ICT Power Of Three - Explained In-depth

Summary

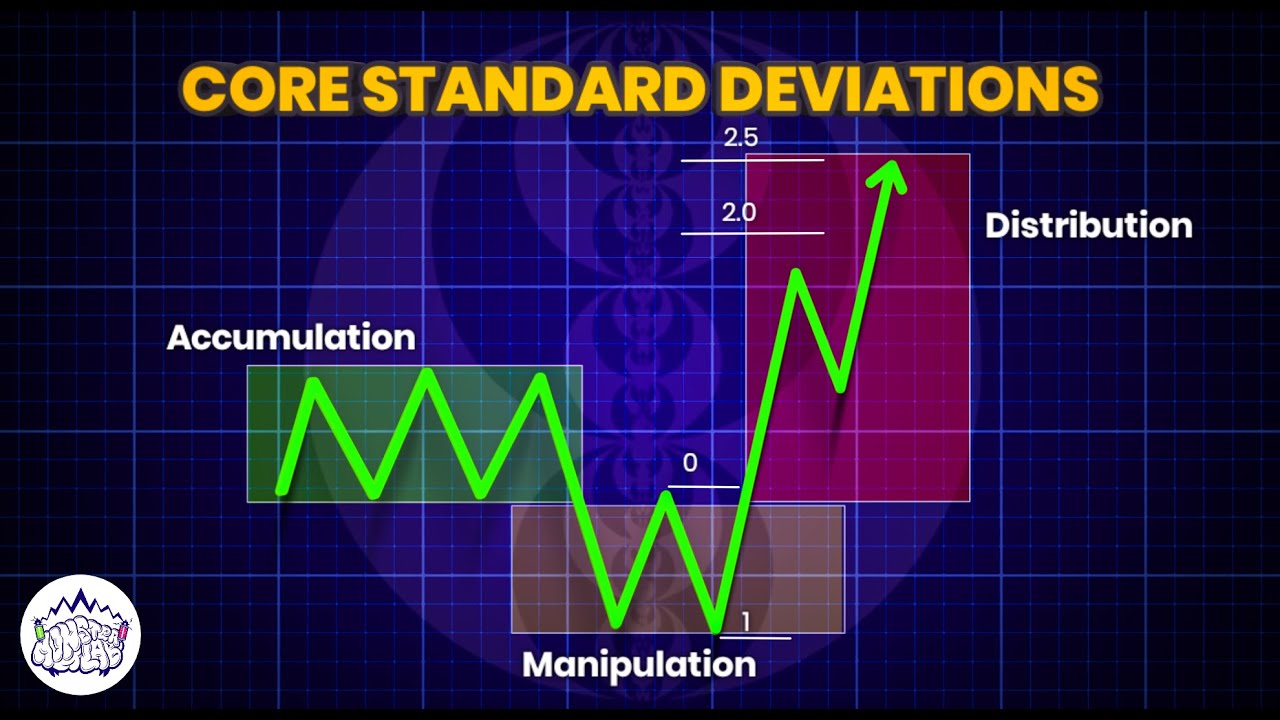

TLDRIn this video, the ICT Power of 3 concept is explained, focusing on accumulation, manipulation, and distribution in price action. The strategy identifies key times such as midnight and 8:30 New York time, marking significant price openings. For bullish setups, the price dips below the opening price, and for bearish setups, it moves above. The goal is to position trades in line with market manipulation and hold until liquidity targets are reached. The video provides an in-depth breakdown, offering practical insights into using time-based analysis and specific price action signals for trading strategies.

Takeaways

- 😀 The ICT 'Power of 3' concept consists of three phases: Accumulation, Manipulation, and Distribution.

- 😀 Accumulation occurs when price moves within a range near a key opening price, such as midnight or 8:30 AM (New York time).

- 😀 Manipulation refers to price movements that trigger stop orders (buy or sell stops), often creating a high or low in the market.

