Penjelasan Tentang Capital Asset Pricing Model

Summary

TLDRIn this video, the Capital Asset Pricing Model (CAPM) is explained, focusing on how it relates to stock returns, market risk, and beta. CAPM helps investors understand the risk of a stock relative to the market, using beta to measure volatility. A stock with a beta greater than one is more volatile and offers higher potential returns. The video demonstrates how to calculate expected returns using CAPM, with examples for companies like BCA and Unilever. The model is vital for determining the cost of equity and making informed investment decisions.

Takeaways

- 😀 The Capital Asset Pricing Model (CAPM) explains the relationship between a stock's return and its market risk.

- 😀 CAPM helps investors understand the risk and return profile of individual stocks relative to the market.

- 😀 The model uses **beta** to measure a stock's market risk, where a beta greater than 1 indicates higher risk than the market.

- 😀 A **beta** value less than 1 means the stock is less volatile than the overall market.

- 😀 The **risk-free rate (RF)** represents the return on an investment with no risk, typically government bonds.

- 😀 The **market risk premium** is the additional return expected from investing in the market over a risk-free asset.

- 😀 The CAPM formula is: Expected Return (Ri) = Risk-Free Rate (RF) + Beta (β) * (Expected Market Return (RM) - RF).

- 😀 A **higher beta** results in higher expected returns, but it also means more risk for the investor.

- 😀 Investors can use CAPM to assess whether the expected return from a stock justifies the risk associated with it.

- 😀 CAPM is useful for calculating the **cost of equity** in business finance and determining whether a stock is a good investment.

- 😀 Examples like **BCA (beta 1.2)** and **Unilever (beta 0.8)** help illustrate how different betas affect stock price movements in relation to market changes.

Q & A

What is the Capital Asset Pricing Model (CAPM)?

-CAPM is a financial model that explains the relationship between the expected return of a stock and its risk, relative to the overall market. It helps in evaluating how much return investors can expect from a stock, considering both the stock's specific risk and the market risk.

What does beta (β) represent in CAPM?

-Beta (β) is a measure of a stock's volatility relative to the overall market. A beta of 1 means the stock moves in line with the market, a beta higher than 1 indicates more volatility, and a beta lower than 1 indicates less volatility compared to the market.

How is the risk of a stock evaluated using CAPM?

-The risk of a stock is evaluated using beta, which quantifies its exposure to market risk. A higher beta suggests higher risk, while a lower beta indicates lower risk. CAPM helps determine if the stock’s expected return justifies its level of risk.

What is the role of the risk-free rate (RF) in the CAPM formula?

-The risk-free rate (RF) represents the return on an investment with zero risk, typically the interest rate on government bonds. In the CAPM formula, it serves as a baseline for calculating the excess return of the stock compared to a risk-free investment.

What is the market risk premium in CAPM?

-The market risk premium is the difference between the expected return of the market portfolio (RM) and the risk-free rate (RF). It represents the additional return expected by investors for taking on the risk of investing in the market.

How is the expected return (Ri) of a stock calculated in CAPM?

-The expected return (Ri) of a stock is calculated using the formula: Ri = RF + β × (RM - RF). In this formula, RF is the risk-free rate, β is the stock's beta, and (RM - RF) is the market risk premium.

How does beta influence the expected return of a stock?

-Beta influences the expected return by adjusting the market risk premium based on the stock's volatility. A stock with a higher beta (greater risk) will have a higher expected return, while a lower beta results in a lower expected return.

