V150 MURABAHA PRICING 5: WHAT DETERMINES THE SPREAD?

Summary

TLDRThis transcript explains how Islamic banks determine the profit rate for Murabaha facilities, highlighting the combination of base rates and credit risk premiums. It outlines how the base rate is influenced by the Overnight Policy Rate (OPR) and how the spread is based on the borrower’s creditworthiness, assessed through frameworks like FICO and FES of credit. The discussion emphasizes that Murabaha structures avoid business and ownership risks, relying on financial and credit risks, which are similar to conventional loan pricing. The content provides insight into the complex pricing mechanisms in Islamic finance and their relation to conventional interest-based systems.

Takeaways

- 😀 The selling price of the Murabaha facility is calculated by adding the facility amount and the profit margin, which is derived from the facility amount multiplied by the profit rate and tenure.

- 😀 The profit rate for Murabaha is based on the Islamic Base Rate (IBR), which is derived from the conventional overnight policy rate (OPR) of 3%.

- 😀 The benchmark for setting the Murabaha profit rate is linked to the interest rate, specifically the conventional loan's risk, which is mainly credit risk and not business risk.

- 😀 The Islamic Bank's risk in both artificial and commodity Murabaha is primarily financial or credit risk, as they do not take ownership or business risk.

- 😀 In the case of commodity Murabaha, the stability of asset prices, like the CPO (Crude Palm Oil), helps mitigate risks, making it similar to interest-bearing loans in terms of risk profile.

- 😀 The spread in the profit rate of Murabaha, which represents the credit risk premium, is influenced by the creditworthiness of the borrowing party.

- 😀 The base rate is controlled by regulators, but the spread is controlled internally by the bank and varies depending on the borrower's credit risk.

- 😀 The spread size is influenced by credit rating systems, such as the FIS (Feces of Credit) and FICO scoring, which assess the borrower's ability to repay the loan.

- 😀 The FIS of Credit evaluates the borrower's character, capacity, capital, collateral, and the economic conditions that may affect the repayment ability.

- 😀 Expected loss estimation, based on the borrower's credit rating, helps determine the spread that will be added to the base rate for setting the final profit rate in Murabaha financing.

Q & A

What is the selling price of the murabaha facility, and how is it calculated?

-The selling price of the murabaha facility is $550,000. It is calculated by adding the profit margin to the facility amount. The profit margin is derived from the facility amount multiplied by the profit rate, which is based on the Islamic Base Rate (IBR) and the tenure.

What role does the Islamic Base Rate (IBR) play in the murabaha pricing?

-The Islamic Base Rate (IBR) of 3% is used as the benchmark for determining the murabaha profit rate. It is based on the conventional overnight policy rate (OPR) and is used to price the murabaha facility.

Why is it logical to benchmark the murabaha profit rate against interest rates?

-It is logical to benchmark the murabaha profit rate against interest rates because the risk profile of both artificial and commodity murabaha is similar to that of conventional loans. These murabaha transactions primarily carry financial or credit risk, not business or ownership risk.

What is the difference between the base rate and the spread in murabaha pricing?

-The base rate is the standard rate controlled by the regulator (e.g., the Islamic Base Rate), while the spread is the additional margin that reflects the credit risk associated with the borrower. The spread is internally controlled by the bank based on the borrower’s creditworthiness.

What factors influence the spread in murabaha pricing?

-The spread is influenced by the borrower’s credit risk profile, which is determined by factors such as credit history, income, assets, collateral, and the overall economic conditions. The spread compensates the bank for the credit risk associated with the loan.

What is the significance of the credit rating systems like FICO and FES in murabaha pricing?

-Credit rating systems like FICO and FES are used by the bank to assess the creditworthiness of the borrower. These systems evaluate factors such as character, capacity, capital, collateral, and the loan’s condition to determine the risk profile, which directly impacts the spread charged on the murabaha facility.

How does the FICO system assess a borrower’s creditworthiness?

-The FICO system assesses a borrower’s creditworthiness by evaluating factors like their credit history (character), income and assets (capacity), capital available for down payments, the collateral provided, and the economic conditions affecting repayment. These factors determine the borrower’s risk level and, in turn, the spread charged on the murabaha.

