Audit Planning | Understanding the Entity and its Environment | Hermosilla, Tiu, Salosagcol

Summary

TLDRThis lecture delves into audit planning, emphasizing its importance in strategizing the audit process. It highlights the auditor's goal to determine the scope of audit procedures, ensuring the audit is conducted effectively and efficiently. The lecture discusses the significance of understanding the client's business and industry, including its objectives, strategies, and related business risks. It also touches on the auditor's role in evaluating the client's estimates and the selection of audit procedures. The lecture further explores the sources of information for understanding the client's environment and the importance of updating and re-evaluating prior information for ongoing engagements.

Takeaways

- 📝 Audit planning involves developing a general strategy for conducting the audit effectively.

- 📊 The auditor must understand the client's business and industry to plan the audit efficiently.

- ✅ The main objective of audit planning is determining the scope of audit procedures.

- ⚙️ Effective planning helps focus on critical areas, ensuring the audit is both efficient and effective.

- 📋 Understanding the entity’s environment includes knowing the regulatory framework and business risks.

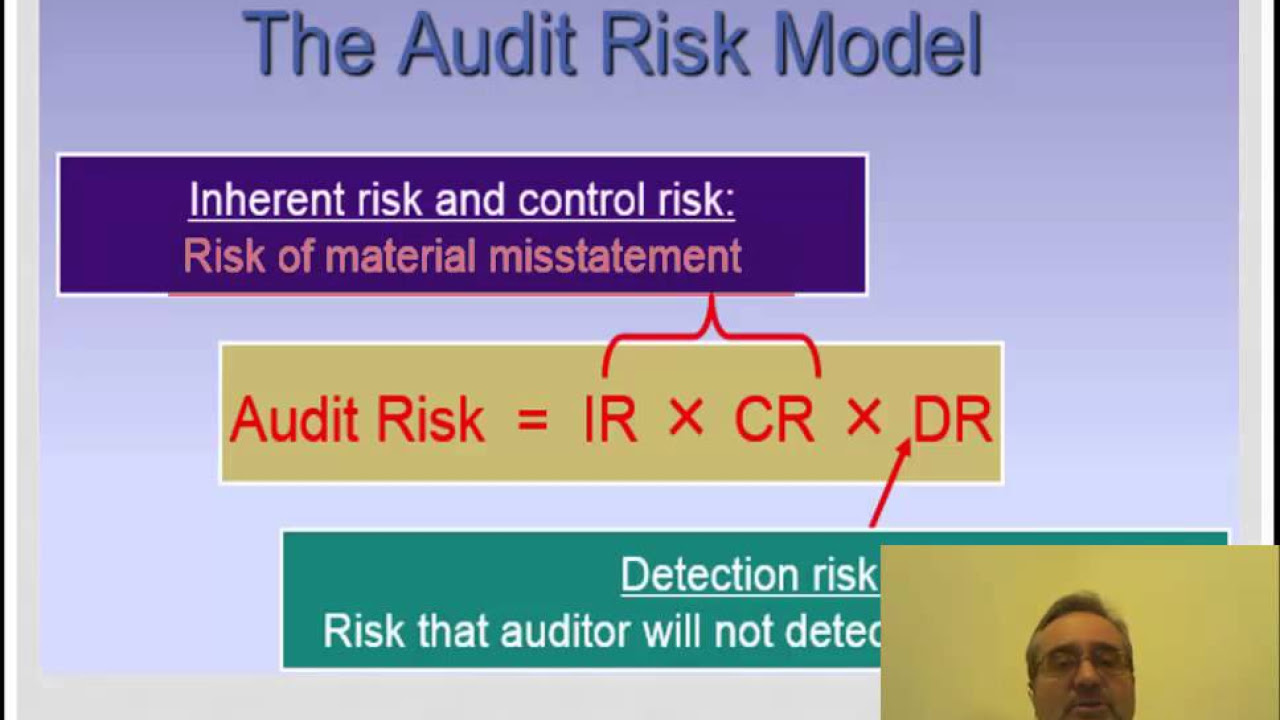

- 📉 Auditors must evaluate the entity’s performance metrics and internal controls to assess risks of material misstatement.

- 📚 Information sources for understanding the client include prior audits, interviews, and industry publications.

- 💡 Gaining insight into business risks helps auditors identify areas with potential misstatements.

- 📈 Auditors must verify opening balances to ensure there are no misstatements affecting the current audit.

- 🔄 Professional judgment is key in evaluating audit evidence and applying knowledge of the business to the audit.

Q & A

What is the primary goal of audit planning?

-The primary goal of audit planning is to determine the scope of the audit procedures to be performed, ensuring the audit is conducted effectively and efficiently.

Why is it important for auditors to understand the client's business and industry?

-Understanding the client's business and industry is crucial as it helps the auditor to identify risks of material misstatement, design appropriate audit procedures, and evaluate the reasonableness of the client's estimates and assertions.

What are the key components of a general audit strategy?

-A general audit strategy includes developing an approach for the expected conduct of the audit, determining the scope of audit procedures, and planning the audit work for effectiveness and efficiency.

How does audit planning affect the auditor's risk assessment?

-Audit planning assists in risk assessment by helping the auditor to identify potential problems, allocate attention to important areas, and design audit procedures that are more likely to detect material misstatements.

What role does the auditor's understanding of the business play in evaluating accounting estimates?

-The auditor's understanding of the business operations allows them to evaluate the reasonableness of the client's accounting estimates, as it provides context for the transactions and events involved.

What are some sources of information that auditors use to understand the client's business and industry?

-Auditors gather information from sources such as prior year's working papers, interviews, discussions, industry publications, corporate documents, financial reports, and forecasts.

How does the auditor ensure that the audit is performed in an effective and efficient manner?

-The auditor ensures effectiveness and efficiency by planning the audit work, assigning and coordinating tasks, and using their understanding of the business to focus on significant risks and design appropriate audit procedures.

What is the significance of understanding the entity's measurement of performance?

-Understanding the entity's measurement of performance is significant as it can reveal pressures that may motivate management to either improve business processes or manipulate financial statements.

How does the auditor's knowledge of the client's business affect the evaluation of audit evidence?

-The auditor's knowledge of the client's business enhances the evaluation of audit evidence by providing a frame of reference for professional judgment, which aids in assessing risk, identifying potential problems, and testing the validity of client assertions.

What is the auditor's responsibility regarding opening balances according to PSA 510?

-According to PSA 510, the auditor is responsible for obtaining sufficient appropriate audit evidence to ensure that opening balances do not contain material misstatements that could affect the current year's financial statements.

Why is it necessary for auditors to update and re-evaluate previously gathered information?

-Auditors need to update and re-evaluate previously gathered information to ensure that their understanding of the business remains current and relevant, which is essential for accurate risk assessment and effective audit planning.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

2.2 Overview of the Audit Process Auditing Planning Knowledge, Analytics, Materiality

Tahapan Audit

2.4 Overview of the Audit Process Audit Planning Audit Strategy vs Plan vs Program

FASE DE LA AUDITORIA PLANIFICACION ESPECIFICA

Risk of Material Misstatement

Belajar Singkat: Kertas Kerja Audit (Audit Working Papers)

5.0 / 5 (0 votes)