How To Spot the Bottom of ICT's Market Maker Model

Summary

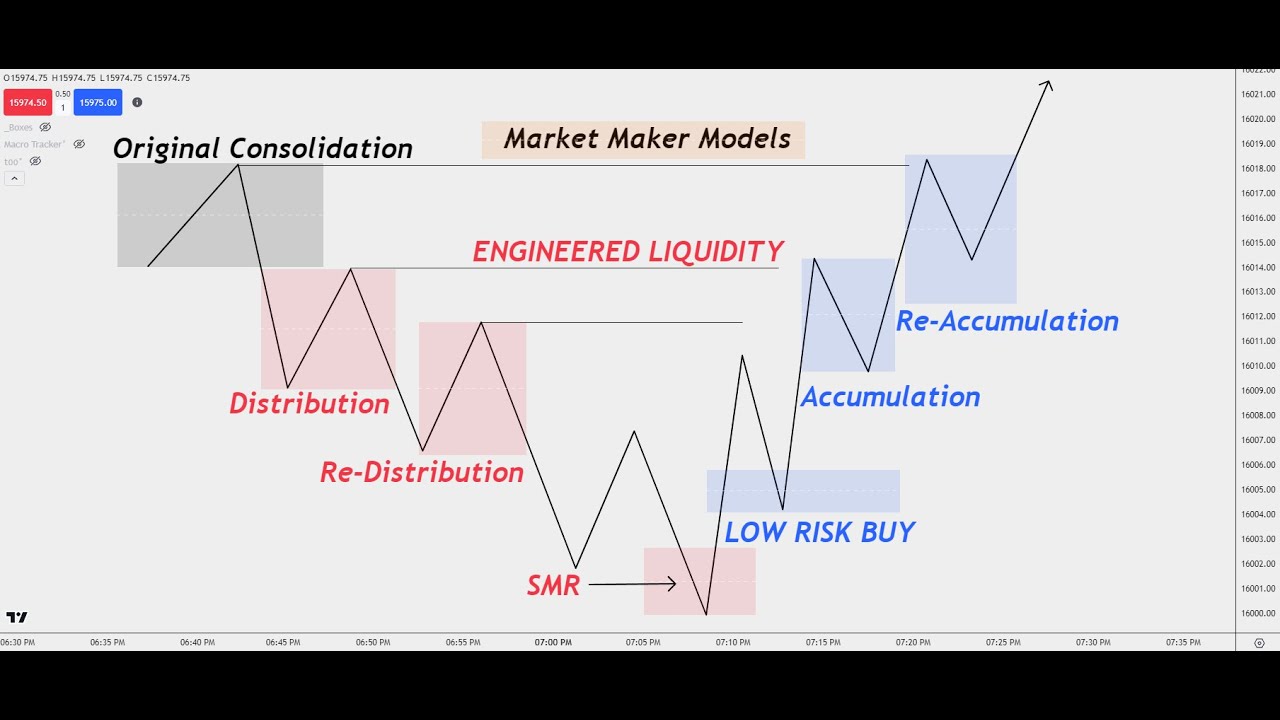

TLDRIn this video, the trader explains how to predict smart money reversals and trade using the market maker buy model, focusing on accumulation and reaccumulation phases. The strategy emphasizes identifying bullish order flow, utilizing SMT divergence between correlated assets like NASDAQ and S&P 500, and entering positions based on lower-risk areas such as fair value gaps and order blocks. The trader highlights key concepts such as market structure shifts, liquidity zones, and the importance of not waiting for deep retracements in certain conditions. The video aims to provide an in-depth understanding of trading ICT concepts from beginner to advanced levels.

Takeaways

- 😀 Focus on predicting smart money reversals in market maker buy models and how to trade the accumulation and reaccumulation legs.

- 😀 The strategy involves buying in areas where price shows bullish order flow and returns to key levels like order blocks and PD arrays.

- 😀 Understanding price action is key: look for signs like down-closed candles being respected to confirm bullish order flow.

- 😀 Divergence between correlated assets (like the NASDAQ and S&P 500) provides valuable extra confluence for potential reversals.