- 😀 Distribution is the phase when price moves towards a liquidity target after manipulation, continuing in the direction of the larger trend.

- 😀 In a bearish Power of 3, price opens, accumulates, makes a high (manipulation), and then distributes downward to a target.

- 😀 In a bullish Power of 3, price opens, accumulates, makes a low (manipulation), and then distributes upward to a target.

- 😀 Key time openings (midnight and 8:30 AM New York time) are used to mark significant levels of accumulation and manipulation.

- 😀 'Draw on liquidity' is the key concept to identify where price is likely to reach, such as a previous high or low.

- 😀 The trader needs to observe price action near key opening times, which help pinpoint where accumulation and manipulation are happening.

- 😀 Breakers (market structure shifts) indicate when price is likely to expand in a new direction, either up or down, after manipulation.

- 😀 The trader should look for specific price signatures at key levels (like buy/sell stops) to identify high-probability entry points.

Q & A

What is the ICT Power of 3 concept?

-The ICT Power of 3 is a trading concept involving three main phases: accumulation, manipulation, and distribution. In a bearish Power of 3, price accumulates near the open, manipulates to create a high, and then distributes lower. For a bullish Power of 3, the price accumulates, manipulates to create a low, and then distributes higher.

What is accumulation in the context of the Power of 3?

-Accumulation refers to the phase where the price moves back and forth within a specific range, typically near the opening price. It is the period where price consolidates before the manipulation phase, which helps traders identify key levels for potential entries.

What is manipulation in the ICT Power of 3?

-Manipulation occurs when price moves beyond the accumulation range to trigger buy or sell stops. For a bearish Power of 3, it makes a high above the opening price to trigger buy stops, while for a bullish Power of 3, it manipulates by making a low below the opening price to trigger sell stops.

How does distribution fit into the Power of 3?

-Distribution follows manipulation and refers to the movement of price in the intended direction (either up or down) after manipulation. For a bearish Power of 3, distribution involves price moving lower towards a liquidity target, and for a bullish Power of 3, it moves higher after manipulation to capture the liquidity.

Why is the opening price important in the Power of 3 concept?

-The opening price, especially at midnight (New York time) or 8:30 AM, is critical in marking the boundaries for accumulation and manipulation phases. These openings serve as reference points for understanding where price might consolidate or move during the trading day, helping traders predict the likely direction.

What is the role of 'draw on liquidity' in the Power of 3?

-'Draw on liquidity' refers to the target price levels that are likely to be reached as price moves throughout the day. These levels could be old highs or lows, and the ICT Power of 3 concept involves anticipating where price will head to gather liquidity before retracing or reversing.

What is the significance of 8:30 AM and midnight openings?

-The 8:30 AM and midnight openings (based on New York time) are key times for identifying potential market movements. The midnight opening marks the start of the daily range, while the 8:30 opening is especially relevant for the morning session. These openings help define accumulation and manipulation phases.

How does the ICT Power of 3 relate to market structure and price action?

-The Power of 3 relies heavily on market structure, with accumulation and manipulation phases setting up price action that leads to distribution. Key price action signals, such as the creation of highs or lows, break of structure, and the formation of order blocks, are used to identify entry points and anticipate the draw on liquidity.

What are buy and sell stops, and how do they fit into the Power of 3?

-Buy stops are orders placed above the current market price to trigger when price moves higher, while sell stops are orders placed below the market to trigger when price moves lower. In the ICT Power of 3, manipulation often involves running these stops to trigger market reactions, setting up the price action for the next phase of movement (distribution).

How can traders identify the high or low of the day using the Power of 3?

-Traders can identify the high or low of the day by looking for manipulation above or below the opening price. For a bearish setup, the price will manipulate above the opening price to create a high, and for a bullish setup, it will manipulate below the opening price to create a low. These levels act as key reference points for potential entries and targets.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade Now5.0 / 5 (0 votes)