Audit Planning Overall Audit Strategy | Audit Course

Summary

TLDRThis session focuses on the audit strategy during the planning phase, emphasizing understanding the client's business, industry, and motives. The strategy outlines the audit's scope, timing, and direction, considering regulatory deadlines and seasonal factors. It also addresses resource allocation, including staff and specialists, to ensure an efficient audit. The importance of continuity in staff and the potential need for specialists in areas like valuation or IT is highlighted. The session concludes with a reminder to utilize resources like Forehead Lectures for CPA exam preparation and a call to action for further detailed study.

Takeaways

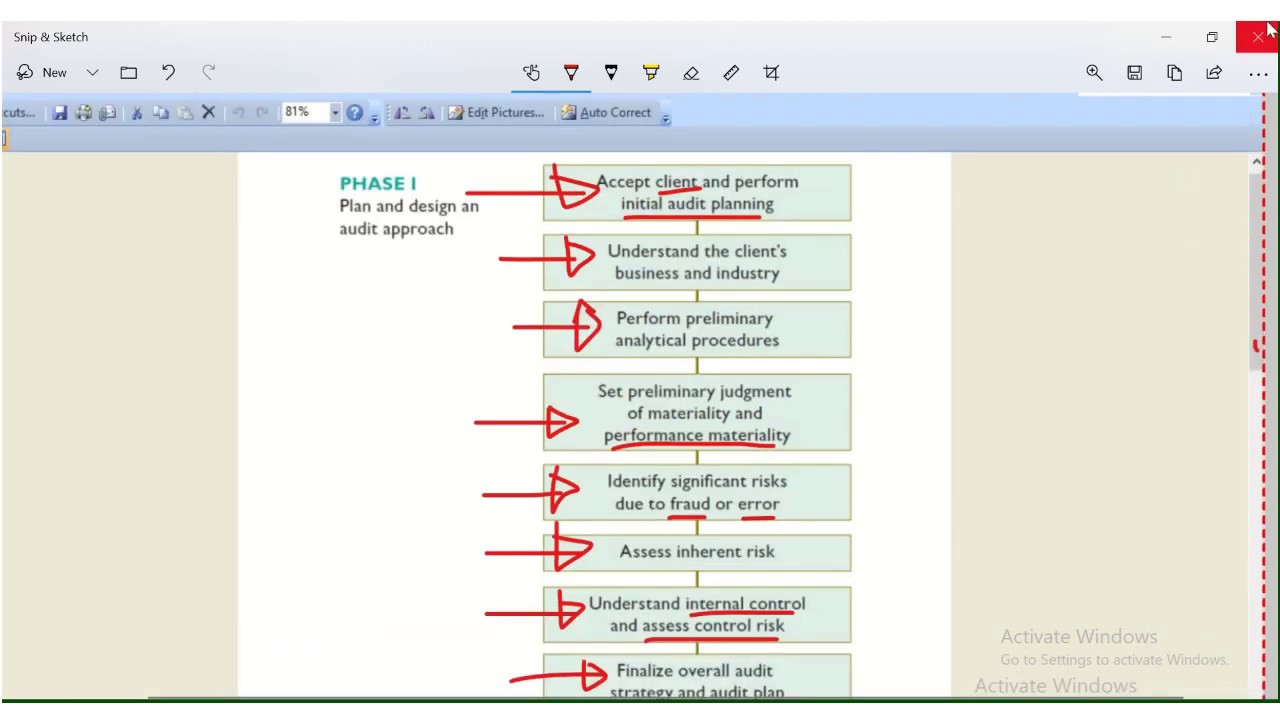

- 📈 The audit strategy is a crucial part of the planning phase, focusing on understanding the business, industry, and client motives.

- 🔍 The strategy outlines the scope, timing, and direction of the audit, which may include financial statements and regulatory deadlines.

- 📅 Audit timing considerations include year-round or end-of-year assessments, influenced by factors like seasonality and shareholder meetings.

- 👥 Staffing for the audit involves assigning proficient and knowledgeable personnel, which may include specialists depending on the audit's nature.

- 🌐 For large audits, multiple partners and staff from various offices or even international offices might be involved.

- 🏢 Understanding the client's business is essential to determine if a specialist is needed, such as for inventory assessment or legal contracts.

- 👨💼 Specialists can be external to the firm and have specialized knowledge in areas like business valuation, IT, or actuarial science.

- 📝 The auditor remains responsible for the audit report even when using specialists, and specialists' involvement is only mentioned if it affects the audit opinion.

- 💼 Embracing audit assignments, even if not preferred, can lead to professional growth and expertise, benefiting the auditor in the long term.

- 🎓 For CPA exam candidates and accounting students, resources like Forehead Lectures can supplement their study materials and improve understanding of audit planning.

Q & A

What is the primary purpose of the initial audit strategy discussed in the session?

-The primary purpose of the initial audit strategy is to outline the scope, timing, and direction of the audit, which serves as a blueprint for crafting the audit plan.

What factors are considered when determining the timing of the audit?

-Factors considered for the timing of the audit include regulatory deadlines, shareholder meeting requirements, and the seasonality of the business.

Why is understanding the client's business and industry important in the audit planning phase?

-Understanding the client's business and industry is crucial for tailoring the audit approach, identifying risks, and ensuring the audit is conducted in a manner that is relevant and effective for the specific business context.

How does the number of client sites impact the audit planning?

-The number of client sites affects the audit planning by influencing the budgeting and resource allocation, as each site may require a visit and audit work.

What role does the historical effectiveness of internal control play in audit planning?

-The historical effectiveness of internal control helps in determining the extent of reliance on internal control systems, which in turn affects the nature, timing, and extent of the audit procedures.

Why is it important to maintain staff continuity across years in an audit engagement?

-Maintaining staff continuity ensures that the audit team becomes more efficient and effective over time, leading to better technical understanding of the client's business and stronger relationships with client staff.

What are the potential benefits for an auditor when assigned to a specific audit engagement?

-Being assigned to an audit engagement allows an auditor to grow professionally by gaining expertise and experience, which can make them more independent and valuable in the market.

Why might an auditor need to involve specialists in an audit?

-An auditor might need to involve specialists to address specific areas of expertise that are outside the standard audit team's knowledge, such as inventory valuation, actuarial assessments, or legal contract interpretations.

What is the impact of using a specialist on the auditor's responsibility?

-Using a specialist does not change the auditor's responsibility; the auditor remains accountable for the specialist's work and its impact on the audit report.

How should an auditor determine if a specialist is needed in an audit?

-An auditor should determine the need for a specialist by understanding the client's business well enough to identify areas where specialized knowledge is required for an accurate and effective audit.

What is the role of a specialist in an audit, and how does their involvement affect the audit report?

-A specialist contributes specialized knowledge to specific areas of the audit. Their involvement is only mentioned in the audit report if it leads to a modification of the audit opinion.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

5.0 / 5 (0 votes)