IPDA Market Cycles - Phases of Price Delivery | ICT Concept in Trading

Summary

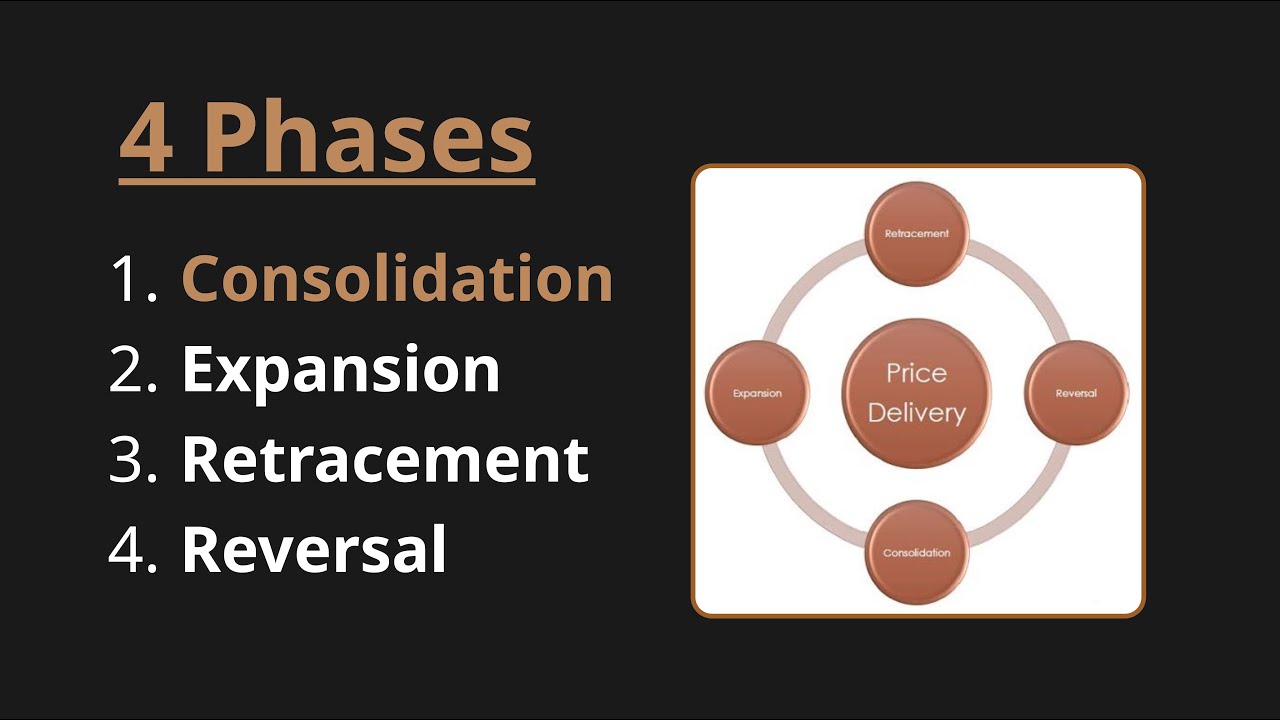

TLDRThis video dives into the concept of IBDA Market Cycles, explaining the phases of price delivery in trading: consolidation, reversal, expansion, and retracement. It explores how price moves through these phases, with consolidation occurring before reversals, and expansion phases following manipulations. Key concepts like fair value gaps, order blocks, and SMT divergence are discussed. The video provides practical examples using charts, explaining how to recognize and trade each phase, emphasizing the importance of reversals and transitions between different timeframes in predicting price movements.

Takeaways

- 😀 The IBDA market cycle refers to the phases of price delivery in trading, including consolidation, reversal, expansion, and retracement.

- 😀 Consolidation occurs when price moves within a defined range, often after a large price expansion, and ends with a manipulation leading to expansion.

