ICT 4 Phases of Price Delivery, Find Daily Bias with Phases of Price Delivery,

Summary

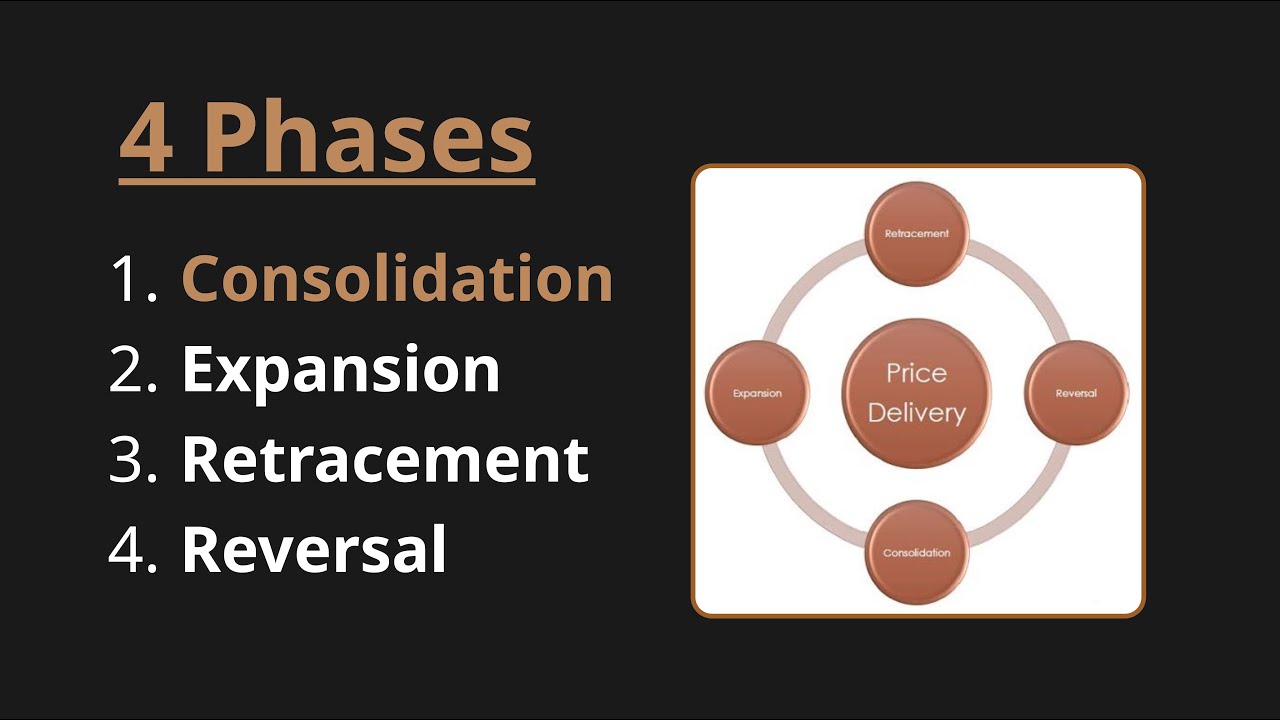

TLDRIn this video, the concept of price delivery phases in trading is discussed, focusing on the four key stages: consolidation, expansion, retracement, and reversal. The video explains how to identify and use these phases to improve trading strategies, including integrating them with weekly profiles for higher probability outcomes. It provides real-life chart examples and emphasizes the importance of recognizing manipulation, changes in state of delivery, and appropriate entry points. The content is designed to help traders understand market behavior and enhance their decision-making process in daily and weekly trades.

Takeaways

- 😀 Consolidation is a range-bound price movement between a swing high and low, where traders are trapped and price moves to the opposite side after manipulation.

- 😀 The key to identifying consolidation is the market's indecision, where traders expect trends in both directions, leading to price manipulation and eventual expansion.

- 😀 In consolidation, look for one side of the range to be manipulated before price moves to the opposite side, confirming a change in market behavior.

- 😀 Expansion occurs when the price moves in one direction following a consolidation, reversal, or retracement phase, and can last for up to three days.

- 😀 A swing point is essential for successful trading during an expansion phase, as price must move away from it for high-probability trades.

- 😀 The retracement phase occurs when price pulls back into key levels, such as an order block or fair value gap, before continuing its trend or expansion.

- 😀 During retracement, price may sweep short-term lows or trade into significant levels like bullish or bearish order blocks, preparing for further expansion.

- 😀 Reversal is the final phase, marked by a significant change in market sentiment, where price reaches key liquidity levels and shifts direction.

- 😀 To trade a reversal, confirmation from daily chart closures and a shift in market sentiment (e.g., from bullish to bearish) is crucial.

- 😀 The process involves identifying key price delivery phases, such as consolidation, expansion, retracement, and reversal, and integrating them with weekly profiles for high-probability trades.

Q & A

What are the four phases of price delivery mentioned in the video?

-The four phases of price delivery discussed are: Consolidation, Expansion, Retracement, and Reversal.

What is consolidation in the context of price delivery?

-Consolidation is a phase where price moves within a defined range, oscillating between a swing high and swing low. During this phase, the market is indecisive, and traders are trapped as they anticipate the market to either go up or down.

How can traders identify the consolidation phase?

-Traders can identify consolidation when the price remains bound within a specific range. This phase is often marked by price manipulation at one end of the range, followed by an expansion to the opposite side.

What does the 'expansion' phase involve?

-Expansion occurs when price moves in one direction following a consolidation, retracement, or reversal. It typically follows a reversal or a retracement, where price breaks out of the range and moves strongly in one direction.

How does a trader align expansion with the weekly profile?

-Traders align expansion with the weekly profile by identifying a reversal point and then looking for price to move away from that point, expanding to the other side. This is often validated by price closures and swing points.

What is retracement, and why is it important in price delivery?

-Retracement occurs when the price temporarily pulls back in the opposite direction to fill orders before continuing in the original direction. It is crucial because it allows for price to gather more liquidity before expanding further.

What key indicators should traders look for during the retracement phase?

-Traders should look for retracements into key areas like order blocks, fair value gaps, or previous short-term lows. Once price reaches these levels, they watch for price to resume its trend, often confirmed by closures and reversal patterns.

What is the reversal phase in price delivery?

-The reversal phase occurs after an expansion, where price reaches a key liquidity point or a significant level, causing the market sentiment to shift. It involves a change in price direction, usually marked by strong candlestick formations and confirmation from higher time frames.

How can a trader confirm a reversal in the market?

-Traders confirm a reversal by observing a strong price movement that reaches a key liquidity level, followed by a change in market sentiment, such as a closure below or above specific price points, signaling a shift from bullish to bearish or vice versa.

What does the concept of 'one shot, one kill' mean in the context of price delivery?

-'One shot, one kill' refers to a high-probability entry strategy where traders wait for a strong confirmation before entering a trade, aiming for a precise target with a good risk-to-reward ratio, typically in a weekly context.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

IPDA Market Cycles - Phases of Price Delivery | ICT Concept in Trading

4 Stages of Price Delivery (ICT Concepts)

Anticipating Expansions From Consolidations - Episode 1

You Are Using Discount and Premium Wrong! - EQ For Expansions

Using Weekly Profiles for Daily Bias (Simplified)

The Secret To ICT Daily Bias: A Mechanical Approach

5.0 / 5 (0 votes)