3 CORE AMP, Payroll & ACCTG Portal Part 2

Summary

TLDRThis instructional guide covers the steps involved in processing payroll, including selecting employees, managing Daily Time Records (DTR), and processing payslips. It also outlines the various government-mandated deductions, such as PhilHealth, SSS, and withholding tax, providing users with a clear understanding of how to calculate employee deductions. Additionally, the script explains how to generate and view payslips and offers details on the updated deduction tables for 2021. The guide is designed to assist accounting and payroll departments in efficiently managing payroll processes and government compliance.

Takeaways

- 😀 Process DDR by selecting the appropriate customer, department, section, and group before clicking 'Process DTR'.

- 😀 Payroll processing starts by selecting 'CorePay' on the homepage, followed by 'Transactions' and 'Process Payroll'.

- 😀 To process payroll, choose the relevant customer, department, section, and group, then select the desired cutoff.

- 😀 Employees can view their processed payslips and DTRs by logging into the Core ESS system and selecting 'View Payslip'.

- 😀 After processing payroll and DTRs, you can print the payslips and DTRs by selecting the relevant employee group and clicking 'View Payslip'.

- 😀 PhilHealth contribution is based on salary: P10,000 or below is P350, while higher salaries have a higher premium based on current rates.

- 😀 Due to the pandemic, PhilHealth contributions increased to 3.5%, up from the previous 2%.

- 😀 Pag-IBIG contributions are divided between the employee and employer, with 1% from the employee and 2% from the employer for salaries over P1,500.

- 😀 SSS contributions depend on the employee's salary, with different tables for regular employees, OFWs, and voluntary contributors.

- 😀 Withholding tax is deducted from employees' salaries as a partial payment toward their income tax obligations.

- 😀 The payroll system uses current contribution tables, which may change annually or due to special circumstances like the pandemic.

Q & A

What is the first step in processing the payroll?

-The first step in processing the payroll is selecting the group, department, or section, and then choosing the employees to process the Daily Time Record (DTR).

How do you process the DTR for employees?

-To process the DTR, click 'Process DTR' after selecting the employees, then choose the appropriate cut-off period, and confirm by clicking 'Process DTR' again.

What should you do after processing the DTR for employees?

-After processing the DTR, proceed to CorePay, click 'Transactions', and choose 'Payroll' to begin processing the payroll for selected employees.

How do you process the payroll for employees?

-To process payroll, select the relevant department, section, and group, choose the appropriate cut-off, and click 'Process Payroll'.

How can employees view their payslips after payroll is processed?

