Economic forecasts show Trump's tariffs having major global impact

Summary

TLDRThe transcript discusses the global economic slowdown caused by President Trump's trade wars, with the IMF forecasting a U.S. growth drop to 1.8%. Market volatility is rising, and investors are concerned about Treasury bonds and tariff impacts. The Treasury Secretary suggests the trade war with China may be unsustainable, while President Trump hints at easing tensions. Financial experts warn of a potential recession, with the risk of U.S. growth falling below 1% if uncertainties persist. The Federal Reserve, under Jay Powell, is expected to remain independent despite external pressures. Overall, economic stability remains uncertain amid these trade and policy challenges.

Takeaways

- 😀 The International Monetary Fund (IMF) projects a significant slowdown in global economic growth due to President Trump's trade wars.

- 😀 The U.S. economy is expected to grow at just 1.8% in 2025, down from an earlier estimate of 2.7%.

- 😀 The trade war, including tariffs, has caused a decline in investor confidence and market volatility.

- 😀 The value of the U.S. dollar has been sliding, and there are growing concerns about U.S. Treasury bonds.

- 😀 U.S. stock markets rebounded after Treasury Secretary Scott Bessent expressed that the trade war with China may be unsustainable.

- 😀 President Trump showed openness to easing trade tensions with China, indicating a shift in his approach.

- 😀 Financial markets are urging political leaders to adopt a more clear and strategic approach to trade negotiations.

- 😀 Ron Insana suggests that ongoing trade tensions may lead to a potential recession if not resolved.

- 😀 Volatility is expected to remain in the markets until there is clarity on the outcomes of trade negotiations and tariffs.

- 😀 The Federal Reserve, under Chairman Jay Powell, has resisted political pressure from President Trump, maintaining its independence.

- 😀 Despite IMF’s optimistic forecast, experts predict that U.S. growth may dip below 1% if trade tensions persist for several more months.

Q & A

What is the main economic forecast provided by the International Monetary Fund (IMF) for the U.S. economy?

-The IMF has projected that the U.S. economy will grow by just 1.8% in 2025, down from its earlier estimate of 2.7%, due to the impacts of trade wars, particularly with China.

How has the trade war with China impacted global growth projections?

-Global growth has been downgraded by half a percentage point, as the trade war with China has created significant economic uncertainty worldwide.

What market trends indicate the economic volatility caused by the trade war?

-The U.S. dollar has continued its decline, and there has been notable volatility in the stock market, especially in the Treasury bond market, which has raised concerns among investors.

What significant market event occurred following Treasury Secretary Scott Bessent's comments about the trade war with China?

-The U.S. stock markets rebounded strongly after reports that Treasury Secretary Scott Bessent had stated the trade war with China was unsustainable, with hopes that tariffs on both sides could be eased.

How did President Trump's stance on the trade war evolve in the news segment?

-President Trump indicated a willingness to ease up on the trade war with China, suggesting he was open to negotiations and that both sides should aim for a deal.

What is Ron Insana’s perspective on the impact of the trade war on the U.S. economy?

-Ron Insana believes that the trade war is detrimental to growth, and if it continues, it could harm the U.S. economy. He suggests that such conflicts, without a clear resolution, could lead to significant economic downturns.

What role do financial markets play in shaping political decisions regarding trade policy, according to Ron Insana?

-Ron Insana suggests that the financial markets are influencing political decisions by signaling the negative impact of ongoing volatility, which is pushing policymakers, like the Treasury Secretary, to reconsider the intensity of the trade war.

What are the implications of President Trump's potential firing of Federal Reserve Chairman Jay Powell?

-The possibility of President Trump firing Jay Powell has raised concerns about the independence of the Federal Reserve. However, Ron Insana believes that Powell and the Fed are resilient enough to withstand this pressure and maintain their independence.

What is the general economic outlook if the trade war persists, according to experts in the segment?

-Experts, including Ron Insana, suggest that if the trade war continues, the U.S. economy could experience a recession, with growth possibly falling below 1% for the year, as businesses struggle with uncertainty around tariffs and trade policies.

