2 PPh Pasal 4 ayat 2 : Objek, Pelunasan, Pelaporan

Summary

TLDRThis video provides an overview of Indonesia's PPh Pasal 4 Ayat 2, focusing on final tax income, which includes various types of income such as interest from deposits, bond coupons, lottery winnings, and income from stock transactions. It explains the objects and subjects of the tax, the payment and reporting process, and the deadlines for tax submission. Key details include the roles of tax authorities, such as tax deductors and tax report filing. Additionally, it discusses the implementation of regulations like PP 2-3-2018 and outlines how businesses and individuals must comply with tax obligations.

Takeaways

- 😀 PPh Pasal 4 Ayat 2 refers to the final income tax in Indonesia, which applies to certain types of income that are subject to a fixed tax rate.

- 😀 Types of income subject to final tax include interest on deposits, bonds, savings, and other financial instruments.

- 😀 Final tax also applies to income from stock transactions, the sale of assets like land and buildings, as well as income from construction services and real estate rentals.

- 😀 Government regulations like PP 2-3-2018 and PP 45-2010 set the tax rates and guidelines for specific income types, such as honorariums from public funds and interest payments.

- 😀 PPh Pasal 4 Ayat 2 taxes can be withheld by the payer, such as employers, cooperatives, and financial institutions, who are required to deduct the tax and submit payments.

- 😀 In cases where the payer is not obligated to withhold the tax (such as self-employed individuals or freelancers), the recipient is responsible for paying the tax themselves.

- 😀 Deadlines for tax payments and reporting vary depending on the income type, such as the 10th or 15th day of the following month after the tax period ends.

- 😀 Final tax on certain transactions, such as stock sales and property transfers, requires reporting by the payer, who also needs to provide proof of tax withholding to the recipient.

- 😀 Taxpayers are required to report final tax payments through the annual SPT (tax return), which consolidates all tax payments for the year.

- 😀 Certain income types are also regulated by specific government regulations, with slots left open for future provisions and updates to tax law to address new income categories.

Q & A

What is PPh Pasal 4 Ayat 2, and why is it important?

-PPh Pasal 4 Ayat 2 refers to income tax that is subject to a final tax rate. This means that once the tax is withheld at the source, no further tax is due. It's important because it simplifies tax reporting for certain types of income, as it doesn’t need to be included in the annual tax return.

What types of income are subject to PPh Pasal 4 Ayat 2?

-The types of income subject to PPh Pasal 4 Ayat 2 include interest from deposits, savings, bonds, government debt securities, prize money, income from stock transactions, income from asset transfers (e.g., land and buildings), real estate and construction business income, and other specific income defined by government regulations.

Who are the subjects (taxpayers) of PPh Pasal 4 Ayat 2?

-The subjects of PPh Pasal 4 Ayat 2 include both individual taxpayers (WP Pribadi) and corporate taxpayers (WP Badan). It also includes other entities that are required to withhold the tax, such as businesses and government bodies.

Who is responsible for withholding the tax under PPh Pasal 4 Ayat 2?

-The withholding agent, typically the party making the payment (such as a company, government body, or other businesses), is responsible for withholding the tax. In cases where the taxpayer is not a business or professional, the responsibility falls on the income recipient to pay the tax themselves.

What is the deadline for reporting and paying taxes under PPh Pasal 4 Ayat 2?

-The deadline for payment and reporting varies based on the type of income. For example, interest from deposits is paid by the 10th of the month after the tax period and reported by the 20th. Stock transaction income is paid by the 20th and reported by the 25th. For property sales or transfers, payment is due by the 10th or 15th, and reporting is due by the 20th.

What is the role of Government Regulations (Peraturan Pemerintah) in PPh Pasal 4 Ayat 2?

-Government Regulations (Peraturan Pemerintah) play a significant role by defining specific types of income that are taxed at a final rate. These regulations can adjust tax rates and clarify which income types are subject to PPh Pasal 4 Ayat 2, ensuring comprehensive taxation rules.

What happens if a tax is withheld under PPh Pasal 4 Ayat 2?

-If a tax is withheld under PPh Pasal 4 Ayat 2, the taxpayer does not need to report it in their annual tax return, as it has already been settled. However, the taxpayer must include the withheld tax in their annual SPT for transparency and record-keeping purposes.

How is income from stock transactions taxed under PPh Pasal 4 Ayat 2?

