The Simplest And Most Accurate Buy Sell Strategy On Tradingview

Summary

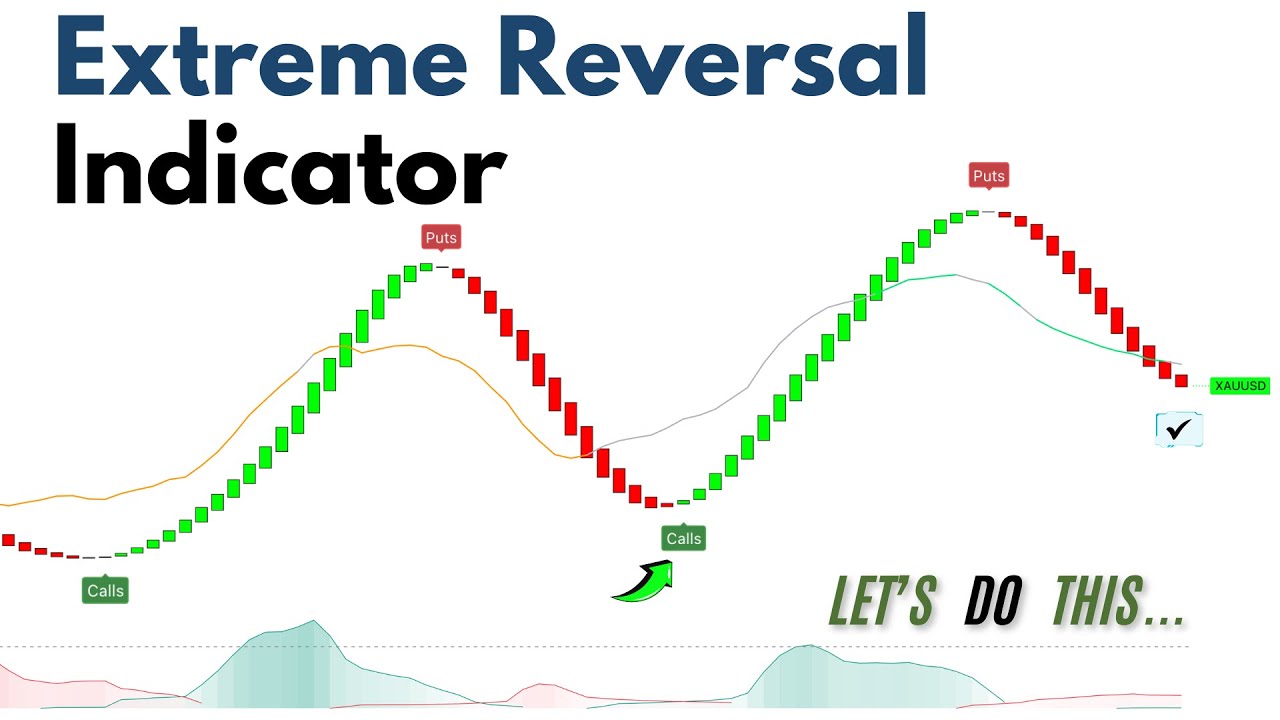

TLDRThis video introduces an accurate buy-sell strategy on TradingView using the Optimized Trend Tracker Oscillator and SuperTrend indicators. It explains how to set up these indicators on the GBP-JPY one-hour chart, emphasizing their combined use for confirming trend shifts and identifying entry points. The presenter also recommends Hankotrade for its low spreads and leverage, offering a 100% deposit bonus. The strategy is not foolproof, but it serves as an example of using indicators to enhance an existing trading strategy.

Takeaways

- 📈 The video introduces an accurate buy-sell strategy using two free indicators on TradingView.

- 🌐 The core indicator is the Optimized Trend Tracker Oscillator by Kivan, which can be applied to any trading security and timeframe.

- 🔍 To add the Optimized Trend Tracker Oscillator, load the one-hour timeframe of GPB-JPY on TradingView and search for the indicator.

- 🛑 The indicator includes a trend cloud that changes between red and green, and labels for buy and sell signals.

- ❌ The video suggests disabling the High and Low Optimized Trend Tracker lines for this strategy.

- 📊 The SuperTrend indicator, also by Kivan, is added for trend identification and is based on the ATR.

- 💼 Hankotrade is recommended as a Forex broker for its low commissions, spreads, high leverage, and deposit bonus.

- 📝 The strategy combines a buy signal from the Optimized Trend Tracker Oscillator with a green SuperTrend cloud for a long position.

- 📉 Conversely, a sell signal with a red SuperTrend cloud indicates a short position.

- 🚫 The strategy is not fool-proof and should be backtested and incorporated into an existing strategy with caution.

- 📚 Learning price action is emphasized as a foundation before integrating indicator strategies.

Q & A

What is the main focus of the video?

-The video focuses on showcasing a buy-sell strategy using two free indicators on TradingView, which is applicable to any trading security and timeframe.

What is the core indicator of the strategy discussed in the video?

-The core indicator of the strategy is the Optimized Trend Tracker Oscillator, designed by Kivan.

What does the Optimized Trend Tracker Oscillator consist of?

-The Optimized Trend Tracker Oscillator consists of a trend cloud that changes color between red and green, and two lines called HOTT (High Optimized Trend Tracker) and LOTT (Low Optimized Trend Tracker).

Why are the HOTT and LOTT lines not needed for this strategy?

-For this strategy, the HOTT and LOTT lines are not needed, as the focus is on the trend cloud and the buy/sell labels indicating shifts in trend.

What is the second indicator added to the chart in the strategy?

-The second indicator added to the chart is the SuperTrend indicator, which is an ATR-based indicator used for trend identification.

What is the role of the SuperTrend indicator in the strategy?

-The SuperTrend indicator is used to confirm the overall trend direction. A green ribbon indicates a bullish trend, while a red ribbon indicates a bearish trend.

How does the strategy define a long position entry?

-A long position entry is defined when the bottom indicator prints a buy signal in an area where the SuperTrend indicator is colored green.

What is the recommended stop loss and take profit setting for the trades?

-The stop loss should be set at the bottom of the SuperTrend cloud, and the take profit should be set at 1.5 times the risk.

What is Hankotrade and why is it mentioned in the video?

-Hankotrade is a Forex broker that the presenter has been using. It is mentioned for its low commissions and spreads, high leverage, and a 100% deposit bonus for first deposits.

How does the presenter suggest incorporating the indicators with a price action strategy?

-The presenter suggests using the indicators as confluences to an existing price action strategy, such as confirming entries when both indicators show the same trend direction during a price break and retest.

What advice does the presenter give to beginners regarding indicator strategies?

-The presenter advises beginners to first learn price action before looking at indicator strategies, and then use indicators to add extra confluences to their strategy once they have mastered price action.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Reversal Easy Setup, Quick Profit: My Simple Trading Secret!

TradingView’s Most Underrated Volume Confirmation Tool

1 TBT BigBeluga Indicator, 3 Uses! Most Powerful Trading Tool Ever Created

Best AI TradingView Indicator in 2024 | 100% Winning Strategy 🔥

The Ultimate Gold Scalping 5 Min - Scalping Strategy For Quick and Easy Profits

BEST Trend Line Breakout Strategy on TradingView 📈

5.0 / 5 (0 votes)