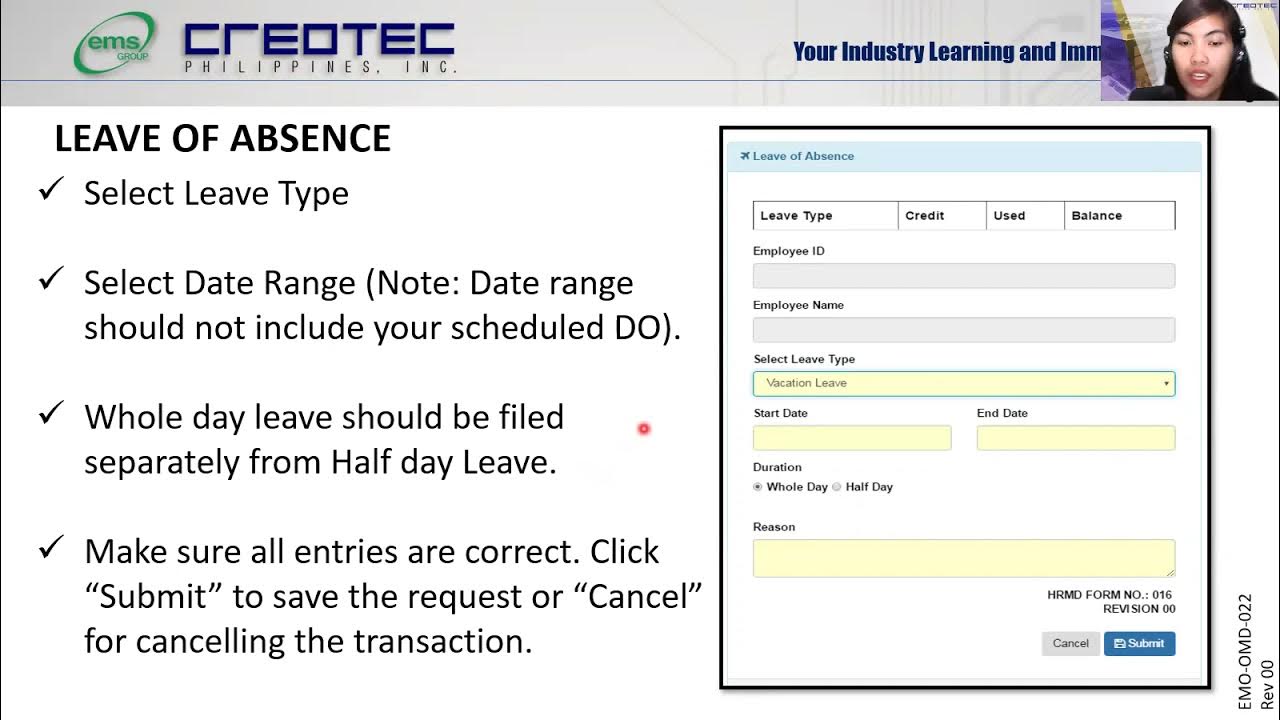

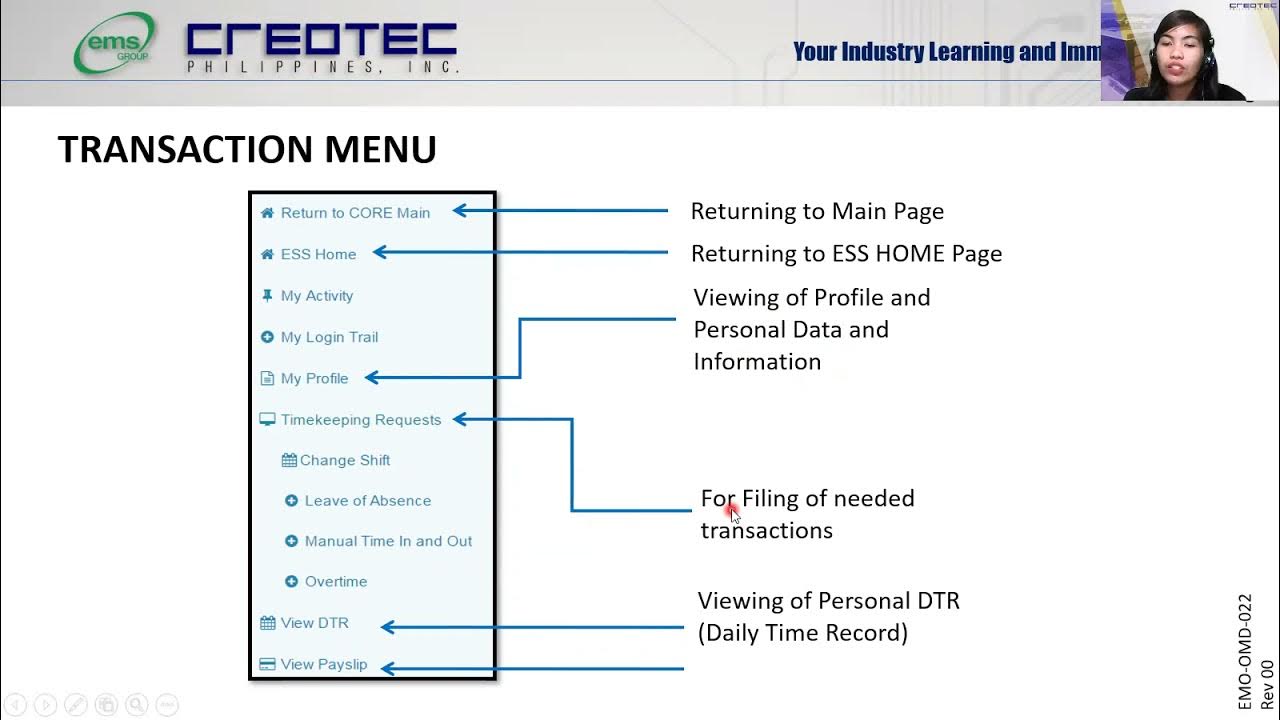

-Employees can view their payslips by going to Core ESS, selecting 'View Payslip', and choosing the relevant cut-off, department, and group.

Can employees print their payslips after processing?

-Yes, employees can print their payslips after selecting the relevant cut-off and group in Core ESS.

How do you handle PhilHealth contributions in payroll?

-PhilHealth contributions are deducted based on salary ranges, with fixed deductions for salaries ≤ PHP 10,000 (PHP 350) and percentage-based deductions (3.5%) for higher salaries.

What is the contribution rate for Pag-IBIG?

-Pag-IBIG contributions are 1-2%, with a shared contribution between the employee and employer, depending on the employee's salary.

How are SSS contributions calculated?

-SSS contributions vary based on employee salary and whether they are an OFW or self-employed. Contribution tables are available for different categories of employees.

What is withholding tax, and how is it deducted from employee salaries?

-Withholding tax is the amount deducted from employee salaries as partial payment of income tax. It is calculated based on the employee's income and applicable tax rates.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade Now5.0 / 5 (0 votes)