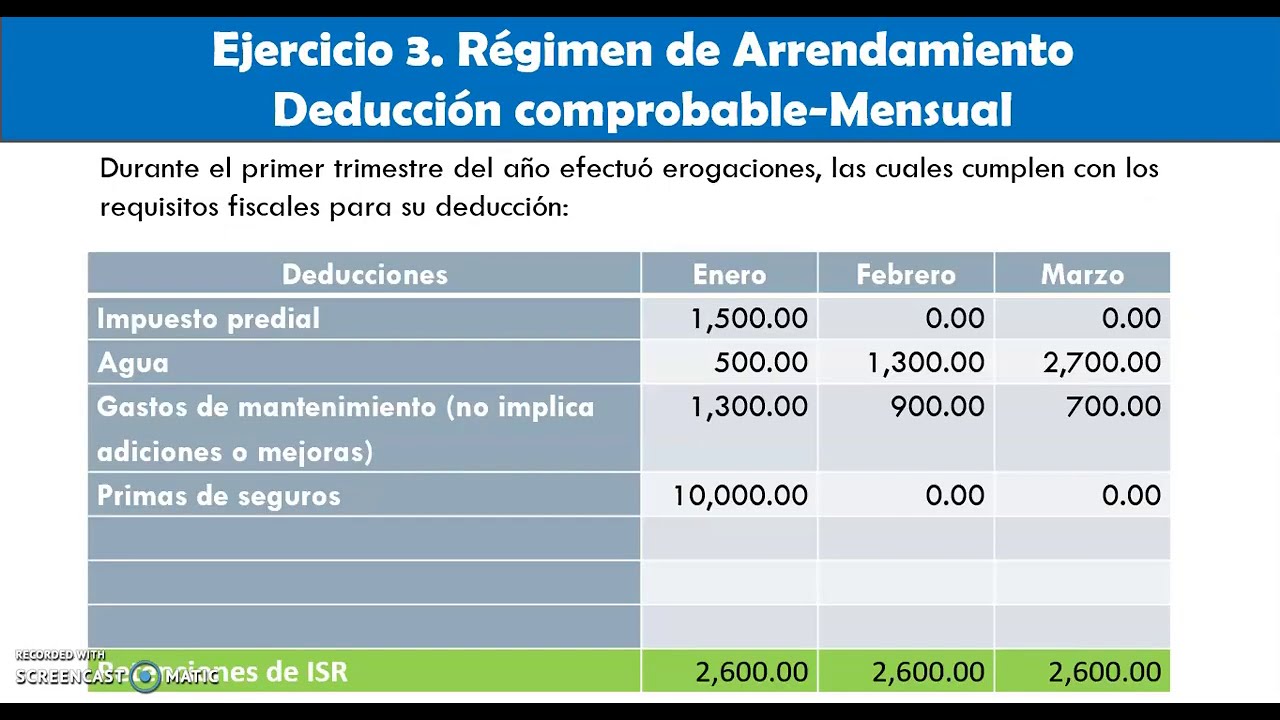

OPCIONES PARA PAGAR ISR EN ARRENDAMIENTO

Pagos provisionales de ISR en Régimen de Arrendamiento parte 2

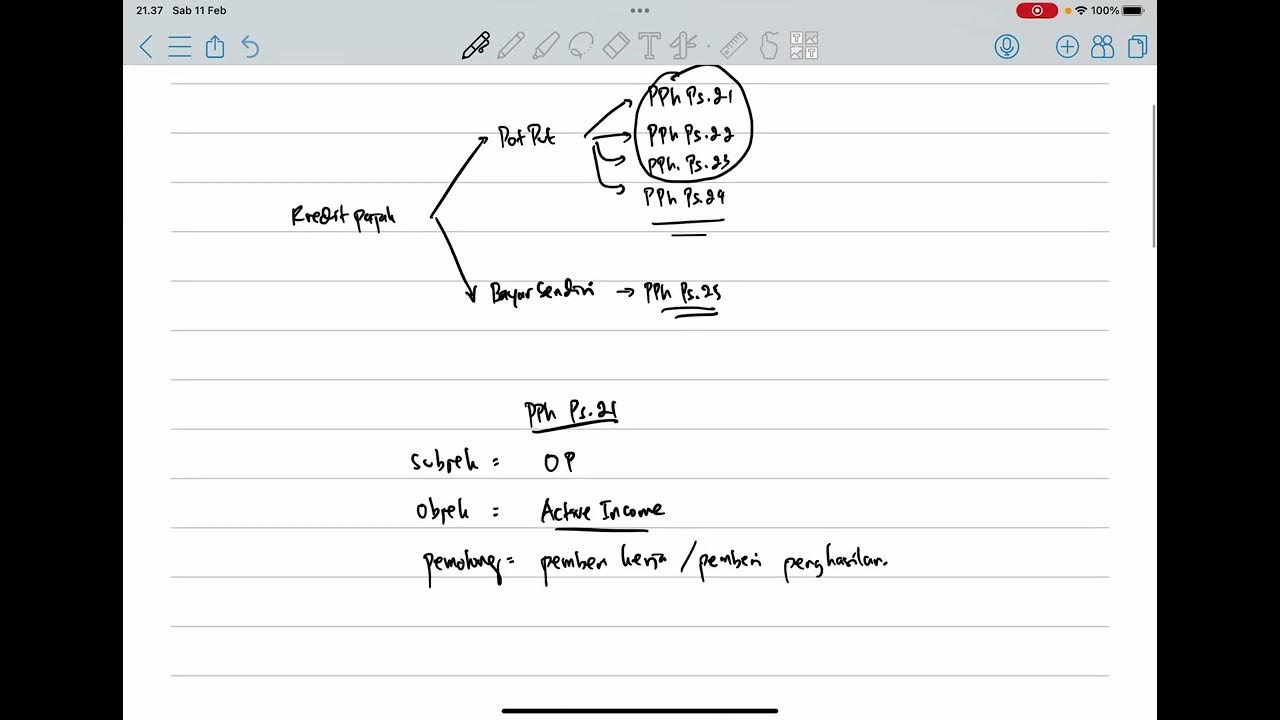

PPh Orang Pribadi (Update 2023) - 5. Kredit Pajak

الاستثمار في العقار بالمغرب : أهم ما يجب معرفته

5.0 / 5 (0 votes)