The Standard Capital Asset Pricing Model (FRM Part 1 – Book 1 – Chapter 10)

Summary

TLDRThe video explains the Capital Asset Pricing Model (CAPM), focusing on how investors balance risk and return by combining market portfolios with risk-free assets. It introduces beta as a measure of volatility, the Security Market Line (SML) representing risk-return dynamics, and the Capital Market Line (CML) showing the optimal tradeoff for mixed portfolios. The video also touches on leveraging, borrowing, and diversification, with practical examples of how these concepts apply to real-world investing strategies.

Takeaways

- 😀 The Capital Asset Pricing Model (CAPM) helps investors determine the expected return on an asset based on its risk, using beta to measure its correlation with market returns.

- 😀 Beta (β) represents an asset's systemic risk in comparison to the broader market, with a beta greater than 1 indicating higher volatility and a beta less than 1 indicating lower volatility.

- 😀 The Security Market Line (SML) plots the relationship between an asset’s expected return and its beta, indicating that underpriced assets lie below the line, and overpriced ones lie above it.

- 😀 The formula for CAPM is: Expected Return = Risk-Free Rate + Beta * (Market Return - Risk-Free Rate), helping investors determine the appropriate return for a given level of risk.

- 😀 The Capital Market Line (CML) represents the efficient frontier for a portfolio combining the risk-free asset and the market portfolio, indicating the best risk-return trade-off.

- 😀 A lending portfolio is formed by combining the market portfolio with a risk-free asset (like Treasury bonds), while a borrowing portfolio uses leverage to enhance returns.

- 😀 Leverage, such as using margin accounts or derivative securities (futures, options, swaps), allows investors to reach higher returns by borrowing money to invest beyond their initial capital.

- 😀 The Fisher Separation Theorem suggests that investment decisions can be separated into two parts: choosing the optimal portfolio and selecting the appropriate amount of risk.

- 😀 Investors should aim to be on the Capital Market Line (CML) because portfolios below the CML are inefficient, while those above are unattainable.

- 😀 An example is provided where an investor borrows 30% in the risk-free asset to invest in the market portfolio, achieving a 12.1% expected return, demonstrating how borrowing can increase returns.

- 😀 The CAPM assumes perfect market conditions, including no transaction costs and the ability to short sell, which simplifies the application of the model but may not always align with real-world constraints.

Q & A

What is the Capital Market Line (CML) and how is it related to portfolio theory?

-The Capital Market Line (CML) represents the efficient frontier in a portfolio that combines a market portfolio and a risk-free asset. It shows the best possible return an investor can achieve for any given level of risk (measured by standard deviation). The CML helps investors understand the risk-return trade-off when adding a risk-free asset to their portfolio.

What role does leverage play in achieving higher returns in portfolio management?

-Leverage allows investors to borrow money to invest more than they could with their own capital. This strategy is used to increase potential returns, but it also increases risk. For example, using margin accounts or derivative contracts such as futures and options enables investors to reach returns above the market portfolio by investing with borrowed funds.

What is the difference between a lending portfolio and a borrowing portfolio?

-A lending portfolio involves investing in risk-free assets like Treasury bonds, often in combination with a market portfolio. It is positioned on the left side of the CML. A borrowing portfolio, on the other hand, uses leverage by borrowing funds to invest in the market portfolio, aiming for higher returns. This portfolio is positioned above and to the right of the market portfolio on the CML.

What is the Fischer Separation Theorem and how does it relate to portfolio management?

-The Fischer Separation Theorem states that an investor can separate the decision of how to allocate funds between risk-free assets and risky assets from their individual preferences. This means that regardless of an investor's risk preferences, they can always combine the risk-free asset with the market portfolio to achieve an optimal portfolio.

What is the significance of the market portfolio in portfolio theory?

-The market portfolio includes all risky assets in the market, weighted according to their market values. It is considered to be the optimal risky portfolio because it offers the best risk-return combination. The market portfolio is central to many models in portfolio theory, including the Capital Asset Pricing Model (CAPM).

How does the Capital Asset Pricing Model (CAPM) determine the expected return of an asset?

-CAPM calculates the expected return of an asset based on its sensitivity to market risk, measured by beta. The formula is: Expected Return = Risk-Free Rate + Beta × (Market Return - Risk-Free Rate). This model assumes that investors only care about systematic risk, which cannot be diversified away.

What is the role of the Sharpe Ratio in portfolio performance evaluation?

