Wave Accounting Tutorial for Small Business | FREE Accounting Software (Beginners Overview)

Summary

TLDRThis tutorial provides a step-by-step guide to Wave Accounting, a free software for small businesses. Stuart walks viewers through setting up an account, connecting bank accounts, creating invoices, managing customers and vendors, and utilizing features like recurring invoices and payroll. He also explains how to track financial transactions, reconcile accounts, and generate reports. The tutorial is designed for business owners to streamline their financial management, offering tips on integrating Wave with other tools and accessing professional help for optimal use.

Takeaways

- 😀 Wave is a free accounting software ideal for small businesses, helping with managing transactions, accounts, invoices, bills, payments, and more.

- 😀 To get started, users need to visit waveapps.com, sign up with an email or Google account, and input basic business details like name, country, and business type.

- 😀 Wave is designed primarily for businesses based in the U.S. and Canada. Non-U.S. or Canadian users are advised to look into alternative tools like Xero.

- 😀 The dashboard provides a snapshot of your business finances, including cash flow, profit and loss, and net income, offering a clear view of your financial situation.

- 😀 Users can easily connect their bank accounts to Wave for automatic transaction tracking and reconciliation, streamlining financial management.

- 😀 The platform supports creating and managing invoices, including recurring invoices for subscription-based businesses or long-term contracts.

- 😀 Wave allows businesses to accept payments through its checkout system, making it easier to process payments directly on websites.

- 😀 Customers and vendors can be managed within Wave. Businesses can create estimates (quotes), invoices, and even recurring invoices for clients.

- 😀 The software enables businesses to manage products and services both for sales and purchases, helping to track what’s being sold and bought.

- 😀 Wave offers a payroll feature where users can manage payroll processes, though it requires a setup and is not available unless configured.

- 😀 Wave provides an option for businesses to file taxes directly through the platform, and offers integrations with other tools to extend its functionality.

Q & A

What is Wave accounting software designed for?

-Wave is a free, award-winning accounting software designed to help small businesses track transactions, manage accounts, create invoices and bills, accept online payments, and more. It provides a streamlined, user-friendly platform for managing business finances.

Can I sign up for Wave using my Google account?

-Yes, you can sign up for Wave either by entering your email and password or by signing up with your Google account for a quick registration process.

Which countries are supported by Wave for business operations?

-Wave is built for businesses based in the United States and Canada. If your business operates outside these countries, it is recommended to look into alternative tools like Xero, which is suitable for businesses in Australia and New Zealand.

How can I set up reoccurring invoices in Wave?

-To set up reoccurring invoices, navigate to the 'Reoccurring Invoices' section under 'Sales' in the Wave dashboard. From there, you can create an invoice and specify the reoccurrence frequency (e.g., monthly, quarterly, annually).

What is the importance of connecting my bank account to Wave?

-Connecting your bank account to Wave allows automatic synchronization of your transactions, making it easier to manage and reconcile them. This integration streamlines your accounting process and ensures your financial data is up-to-date.

What are 'Estimates' in Wave accounting?

-An 'Estimate' in Wave is a quote you send to a customer, outlining potential costs for a service or product before it’s confirmed. Estimates can be created and managed under the 'Sales' section in the dashboard.

How does Wave help with eCommerce payments?

-Wave provides an option to integrate payments directly on your website through its 'Checkouts' feature. This allows you to streamline payment processing and manage eCommerce transactions seamlessly.

What is the 'Chart of Accounts' in Wave, and why is it important?

-The 'Chart of Accounts' in Wave is a list of financial accounts used to categorize and track your business's financial transactions. It is crucial for maintaining accurate records and helps bookkeepers and accountants manage your finances effectively.

Can I use Wave to file my taxes directly?

-Yes, Wave allows you to file your taxes directly through the platform. It also provides the option to consult with Wave advisors for professional guidance during the tax filing process.

How do I manage and track my business's expenses in Wave?