- 😀 Smart money reversal and market structure shifts are key indicators for entering trades, especially when price expands higher after consolidating.

- 😀 In accumulation and reaccumulation legs of the market maker buy model, key levels like fair value gaps and order blocks act as support for price to move higher.

- 😀 Trading in the middle of the range requires a strategy that doesn't rely solely on waiting for price to retrace to a discount level; instead, look for smaller levels of sell stops.

- 😀 Price behavior is influenced by engineered liquidity, where smart money buys up sell stops and drives the price higher, aiming for buy stops.

- 😀 The method of pyramiding entries is used to increase positions at key confirmation levels, improving the overall trade strategy.

- 😀 The ultimate goal in trading these models is to target buy side liquidity, but traders can exit earlier when a good risk-to-reward ratio is achieved, rather than holding for the extreme range.

Q & A

What is the main focus of the video script?

-The main focus of the video script is teaching how to predict market reversals using the smart money reversal concept, along with trading the accumulation and reaccumulation legs of the Market Maker Buy Model. It also explains how to identify entries and manage trades based on market structure and order flow.

How did the speaker enter the trade in the NASDAQ example?

-The speaker entered the trade by buying contracts after price consolidated and expanded higher, following the bullish order flow. They identified a level of buy-side liquidity, where they bought contracts after a market structure shift and a fair value gap appeared.

What is the concept of order flow in this strategy?

-Order flow refers to the direction of market movement. In this strategy, a bullish order flow means the market is moving higher, and the algorithm is offering higher prices. The speaker uses this to identify potential entry points when price returns to a level of sell-side liquidity in a bullish market.

What role does the concept of Smart Money Divergence (SMT) play in this strategy?

-Smart Money Divergence (SMT) is used as extra confluence. The speaker looks for a divergence between correlated assets, like the NASDAQ and S&P 500, where one asset makes a higher low while the other makes a lower low. This suggests a reversal is likely, providing confirmation for potential entries.

What does the speaker mean by 'change in the state delivery'?

-The 'change in the state delivery' refers to a shift in market behavior where price action starts to deliver higher prices after a consolidation or retrace. This signals a potential reversal or continuation of the bullish trend, and it’s often marked by the creation of a fair value gap.

How does the speaker handle risk management in the trade?

-The speaker manages risk by setting stop losses beneath key levels, such as beneath a low or a fair value gap candle. They also adjust their stop loss as price moves in their favor, trailing it to secure profits while maintaining an acceptable risk-to-reward ratio (RR).

What is the significance of using both the NASDAQ and S&P 500 charts together?

-Using both charts together helps to spot potential divergences between correlated assets. For example, if the NASDAQ makes a higher low while the S&P 500 makes a lower low, it indicates that the NASDAQ is likely to experience a stronger move to the upside, which can be used as confirmation for trade entries.

Why does the speaker not always wait for a retrace back to the low-risk buy level?

-The speaker does not always wait for a retrace to the low-risk buy level because they know the Market Maker Buy Model. They focus on the accumulation and reaccumulation legs, which occur before price fully retraces back to the low-risk buy. They anticipate price to engage with fair value gaps or minor sell stops instead.

What is the reasoning behind targeting buy-side liquidity in this strategy?

-Targeting buy-side liquidity is based on the idea that once the market is in a buy program, it will aim to take out buy stops above certain levels. By identifying these liquidity levels, the speaker targets areas where price is likely to move as part of the natural progression of market delivery.

What is the significance of the fair value gap in this trading model?

-The fair value gap represents an imbalance in price action, indicating that price is likely to retrace or revisit that area. In this strategy, it is used as a key entry point for both the accumulation and reaccumulation phases, offering a potential support level where price can bounce back higher.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Why You Keep Missing The Big Moves

HOW TO TRADE THE MARKET MAKER X MODEL without BIAS! trade RECAP pt.9 (detailed explanation)

4HR PO3 | MMXM | Standard Deviations | ICT Concepts

ICT Concepts: Understanding How To Trade ICT Market Maker Models!

ICT Market Maker Model - Live Trade Explanation

Episode 8: Finding Market Makers Models (MMXM's) - ICT Concepts

5.0 / 5 (0 votes)