ICT Forex - The ICT London Killzone

Summary

TLDRThis video teaches traders about the ICT London Open Kill Zone, a critical time frame in the 24-hour trading cycle from 2:00 AM to 5:00 AM New York time. It highlights how this period often sets the high or low of the day, especially in currency pairs like EUR/USD and GBP/USD. By focusing on time, price action, and key market patterns, traders can identify high-probability entry points. The video emphasizes risk management, understanding market structure, and using previous day's data to predict price movement, making the London Open a powerful and profitable trading window.

Takeaways

- 😀 The London Open Kill Zone refers to the time period from 2:00 AM to 5:00 AM New York time, which is crucial for forex trading opportunities.

- 😀 The London session is known for creating the high or low of the day, making it an ideal time for scalping (25-50 pips).

- 😀 The London Open is highly volatile, especially when major economic releases happen, so it's important to use stop-loss orders to manage risk.

- 😀 The London Open is most effective for trading pairs like EUR/USD and GBP/USD, which are sensitive to this session's price action.

- 😀 The concept of fractal price action is emphasized, meaning that patterns seen on higher time frames can be observed in smaller time frames as well.

- 😀 The London session can lead to significant price moves, with a higher probability of finding low-risk entry points during trends.

- 😀 The time frame between 2:00 AM and 5:00 AM New York time is ideal for observing and entering trades based on the creation of the day's high or low.

- 😀 Price action in the London Open can be mirrored in other asset classes, such as commodities, indices, and even cryptocurrencies.

- 😀 Traders should calibrate their local time to New York time (Eastern Time Zone) to properly align with the London Open timing.

- 😀 Understanding market trends and using higher time frames helps identify when the London Open will likely create the high or low of the day.

- 😀 Risk management is critical when trading the London session due to its high volatility—traders should be prepared for fast and aggressive price movements.

Q & A

What is the London Open Kill Zone and why is it significant for traders?

-The London Open Kill Zone refers to the time window between 2:00 AM and 5:00 AM New York time, during which the Forex market sees high volume and volatility. This session is significant because it often sets the high or low of the day, offering short-term traders the opportunity to capture large price movements and significant profits.

What is the optimal trading strategy during the London Open Kill Zone?