- 😀 Expansion is characterized by large price movements with big candles, usually following consolidation, and can last up to three candles before transitioning into other phases.

- 😀 Retracement happens when price temporarily moves against the prevailing trend during an expansion phase before returning to the original trend.

- 😀 Reversals occur when an expansion phase meets another expansion in the opposite direction, signaling a significant change in market trend.

- 😀 Fair value gaps (FVG) and order blocks are critical tools used to identify potential retracement points and areas of interest for reversals.

- 😀 Price delivery phases are interconnected across different timeframes, meaning higher timeframe phases (like retracements) can lead to reversals on lower timeframes.

- 😀 SMT (Smart Money Technique) divergence between assets, like gold and silver, can indicate price manipulation and the start of an expansion phase.

- 😀 The change in state of delivery confirms the market's transition, which helps identify when a phase is ending and another one is beginning.

- 😀 To trade effectively using these market cycles, traders need to watch for candle closures, fair value gap formations, and the shift in price delivery phase.

- 😀 Understanding the historical nature of price action, where large expansions lead to smaller consolidations and vice versa, is crucial for predicting market moves.

Q & A

What is the 'IBDA' and why is it important in understanding market cycles?

-The IBDA stands for 'Interbank Price Delivery Algorithm.' It is crucial for understanding how price movements are structured in the market, as it helps traders identify the different phases of price delivery that occur within a market cycle.

What are the four phases of the market cycle described in the script?

-The four phases of the market cycle are consolidation, reversal, expansion, and retracement. These phases represent how price moves through different stages in response to market conditions.

What characterizes the consolidation phase in the market cycle?

-The consolidation phase occurs when the price is ranging within a defined range, marked by resistance and support levels. It typically lacks large expansion movements and can precede a trend shift, especially after a large expansion phase.

How does a reversal phase occur within the market cycle?

-A reversal occurs when price expansion meets another expansion, signaling a change in direction. This can happen after a period of consolidation or following a significant price movement. A reversal phase is crucial for predicting trend changes.

What is meant by 'expansion' in the market cycle, and how does it affect price movement?

-Expansion refers to a phase where the price moves strongly in one direction, often characterized by large candles. This phase follows consolidation and can occur after a reversal, driving significant price movement in a single direction.

What role do fair value gaps play in the retracement phase?

-Fair value gaps are key in identifying retracements, as they represent areas where the price temporarily moves against the prevailing trend. These gaps can act as zones where price is likely to return before continuing the larger trend.

Why is the reversal phase considered the most important in price delivery?

-The reversal phase is crucial because it often marks the transition between different states of price delivery. A reversal in higher time frames can lead to a reversal in lower time frames, which is important for traders to anticipate changes in trend.

What is the significance of SMT divergence in the context of the script?

-SMT (Smart Money Technique) divergence occurs when the price of one asset (such as gold) moves contrary to a related asset (like silver). This divergence can signal manipulation and a potential price shift, indicating a potential reversal or expansion.

How does the market transition between different phases of price delivery?

-The market transitions between phases such as consolidation, reversal, expansion, and retracement through various signals like changes in state of delivery, manipulation of range highs or lows, and the formation of swing points. These transitions help traders predict upcoming price movements.

What is the purpose of using order blocks and fair value gaps in trading?

-Order blocks and fair value gaps are important tools in trading as they help identify zones of potential price action. Order blocks highlight areas where significant buying or selling has occurred, while fair value gaps represent price areas that may be revisited during retracement or reversal phases.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

ICT 4 Phases of Price Delivery, Find Daily Bias with Phases of Price Delivery,

Anticipating Expansions From Consolidations - Episode 1

Episode 12: Using Standard Deviation Projections - ICT Concepts

4 Stages of Price Delivery (ICT Concepts)

The Secret To ICT Daily Bias: A Mechanical Approach

ICT Weekly Profile Explained | In Depth

5.0 / 5 (0 votes)