What is the expected loss model in murabaha pricing, and how does it work?

-The expected loss model in murabaha pricing is used to estimate the potential loss the bank might incur if the borrower defaults. It takes into account the probability of default (PD), the exposure at default (EAD), and the loss given default (LGD). This model helps determine the amount of spread to be added to the base rate.

What are the key components of the expected loss model?

-The key components of the expected loss model are the probability of default (PD), exposure at default (EAD), and loss given default (LGD). These factors help estimate the potential loss to the bank in the event of a default and determine the spread to be applied.

How does the expected loss model impact the murabaha profit rate?

-The expected loss model impacts the murabaha profit rate by influencing the spread that is added to the base rate. A higher expected loss due to higher credit risk will result in a higher spread, thus increasing the overall murabaha profit rate.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Manajemen Pembiayaan Bank Syariah Bagian 1 | Rais Sani Muharrami, M.E.I

Determinants of interest rates (for the CFA Level 1 exam)

Fiqh al-Muamalat | Topic 36: Murabahah (1)

How banks create credit - MoneyWeek Investment Tutorials

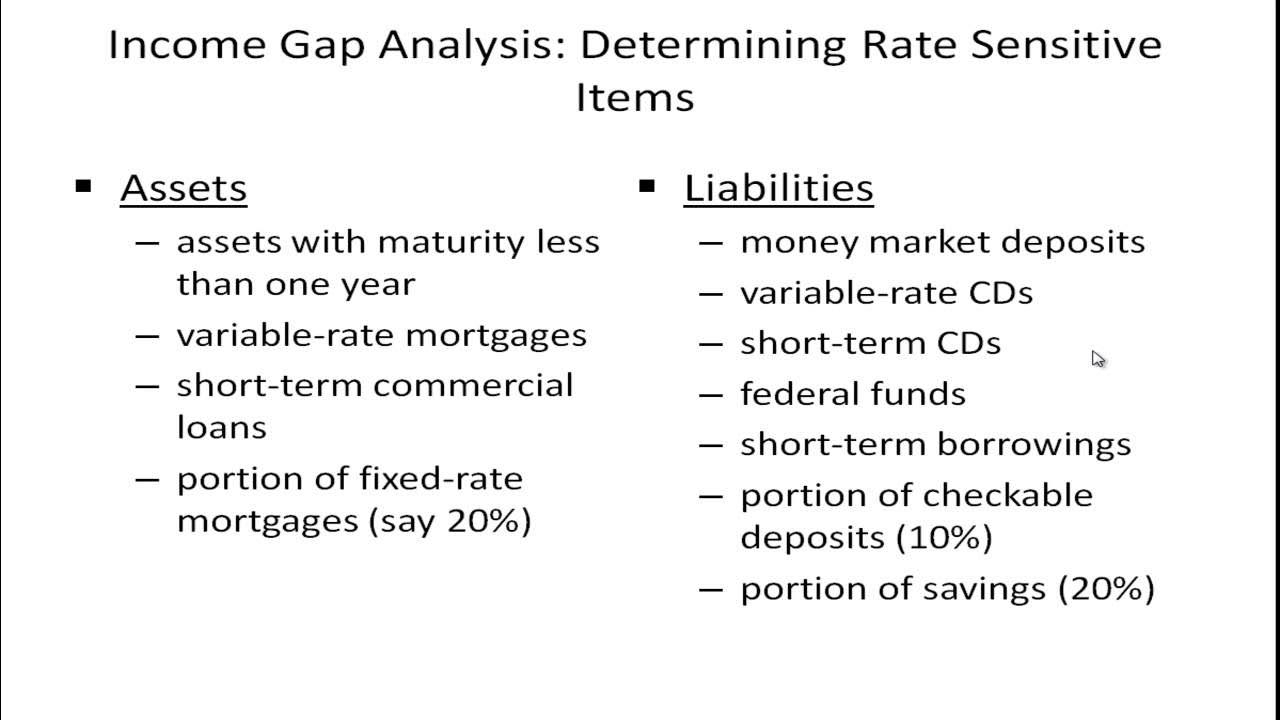

Managing Interest Rate Risk - Income Gap Analysis

What is the purpose of the central banks? (May 2013)

5.0 / 5 (0 votes)