Core Standard Deviations + PO3 | ICT Concepts | DexterLab

Summary

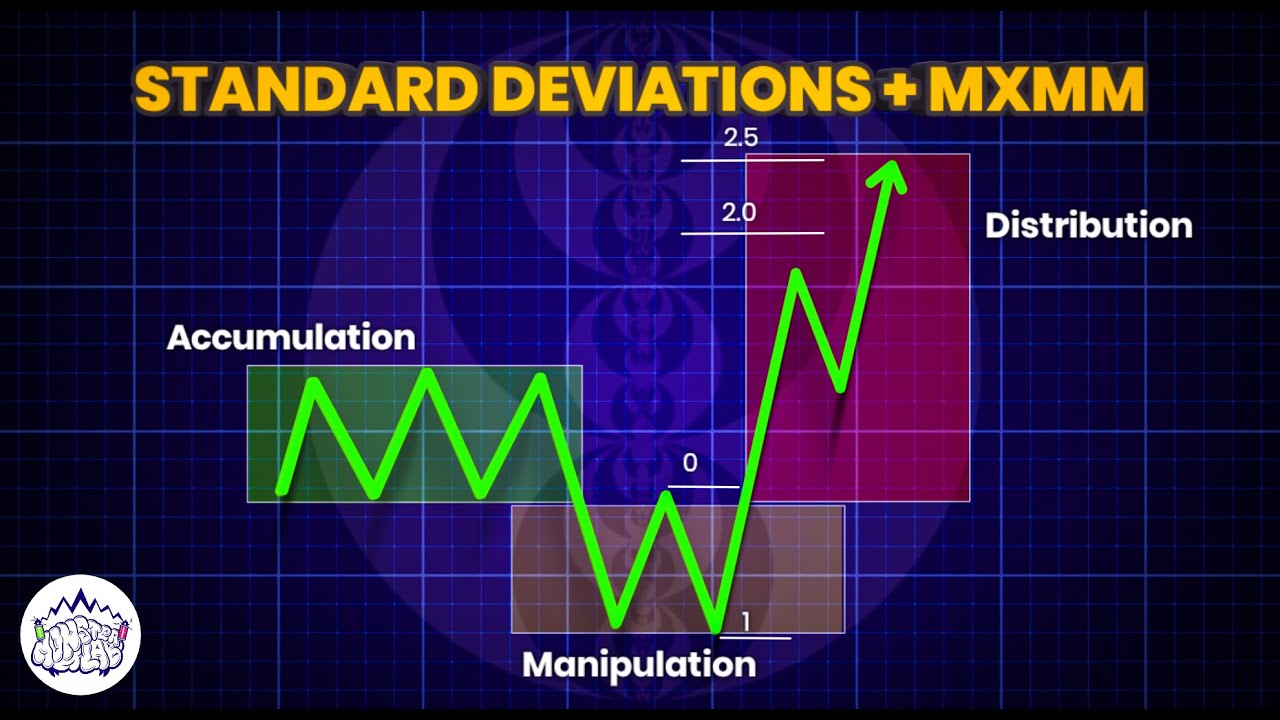

TLDRIn this video, the speaker introduces the concept of the 'Power of Three' in trading, focusing on the three key phases of price action: Accumulation, Manipulation, and Distribution (Expansion). By using standard deviations, particularly 2 or 2.5, the speaker explains how to predict price movements, including retracements and reversals. The concept of the 'Silver Bullet Zone' is highlighted as a key area for entry strategies. This detailed analysis aims at helping traders understand and measure market phases to improve their trading decisions, emphasizing the need for experience and backtesting to master these methods.

Takeaways

- 😀 The 'Power of 3' refers to three key phases in market analysis: accumulation, manipulation, and distribution/expansion.

- 😀 Accumulation is the first phase, where price movements are analyzed to determine the range for the manipulation phase.

- 😀 The manipulation phase is the second phase, where price actions project possible reversals and the next move direction.

- 😀 The distribution/expansion phase is the third phase, where price projects toward higher or lower targets, based on deviations.

- 😀 Standard deviations (2 or 2.5) are used to project potential price movements and determine the boundaries for manipulation and distribution.

- 😀 Price retracements or reversals are anticipated after the expansion phase, returning toward the equilibrium range.

- 😀 Retracement or reversal decisions depend on whether price has 'unfinished business' in the current direction.

- 😀 The 'Silver Bullet Zone' is a powerful concept, using deviations between 1 and 2.5 to determine significant price zones for re-accumulation or pre-distribution.

- 😀 Identifying institutional order flow and matching it with high-time frame data helps in refining predictions for the Power of 3 phases.

- 😀 To master the Power of 3 strategy, it's crucial to understand how each phase relates to price behavior and market trends at different time frames.

Q & A

What is the 'power of three' in the context of the script?

-The 'power of three' refers to three distinct phases of price action in trading: accumulation, manipulation, and distribution (or expansion). These phases help traders understand the market dynamics and project price movements.

What is meant by 'accumulation' in the power of three?

-'Accumulation' is the first phase where price moves sideways, indicating that institutional investors or big players are gathering positions before a larger price move.

How do you identify the 'manipulation' phase in the power of three?

-The 'manipulation' phase occurs when the price breaks out from the accumulation range, typically moving in the opposite direction of the expected trend, often creating false signals before the true trend begins.

What is the significance of 'distribution' or 'expansion' in the power of three?

-The 'distribution' or 'expansion' phase represents a large price movement after the manipulation phase, where price starts to move more decisively in the direction of the trend. This phase often results in significant price action and is key to identifying potential reversals.

What role do deviations play in the analysis of price movement?

-Deviations help in projecting future price movement ranges during different phases. For example, price movements are projected based on standard deviations (like two or two and a half deviations) from key swing highs or lows.

How are 'reversals' or 'retracements' identified after the distribution phase?

-Reversals or retracements are identified by looking for price movements that return to equilibrium within the range of the previous accumulation or distribution phase. Traders use key swing highs and lows to project possible reversal levels.

What is the 'Silver Bullet Zone' mentioned in the script?

-The 'Silver Bullet Zone' is a powerful price area identified during the expansion phase. It is marked by internal liquidity, such as imbalances in buy-side or sell-side liquidity, which can be crucial for spotting potential future price moves.

How does price 'unfinished business' influence the market direction?

-If price has 'unfinished business,' meaning there is a potential for further price movement in the same direction after a retracement, it indicates that the trend will likely continue. If there is no unfinished business, a reversal is more probable.

How do institutional order flows play a role in understanding the power of three?

-Institutional order flows help identify the direction in which large market players are moving. By understanding this, traders can align their strategies with the trend, making it easier to anticipate where the price might move next during the phases of the power of three.

How do the phases of accumulation, manipulation, and distribution help in trading strategy?

-By understanding the different phases of the power of three, traders can better time their entries and exits. Identifying whether the market is in accumulation, manipulation, or distribution allows traders to align their strategies with market movements, potentially increasing the success of their trades.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade Now5.0 / 5 (0 votes)