-Income from stock transactions is subject to a final tax, with payment due by the 20th of the month following the transaction. The tax must be reported by the 25th of the month following the transaction.

What are some examples of taxable income subject to final tax from Government Regulations?

-Examples include income from consultancy fees, honorariums, and other specific income types outlined in government regulations such as PP 2-3/2018. These are subject to final taxation rates and may vary depending on the type of income.

How do taxpayers report final tax if they pay it themselves under PPh Pasal 4 Ayat 2?

-If taxpayers pay the final tax themselves (without withholding), they must report it in their annual tax return (SPT). The tax is not required to be reported monthly or quarterly if it has already been paid, but it must be included in the SPT for the relevant year.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

[PART 1- Watax] Pajak Penghasilan (PPh) Pasal 4 Ayat 2| Tax Center UIN Jakarta

Konsep dan Penghitungan PPh Pasal 23

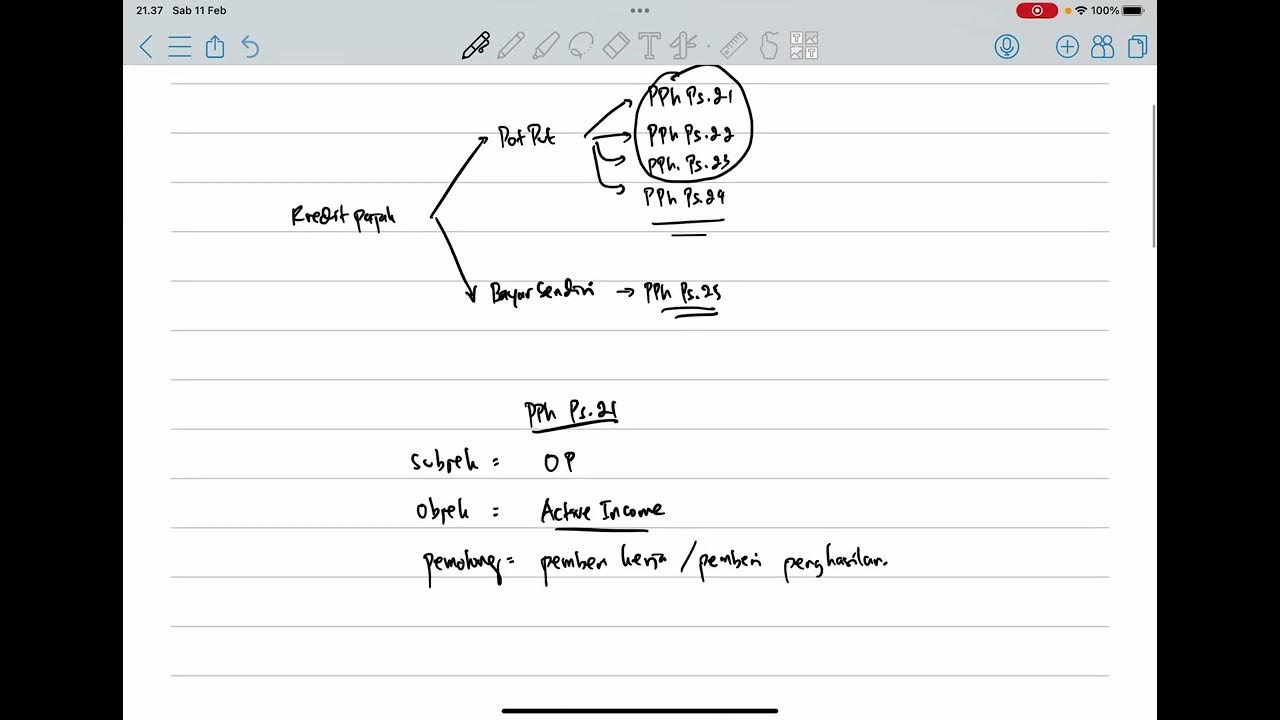

PPh Orang Pribadi (Update 2023) - 5. Kredit Pajak

Tugas Video Presentasi Kelompok 2 (Pajak Penghasilan Pasal 26) Mata Kuliah Perpajakan

PPh Orang Pribadi (Update 2023) - 7. PPh Pasal 25

Perbedaan Pemotongan & Pemungutan Pajak || Withholding Tax #tutorialpajak

5.0 / 5 (0 votes)