-The Sharpe Ratio is used to evaluate the risk-adjusted return of an investment portfolio. It is calculated by subtracting the risk-free rate from the portfolio's return and dividing the result by the portfolio's standard deviation. A higher Sharpe Ratio indicates better risk-adjusted performance.

What are some examples of derivative contracts used to achieve leverage?

-Examples of derivative contracts used to achieve leverage include futures contracts, swap contracts, and option contracts. These instruments allow investors to take on more risk and increase their potential return by controlling larger positions than their capital would otherwise permit.

What does it mean to short an asset in the context of portfolio management?

-Shorting an asset involves borrowing it from another party with the expectation that its price will decline. The investor sells the borrowed asset and plans to buy it back at a lower price to repay the lender. In portfolio management, shorting is often used in a borrowing portfolio to take advantage of expected market movements.

How do risk-free assets and the market portfolio combine to form an efficient portfolio?

-Risk-free assets (such as Treasury bonds) and the market portfolio combine to form an efficient portfolio through a process of diversification. Investors can adjust the proportion of risk-free and risky assets in their portfolio to find the best possible return for a given level of risk, represented by the Capital Market Line (CML).

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Capital Market Line (CML) vs Security Market Line (SML)

Markowitz Model and Modern Portfolio Theory - Explained

CAPM - What is the Capital Asset Pricing Model

Risk and Return: Capital Asset Pricing Model (CAPM) 【Dr. Deric】

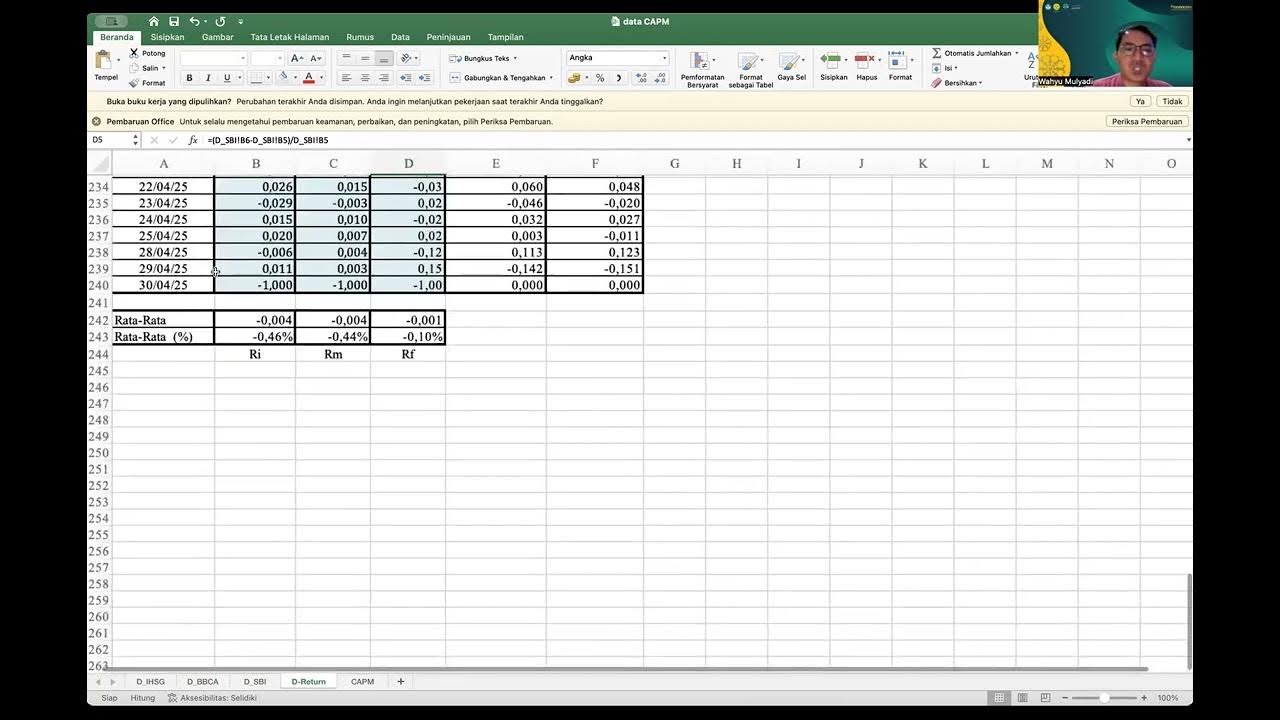

Penjelasan Tentang Capital Asset Pricing Model

Teori Portofolio dan Analisis Investasi sesi 12 ( Menghitung Capital Aset Pricing Model)

5.0 / 5 (0 votes)