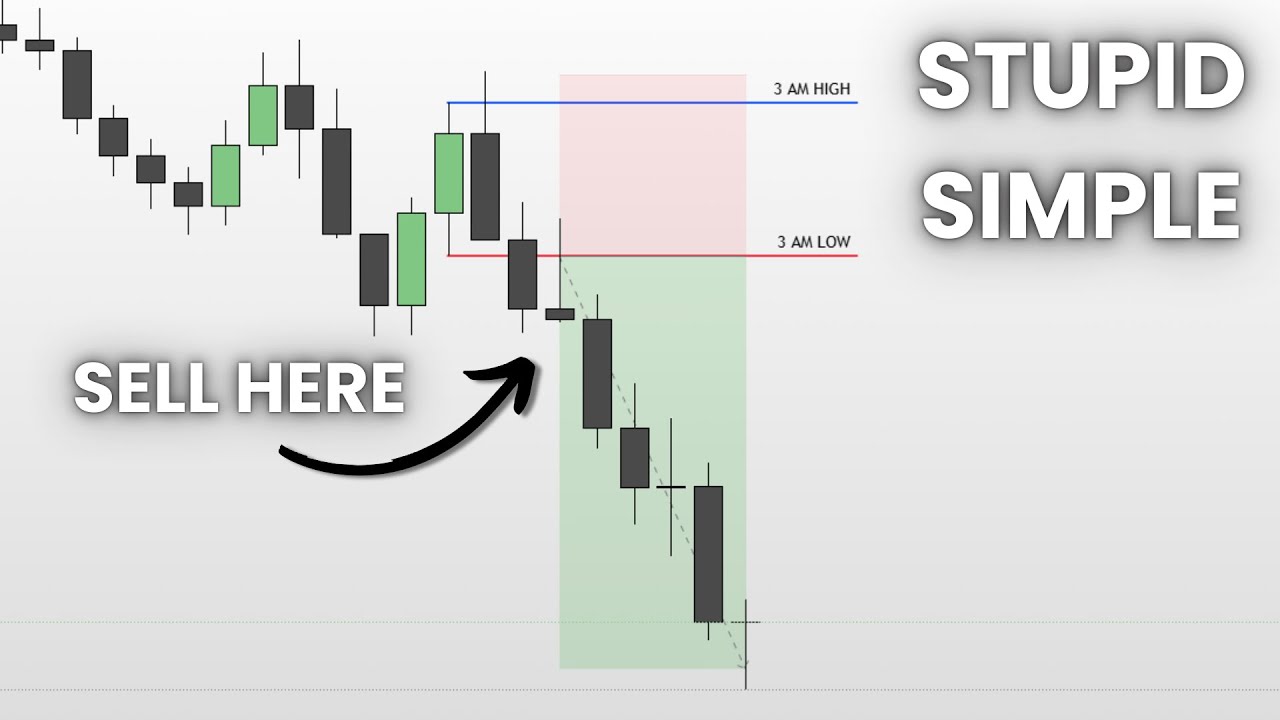

-The optimal strategy involves focusing on price action between 2:00 AM and 5:00 AM New York time, as this is when the market is most likely to create the high or low of the day. Traders should look for key price patterns, such as breakouts and reversals, during this period to enter trades with high probability.

How does the London Open affect the direction of price movement?

-During the London Open, price action often determines the direction of the market for the rest of the day. If the market is bullish, the London session tends to create the low of the day, and if the market is bearish, it usually creates the high of the day. Traders use this to set up trades in the direction of the anticipated daily trend.

Can the London Open Kill Zone strategy be applied to markets other than Forex?

-Yes, the London Open Kill Zone strategy is not limited to Forex. It can be applied to other asset classes such as commodities, cryptocurrencies, and indices like the S&P 500, DAX, and NASDAQ. The key concept of high-volume price action during the London session is universal across markets.

What role does time play in the London Open Kill Zone trading strategy?

-Time is crucial in this strategy because the London Open Kill Zone is specifically defined by the hours between 2:00 AM and 5:00 AM New York time. Traders use this time frame to identify key price movements and make trading decisions based on how the market behaves during this period.

How can traders identify optimal entry points during the London Open?

-Traders can identify optimal entry points by studying price action during the London Open. This includes looking for patterns like price spikes that form the high or low of the day, as well as observing support and resistance levels. The strategy also involves using previous day's data to set up trades for the current day.

What is the significance of understanding the daily range in the London Open strategy?

-Understanding the daily range is important because the London Open often establishes a key part of the daily range—either the high or the low. By knowing the daily range, traders can gauge potential price movements and set up trades that align with the larger market trend.

What risks should traders be aware of during the London Open?

-The London Open can be highly volatile, and if traders are not cautious, they can get caught on the wrong side of a price move. The market can move rapidly during this time, making it crucial for traders to use stop-loss orders to manage risk and avoid significant losses.

Why is the period between 2:00 AM and 5:00 AM New York time critical for traders?

-This period is critical because it sees high levels of price action and volume, which increases the likelihood of significant market moves. Traders focus on this window as it often sets the high or low of the day, making it an ideal time for short-term trading opportunities.

How do market trends (bullish or bearish) affect trading during the London Open?

-The market's overall trend influences the likely outcome during the London Open. If the market is trending bullish, the London Open typically sets the low of the day, providing an opportunity to go long. Conversely, if the market is bearish, the London Open sets the high of the day, providing an opportunity to go short.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

ICT Forex-The ICT London Killzone that confirms Daily Bias.

20 Pips A Day Using ICT Asian Killzone Strategy (BETTER THAN SILVER BULLET)

ICT Mentorship Core Content - Month 08 - Defining The Daily Range

ICT Forex - The ICT London Close Killzone

Important Time Levels For Trading

STOP Using ICT & Trade With This Strategy Instead.. (Stupid Simple)

5.0 / 5 (0 votes)