What does the IMF's revised U.S. economic growth forecast imply about the potential for a recession?

-The IMF's downward revision of U.S. growth to 1.8% suggests that the risk of a recession is increasing, as prolonged trade tensions could severely affect economic activity, with some economists estimating a 90% chance of a recession if tariffs remain in place.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

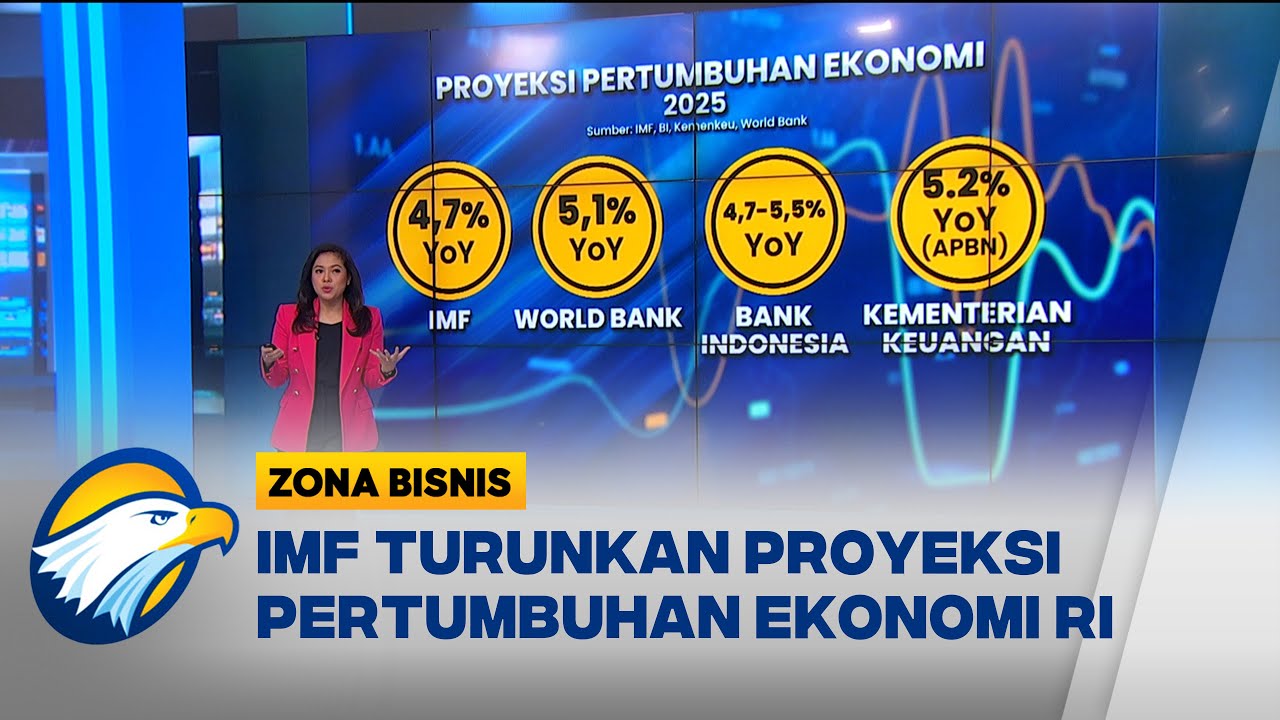

IMF Ramal Ekonomi Indonesia 2025-2026 Bakal Anjlok! [Zona Bisnis]

اخطاء ترامب التي خسرت أمريكا

ECONOMIC OUTLOOK | HOW BAD IS THE IMPACT OF U.S. TARIFF ON INDONESIA?

Perang Dunia Ternyata Dipicu oleh Perang Dagang

What are Trump’s tariffs and is the US in a trade war with China? | BBC News

Trump Mengamuk Hajar China dengan Tarif 104% - [ Primetime News ]

5.0 / 5 (0 votes)