7 Steps on How to Create a Budget

Summary

TLDRThis video script outlines a comprehensive guide to creating a budget through seven steps, emphasizing the importance of tracking income and expenses, setting a baseline, categorizing finances, and comparing income to expenses. It introduces the 50-20-30 rule for budget allocation, suggesting 50% for essentials, 20% for savings and debt, and 30% for lifestyle choices, ultimately aiming to transform budgeting into a tool for financial freedom and planning for unexpected costs.

Takeaways

- 📝 **Track Your Income and Expenses**: Start by journaling all income and expenses to understand your financial flow.

- 💲 **Set Your Income Baseline**: Calculate your total income from various sources to establish a baseline for budgeting.

- 📅 **Determine Your Expenses**: Identify both fixed and variable expenses by reviewing past statements and planning for the future.

- 📁 **Categorize Your Income and Expenses**: Organize your finances into categories for detailed budget management.

- 💵 **Compare Your Income to Your Expenses**: Aim to have more income than expenses to ensure financial stability.

- 💳 **Make Plans for Unplanned Expenses**: Build a rainy-day fund to cover unexpected costs and avoid debt.

- 💹 **Turn Your Budget Into a Document of Freedom**: Use a budget to maintain financial freedom and enjoy life within your means.

- 💰 **50-20-30 Rule**: Allocate 50% of your income to essentials, 20% to savings and debt repayment, and 30% to lifestyle choices.

- 💵 **Income Categories**: At minimum, categorize income into employment, family contributions, and student loans.

- 📈 **Expense Categories**: Essential categories include housing, food, transportation, education, and non-essential expenses.

- 💲 **Budgeting as a Routine**: Make budgeting a regular practice to manage money effectively and achieve financial goals.

Q & A

What is the first step in creating a budget according to the video?

-The first step in creating a budget is to track your income and expenses using a money journal.

What is a money journal and how is it used in budgeting?

-A money journal is a tool, such as a notebook, spreadsheet, or app, used to record all income as 'income' and all spending as 'expenses' to track financial activity.

How do you determine your income baseline?

-You determine your income baseline by identifying all sources of income, such as employment, savings, family contributions, scholarships, grants, and gifts, then adding them up.

Why should student loans be used sparingly in budgeting?

-Student loans should be used sparingly because they are a form of debt and should only be used for essential education-related expenses.

What are the three ways to determine your monthly and annual expenses?

-You can determine your expenses by looking back at your past spending, budgeting for fixed expenses, and using your money journal to track ongoing spending.

What are fixed expenses and can you give some examples?

-Fixed expenses are regular, predictable costs that do not change, such as a 12-month lease payment, internet dues, car payments, and childcare.

How should you categorize your income and expenses in a budget?

-You can categorize your income and expenses based on how detailed you want your budget to be. At minimum, categorize income into Employment, Family Contribution, and Student Loans, and expenses into Housing, Food, Transportation, Education, and Non-Essential expenses.

Why is it important to compare your income to your expenses?

-Comparing income to expenses helps you understand if you are living within your means and allows you to identify areas where you may need to cut back to avoid overspending.

What is the purpose of a rainy-day fund in a budget?

-A rainy-day fund is an emergency savings account for unexpected expenses to avoid relying on credit cards or other high-cost borrowing.

How does the 50-20-30 rule apply to budgeting?

-The 50-20-30 rule suggests allocating 50% of your income to essential expenses, 20% to savings and debt repayment, and 30% to lifestyle choices and discretionary spending.

Why is it important to turn your budget into a document of freedom rather than a restriction?

-Turning your budget into a document of freedom allows you to enjoy life responsibly by planning for both necessities and the things that bring you happiness within your means.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

¿Cómo elaborar un presupuesto familiar?

Presupuesto personal: clave del éxito financiero

MÉTODO N.A PRA QUEM GANHA POUCO DINHEIRO! Planejamento financeiro FÁCIL!

How to Budget with a Side Hustle - Budget Spreadsheet & Tutorial (EXCEL, GOOGLE SHEETS)

Budgeting for Beginners - How to Make a Budget From Scratch 2021

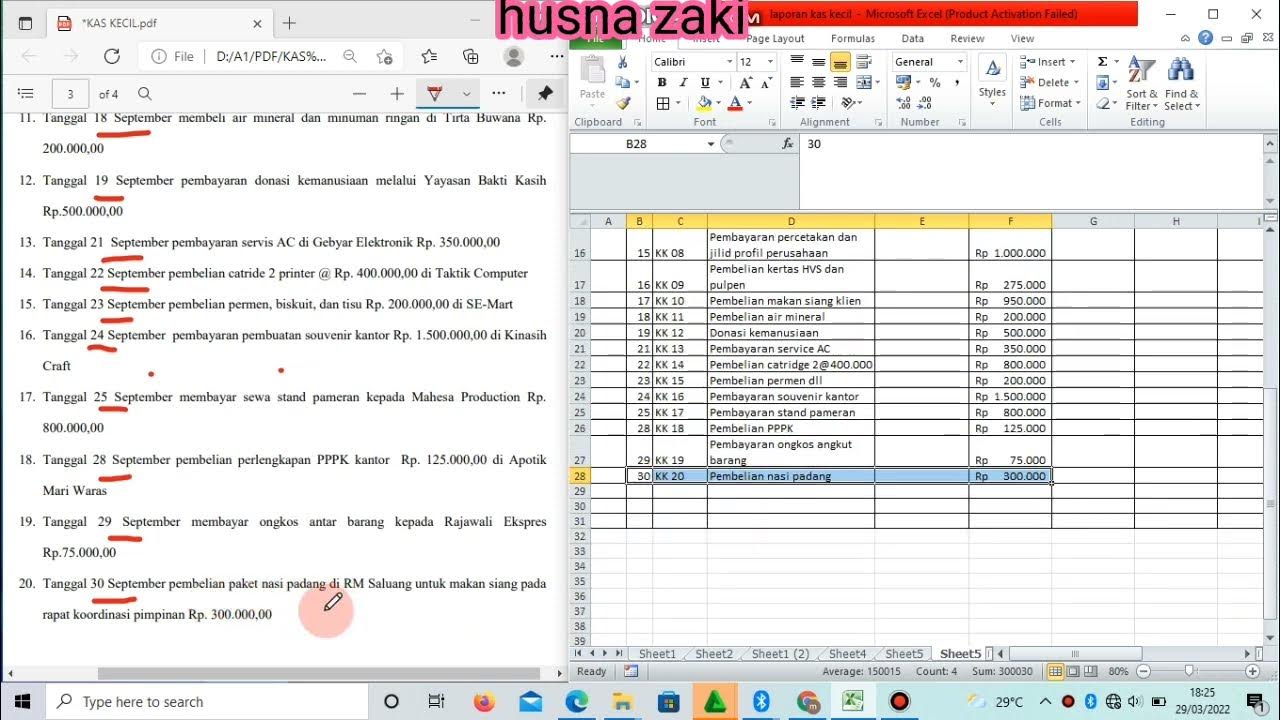

Mengelola Kas Kecil-UKK OTKP 2022

5.0 / 5 (0 votes)