OPCIONES PARA PAGAR ISR EN ARRENDAMIENTO

Summary

TLDRIn this informative video, viewers learn about the tax implications of rental income through the case of Luis, who rents corporate offices. The video outlines three taxation options: authorized deductions, blind deduction, and simplified trust regime, detailing which expenses can be deducted and the associated tax calculations. It explains how to calculate provisional payments and annual declarations, emphasizing the importance of understanding one's financial situation to choose the most beneficial tax regime. The video aims to equip viewers with the knowledge needed to make informed decisions regarding their rental income taxes.

Takeaways

- 😀 Luis earns a monthly rent of 50,000 pesos from leasing corporate offices.

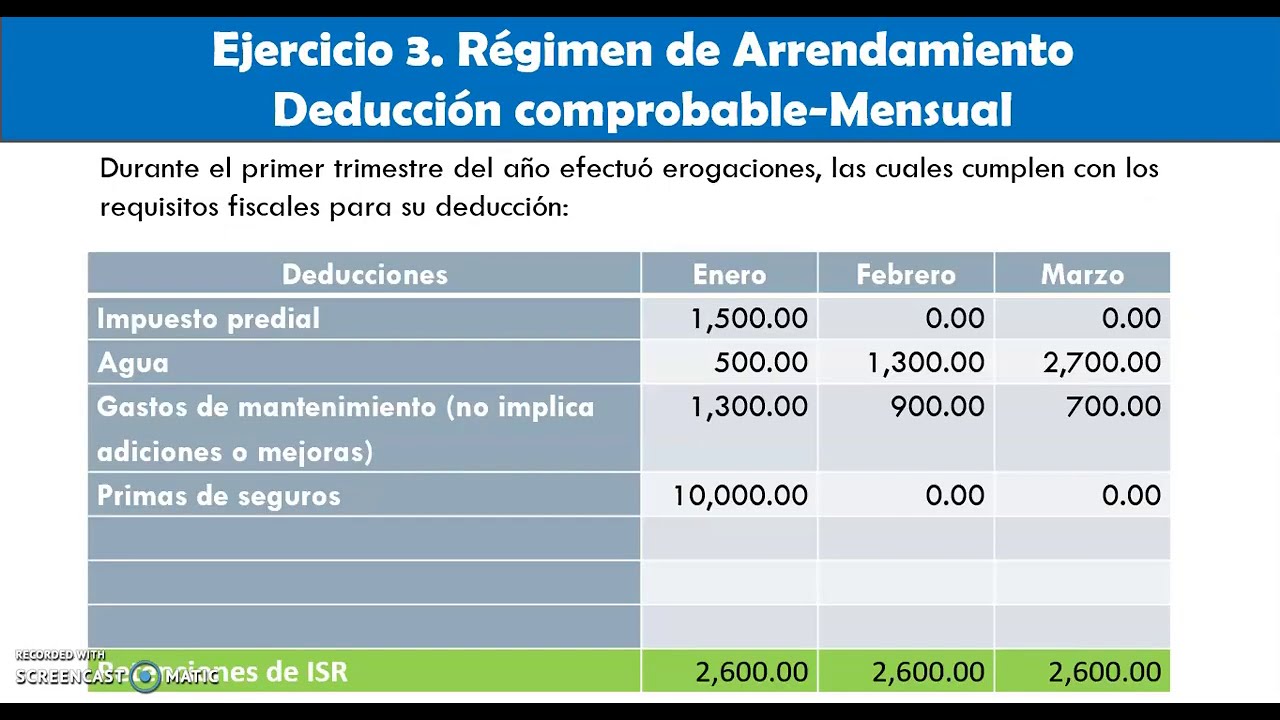

- 📉 Luis incurs authorized deductions such as property tax and maintenance costs.

- 🧾 There are three taxation options for Luis: authorized deductions, blind deductions, and the simplified trust regime.

- 💡 In the authorized deductions regime, Luis can deduct expenses like property taxes, maintenance, and interest on loans related to the property.

- 🔍 The blind deductions option allows Luis to deduct 35% of his income plus property tax.

- 📅 Payments for provisional tax must be made by the 17th of the following month.

- 💵 Provisional tax calculations differ among the three options, affecting the amount Luis pays.

- ✅ All three options require Luis to file an annual income tax declaration by April of the following year.

- 💳 Luis can reduce personal deductions in the annual declaration under the first two options but not under the simplified trust regime.

- 🔑 To qualify for the income tax regime, individuals must earn less than 3,500,000 pesos annually and cannot be shareholders of legal entities or earn assimilated income.

Q & A

What is the main topic discussed in the video?

-The video discusses the different options for individuals to tax their rental income in Mexico, using the case study of Luis, who rents corporate offices.

What are the three tax regimes Luis can choose from?

-Luis can choose from the following three tax regimes: 1) Regimen de Arrendamiento con Deducciones Autorizadas, 2) Regimen de Arrendamiento con Deducción Ciega, and 3) Regimen Simplificado de Confianza.

What monthly rent does Luis receive from the company renting his offices?

-Luis receives a monthly rent of 50,000 pesos.

What types of expenses can Luis deduct under the authorized deductions regime?

-Luis can deduct expenses such as property tax, maintenance costs, interest on loans for property improvements, salaries, commissions, fees paid, and insurance premiums for the rented property.

How is the taxable base calculated in the authorized deductions regime?

-In the authorized deductions regime, the taxable base is calculated by subtracting the total deductions from the income received.

What is the flat deduction percentage for the flat deduction regime?

-The flat deduction percentage in the flat deduction regime is 35% of Luis's income.

What tax payment does Luis have to make under the simplified regime?

-Under the simplified regime, Luis pays a tax of 1.10% of his total income, without considering any deductions.

When must Luis submit his annual tax declaration?

-Luis must submit his annual tax declaration by April of the following year, regardless of the tax regime chosen.

Can Luis claim personal deductions in his annual declaration?

-Yes, Luis can claim personal deductions in his annual declaration for the first two regimes, but not for the simplified regime.

What is the maximum income limit for individuals to be eligible for these tax regimes?

-Individuals must earn less than 3,500,000 pesos annually from rental or business activities to be eligible for these tax regimes.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Contoh Perhitungan PPh Pasal 23 atas Penghasilan Royalti & Penghasilan Sewa

Trick to save taxes | Tax planning | Pay 0 taxes on rental Income

Pagos provisionales de ISR en Régimen de Arrendamiento parte 2

MENGENAL PPH 21 LEBIH DEKAT AGAR TIDAK SALAH PAHAM DENGAN PERUSAHAAN ANDA

7 Types of Income Millionaires Have [How the Rich Make Money]

DO NOT Try Mid-Term Rentals Without Watching This Video

5.0 / 5 (0 votes)