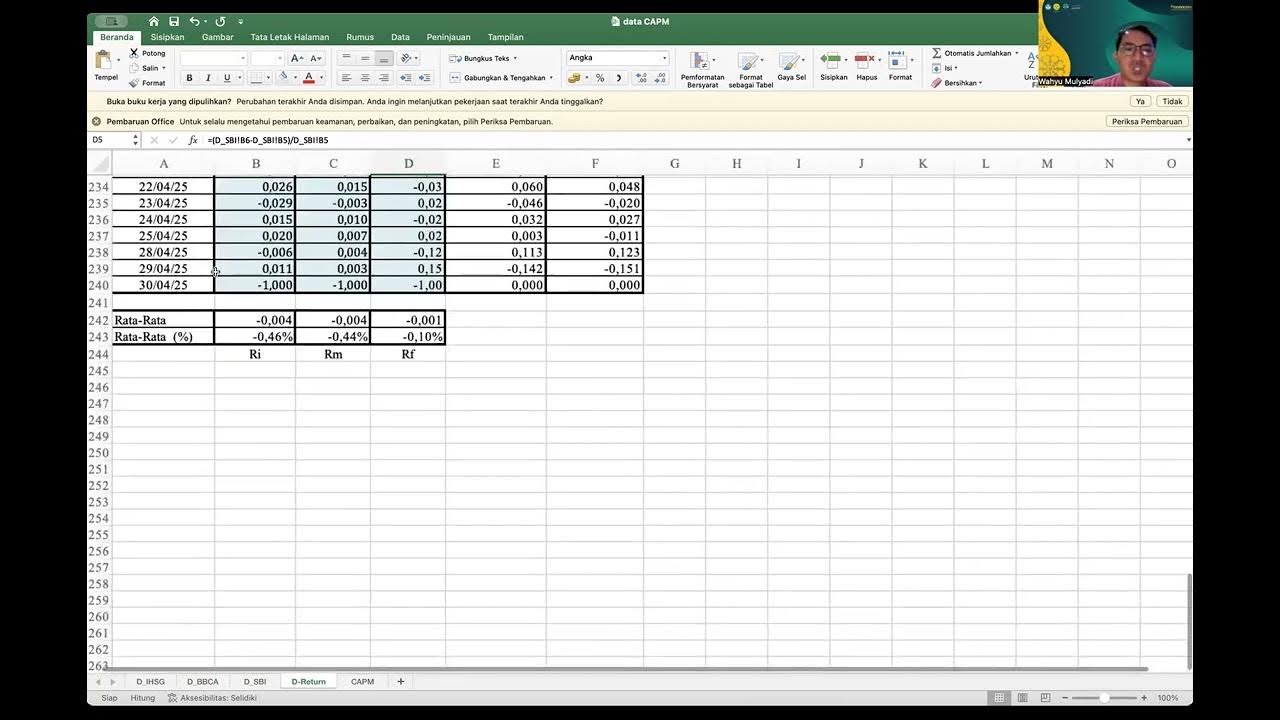

Why is the IHSG used in CAPM calculations in Indonesia?

-In Indonesia, the IHSG (Indeks Harga Saham Gabungan) is used as a representation of the market portfolio. It serves as the benchmark for calculating the market risk premium and the expected return from the market in CAPM calculations.

What does a beta greater than 1 indicate about a company's stock?

-A beta greater than 1 indicates that the company’s stock is more volatile than the market. This means that if the market increases or decreases by a certain percentage, the stock will likely change by a larger percentage in the same direction, suggesting higher risk and potentially higher return.

How does the concept of risk and return relate in CAPM?

-In CAPM, the relationship between risk and return is central. Stocks with higher risk (higher beta) are expected to offer higher returns to compensate investors for taking on that additional risk. Conversely, stocks with lower risk (lower beta) are expected to offer lower returns.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Lecture 05

Teori Portofolio dan Analisis Investasi sesi 12 ( Menghitung Capital Aset Pricing Model)

CAPM - What is the Capital Asset Pricing Model

Risk and Return: Capital Asset Pricing Model (CAPM) 【Dr. Deric】

The Standard Capital Asset Pricing Model (FRM Part 1 – Book 1 – Chapter 10)

Capital Market Line (CML) vs Security Market Line (SML)

5.0 / 5 (0 votes)