How to Budget with a Side Hustle - Budget Spreadsheet & Tutorial (EXCEL, GOOGLE SHEETS)

Summary

TLDRThis video provides a detailed guide on tracking business and personal expenses using Google Sheets or Excel. It covers the process of categorizing expenses, converting negative amounts into positive values, and tracking savings goals like car insurance and travel funds. The video emphasizes the importance of managing both business and personal finances, tracking net worth, and using visual dashboards to track progress. It also explains how to adjust spending categories for side hustlers, ensuring that savings goals are met while maintaining a clear overview of income, spending, and net worth over time.

Takeaways

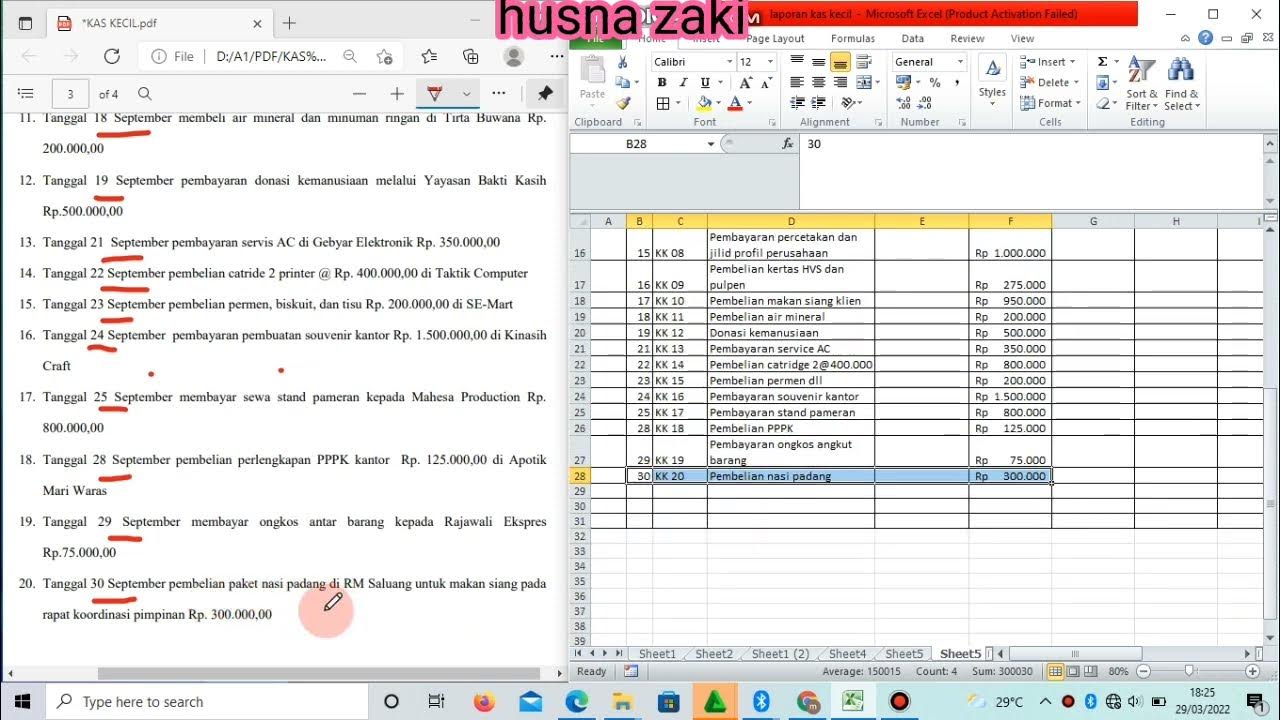

- 😀 Track your expenses accurately by downloading statements and organizing key information like date, company, and amount.

- 😀 Use the `ABS` formula in Google Sheets or Excel to convert negative numbers (expenses) into positive amounts for easier tracking.

- 😀 Organize expenses into categories such as fixed, variable, and savings goal spending to avoid confusion during budgeting.

- 😀 Separate business and personal expenses to get a clear picture of both your business's financial health and your personal spending habits.

- 😀 For accurate financial tracking, always ensure you are pasting data correctly by using 'Paste Special' to avoid errors in your data.

- 😀 Set aside a portion of your income for taxes (around 25%) to ensure you're prepared when tax time comes.

- 😀 Use savings goal categories (e.g., travel, car insurance) to differentiate pre-saved money from regular spending, preventing overspending errors.

- 😀 Regularly update your savings goals in your spreadsheet to keep track of funds you’re setting aside for specific future expenses.

- 😀 Track your net worth each month by recording both your assets (cash, investments, property) and liabilities (debts, loans).

- 😀 Monitor changes in your net worth to measure financial progress, ensuring you can see month-to-month growth or setbacks.

- 😀 Use visual reports and dashboards to quickly understand your spending patterns, net worth growth, and areas to adjust in your financial plan.

Q & A

What is the first step in organizing your business expenses in the spreadsheet?

-The first step is to copy the relevant transaction data, which typically includes the date, the company spent money with, and the amount. After that, unnecessary rows should be deleted.

Why is it important to turn negative expense values into positive numbers in the spreadsheet?

-Turning negative values into positive numbers helps simplify tracking and ensures the expenses are correctly categorized as positive figures, making it easier to understand the financial situation.

How can you quickly turn negative numbers into positive ones in Google Sheets or Excel?

-You can use the formula '=ABS(cell)' where 'cell' refers to the cell with the negative number. This formula will convert the number into a positive one.

What should you do if your spreadsheet doesn't grab all the necessary rows when pasting data?

-If your data isn't fully captured, you can double-check by ensuring all the necessary rows are selected. You can also add extra rows to accommodate additional data and then paste them into the correct cells.

How do you handle categorizing business expenses in the spreadsheet?

-You categorize business expenses by assigning them to specific categories such as office expenses, travel, or other relevant categories based on the nature of the expense. This helps in organizing the financial data effectively.

What does it mean if you are 'under budget' in your business finances?

-Being 'under budget' means that you have spent less than what you planned or allocated for your business expenses, which is a positive outcome, indicating better control over spending.

What is the importance of tracking your net worth each month?

-Tracking your net worth each month allows you to measure financial progress by comparing your assets against your liabilities, giving you a clear picture of your overall financial health.

How does the net worth tracking spreadsheet calculate net worth?

-Net worth is calculated by subtracting your liabilities (e.g., debts, mortgages) from your assets (e.g., cash, investments, and valuable property). The result is your overall financial worth.

What role does the dashboard play in this budget spreadsheet?

-The dashboard provides visual reports that summarize your financial data, including income vs. spending, net worth progress, and spending by category, helping you easily track and analyze your financial trends over time.

What is the benefit of categorizing spending as 'saving goal spending'?

-Categorizing expenses as 'saving goal spending' helps prevent confusion by showing that certain expenditures, like trips or planned purchases, are paid from previously saved funds, not affecting your current budget or overspending.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

5.0 / 5 (0 votes)