ICT Mentorship Core Content - Month 08 - Defining The Daily Range

Summary

TLDRIn this lesson, the focus is on understanding the true interbank 24-hour trading day and the key timeframes that professional traders use to frame their daily ranges. The instructor contrasts retail trading hours with the actual interbank trading times, introducing key concepts like the Asian range, London kill zone, and New York kill zone. Emphasis is placed on New York time and how it impacts trading strategies, with detailed breakdowns of each trading session's start and end points. This lesson provides foundational knowledge for understanding the market structure and timing in day trading.

Takeaways

- ⏱️ The ICT (Interbank Price Delivery Algorithm) day trading model relies on precise New York time references instead of the MT4 retail 24-hour day separators.

- 🌙 The Asian Range begins every day at 8 PM EST and ends at midnight EST, forming the first major time window ICT analyzes.

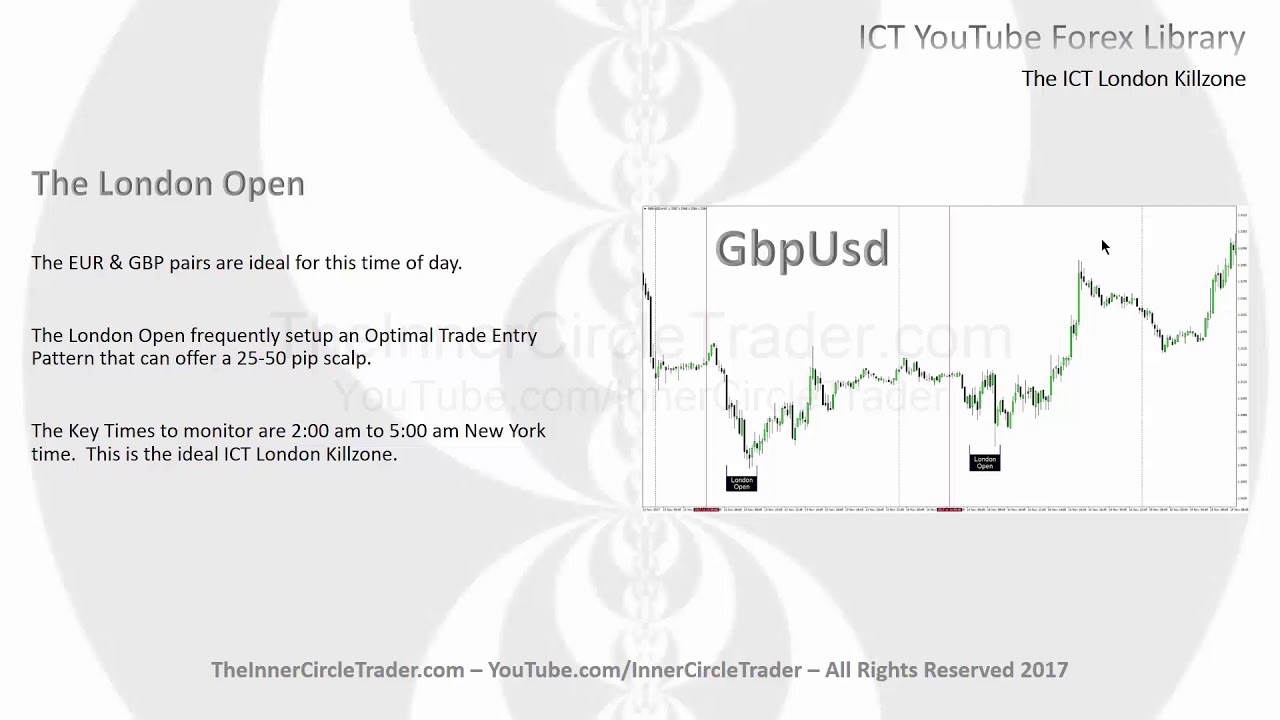

- 🏙️ The London Kill Zone runs from 1 AM to 5 AM EST, and ICT emphasizes that this is the *actual* timing used for high-probability setups.