-In Wave, you can manage your business expenses by navigating to the 'Purchases' section. Here, you can create bills, manage your vendors, and track the products or services you purchase for your business.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

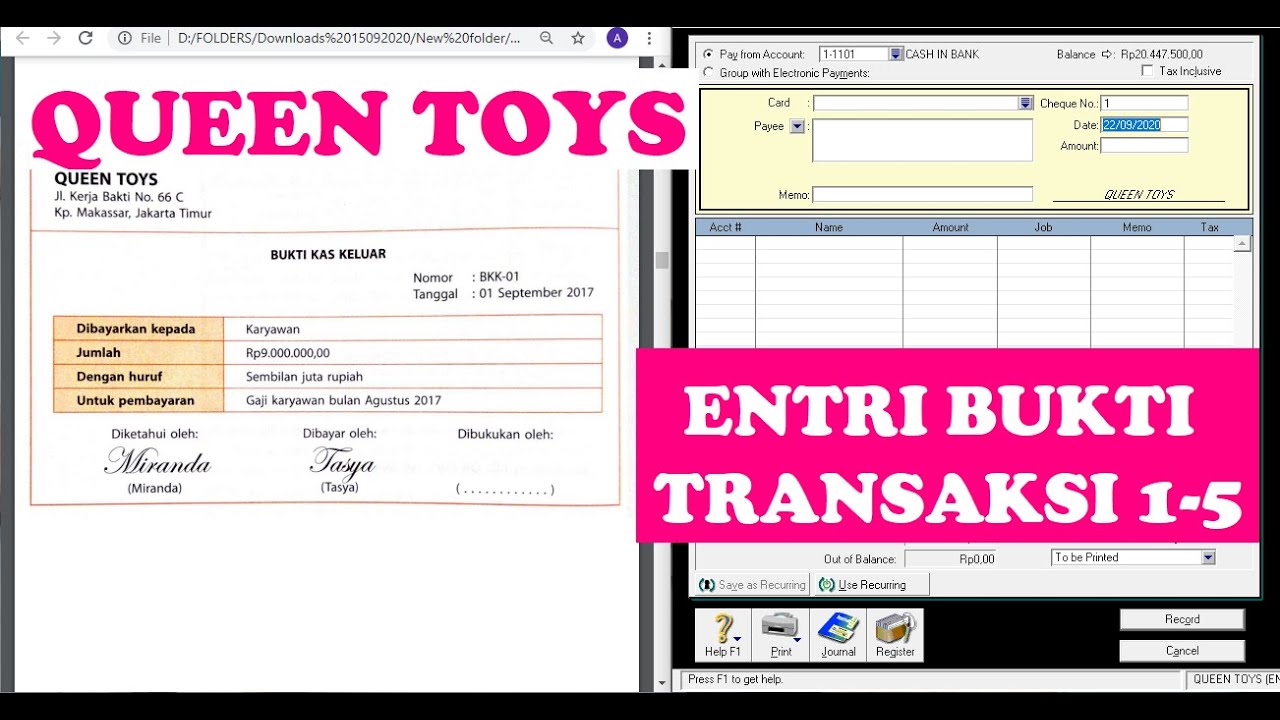

(9-QT) MENGENTRI BUKTI TRANSAKSI 1-5 | MYOB Accounting Plus V18 ED (Queen Toys)

Cara Belajar Accurate Untuk Pemula Menggunakan Persiapan Standar Dengan Mudah Dan Cepat

INSANELY Profitable Side Hustle (How To Make Money Online 2024)

Cara Install Aplikasi MYOB Accounting Plus Versi 18

Piutang Karyawan untuk Akun Piutang (AR) pada Accurate Dekstop

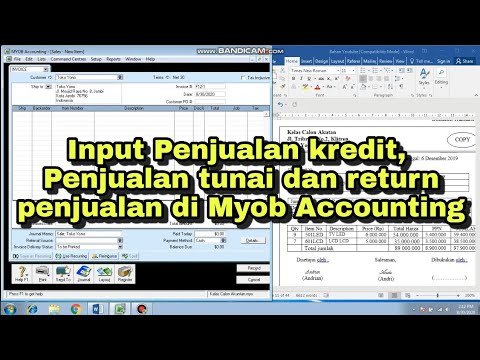

CARA INPUT TRANSAKSI PENJUALAN KREDIT, PENJUALAN TUNAI DAN RETURN PENJUALAN DI MYOB ACCOUNTING

5.0 / 5 (0 votes)