Fiqh al-Muamalat | Topic 36: Murabahah (1)

Summary

TLDRThis video explores the concept of Murabaha, a key contract in Islamic banking, highlighting its importance in debt financing. Murabaha involves the sale of goods where the cost and profit margin are disclosed transparently, ensuring a trust-based transaction. The video explains the contract’s structure, its binding nature, and the ethical standards it upholds. Unlike conventional loans, Murabaha relies on the integrity of the seller to disclose all costs and profits. This ensures clarity in transactions, with a focus on honesty and transparency. The video serves as an essential introduction to understanding Murabaha's role in Islamic finance.

Takeaways

- 😀 Murabaha is a key Sharia contract used in Islamic banking, primarily for asset and commodity financing.

- 😀 Unlike conventional loans, Murabaha involves the disclosure of the original cost and profit margin, making it a transparent contract.

- 😀 The structure of Murabaha closely resembles conventional loans, but with the key difference of profit margins instead of interest charges.

- 😀 Murabaha is a trust-based sale contract where the seller must disclose both the cost and the profit margin to the buyer.

- 😀 The contract is binding and cannot be unilaterally terminated by either party without mutual consent.

- 😀 Murabaha’s trust-based nature means that decisions are made based on the seller's honesty, not bargaining skills or market surveys.

- 😀 Ethical integrity is crucial in Murabaha; dishonesty in disclosing prices or profit margins invalidates the contract.

- 😀 The contract can apply to various goods and assets, including homes, cars, and commodities, with flexible installment payment terms.

- 😀 Murabaha is often used by financial institutions to convert conventional products into Sharia-compliant offerings.

- 😀 The transaction involves full transparency, as both the original cost and markup are disclosed to the buyer before the contract is concluded.

- 😀 Murabaha is distinct from bargaining-based transactions because it is not about haggling over prices but relies on the integrity of the seller.

Q & A

What is Murabaha and how is it used in Islamic banking?

-Murabaha is a Sharia-compliant contract commonly used in Islamic banking, primarily for financing assets and commodities. It involves the seller disclosing the original cost of the asset and the profit margin to the buyer, with the buyer agreeing to purchase the asset at the disclosed price.

How does Murabaha differ from conventional banking loans?

-In conventional banking, a loan is provided with interest on the principal amount, while in Murabaha, the bank sells an asset to the buyer at a disclosed cost plus a profit margin. There is no interest involved, only a transparent markup.

What are the key features of a Murabaha contract?

-Murabaha contracts are characterized by transparency in pricing, where both the cost and profit margin are disclosed to the buyer. The contract is binding, and it is based on trust. Additionally, the contract is mutually agreed upon and cannot be unilaterally terminated.

Why is trust a crucial element in Murabaha contracts?

-Trust is essential in Murabaha because the buyer must rely on the seller to disclose the accurate cost and profit margin. Unlike in bargaining-based sales, Murabaha decisions are made based on the integrity of the seller, rather than negotiation skills.

What happens if the seller lies about the cost or profit margin in a Murabaha contract?

-If the seller misrepresents the cost or profit margin in a Murabaha transaction, the contract becomes invalid. The trust-based nature of Murabaha means that any dishonesty undermines the entire agreement.

What is the nature of the relationship between the bank and the customer in a Murabaha contract?

-In a Murabaha contract, the bank acts as the seller, and the customer is the buyer. The bank discloses the original cost of the asset along with the agreed-upon profit margin, and the buyer accepts the total price, often including installment arrangements.

What is the significance of Murabaha in the Islamic banking sector?

-Murabaha plays a dominant role in Islamic banking as it provides a Sharia-compliant alternative to conventional loans. It is widely used in asset financing and allows for easy conversion of conventional products into Islamic finance products due to its similar structure to conventional loans.

How does Murabaha ensure ethical and transparent transactions?

-Murabaha ensures ethical transparency by requiring the seller to openly disclose both the original cost and the profit margin. This disclosure prevents hidden pricing and ensures that the buyer has full knowledge of the terms before entering into the agreement.