- 🌅 The New York Kill Zone occurs from 7 AM to 10 AM EST, capturing key market setups around the U.S. market open.

- 🔔 The CME open at 8:20 AM EST is highlighted as a precise and meaningful timing point that often aligns with turning points in price.

- 🍽️ The period between the London and New York Kill Zones is considered 'London Lunch,' where markets typically quiet down and major moves are less likely.

- 🔒 The London Close Kill Zone spans from 10 AM to 12 PM EST and frequently delivers daily lows or highs as liquidity is rebalanced.

- 📅 The ICT ‘True Day’ begins at midnight EST and ends at 3 PM EST, marking the official 24-hour cycle used by interbank pricing algorithms.

- 📊 Price highs, lows, and swing points frequently form precisely at these time windows, reinforcing that market movement follows algorithmic timing patterns rather than randomness.

- 🧭 ICT stresses that using proper time delineation provides structure for observing power-three behavior (accumulation, manipulation, distribution) within the daily range.

- 📘 The lesson establishes the definitive timing rules for all subsequent ICT day trading teachings, ensuring students use consistent and correct kill zone definitions.

Q & A

What is the difference between the retail 24-hour trading day and the interbank 24-hour trading day?

-The retail 24-hour trading day is based on the MT4 platform’s time frame and is marked by vertical period separators. The interbank 24-hour trading day, however, follows a different reference point known as the IPDA (Interbank Price Delivery Algorithm), which is the standard used by institutional traders.

What is the significance of understanding the 'Asian range' in day trading?

-The Asian range represents a specific time frame during the trading day, from midnight to 1 a.m. Eastern Standard Time (New York time). This time window is important as it sets the stage for price movements and trends, which will influence the strategy during subsequent kill zones (London, New York).

What are 'kill zones,' and why are they important in the ICT day trading model?

-Kill zones are specific time windows during the day when significant price movements are expected. These include the Asian, London, and New York kill zones. They are critical for identifying high-probability trade setups based on historical patterns and institutional order flow.

What time does the ICT London Kill Zone begin and end?

-The ICT London Kill Zone begins at 1 a.m. and ends at 5 a.m. Eastern Standard Time (New York time). This period is crucial for capturing high-probability price moves that often occur at the start of the London session.

How do the New York kill zones fit into the ICT day trading strategy?

-The New York Kill Zone spans from 7 a.m. to 10 a.m. Eastern Standard Time (New York time). This window is important for identifying price action after the London session, particularly when institutions are actively involved in the market. It is followed by another kill zone called the 'New York close' or 'London close.'

When does the 'True Day' in ICT day trading start and end?

-The ICT True Day starts at midnight New York time and ends at 3 p.m. New York time. This defines the full 24-hour cycle in the interbank trading system, which is critical for framing the entire day’s price movement.

What role does the 8:20 a.m. CME open play in ICT day trading?

-The 8:20 a.m. CME open marks a significant price level, often serving as a reference point for short-term price action. The market tends to move sharply around this time, and it is used to identify turning points or key price levels for trade setups.

How does the London lunch period affect price movements?

-The London lunch period, typically occurring between 10 a.m. and noon New York time, is generally a quieter phase in the market. Significant price movements are less likely during this time, and traders often see consolidation or a continuation of the price action set by the London session.

What is the significance of the New York close in ICT day trading?

-The New York close, occurring at 3 p.m. New York time, marks the end of the 'True Day.' This is when the bulk of price moves related to FOMC announcements and interest rate decisions conclude, providing a clear reference point for traders to analyze daily highs, lows, and swings.

What should traders focus on when analyzing the daily range in ICT day trading?

-Traders should focus on the opening price, daily high, daily low, and closing price. By understanding the key time windows (Asian, London, New York), they can identify turning points, areas of resistance or support, and execute trades based on precise time-based patterns.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

5.0 / 5 (0 votes)