What are the risks involved in Murabaha for both the bank and the customer?

-The main risk in Murabaha for the bank is the possibility of the buyer defaulting on payments. For the customer, the risk lies in the possibility of overpaying for an asset if the bank's markup is too high. However, both parties benefit from the contract's transparency and binding nature.

Can a Murabaha contract be terminated unilaterally?

-No, a Murabaha contract cannot be terminated unilaterally by either party. It is a binding agreement, meaning both the bank and the customer must mutually agree if they wish to terminate the contract.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

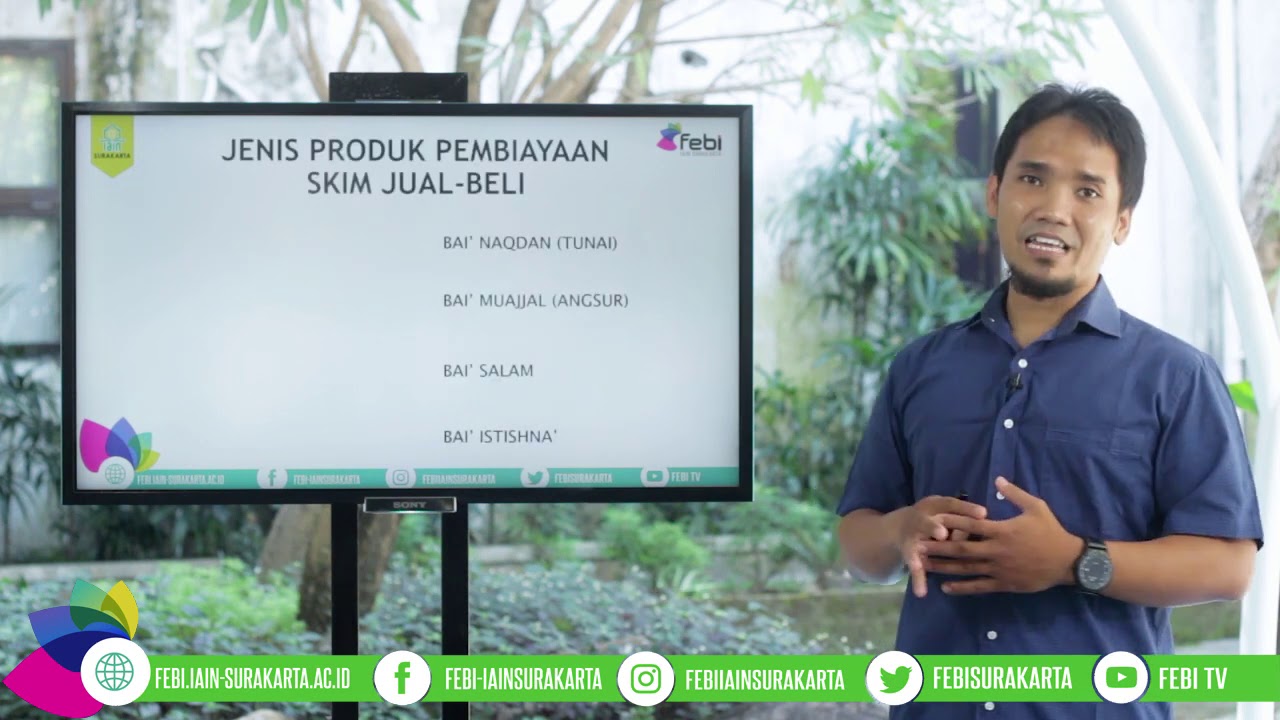

Manajemen Pembiayaan Bank Syariah Bagian 1 | Rais Sani Muharrami, M.E.I

Desain Kontrak Syariah_Manajemen Perbankan dan Keuangan SYariah

simulasi akad murabahah

Use of KIBOR in Murabaha Financing (Part-1)

Ini Dia Isu Paling Hot Terkait Bank Syariah

Fiqh al-Muamalat | Topic 37: MURABAHAH (2) (Components of Muarabahah - Contracting Parties)

5.0 / 5 (0 votes)