Ultimate ICT Daily Bias Guide (5 Methods)

Summary

TLDRThis video explains several methods for establishing a daily market bias using price action, PD arrays, and technical indicators. The speaker introduces strategies such as analyzing the Asian session's sweeps, displacement, and liquidity shifts to identify bullish or bearish trends. They also cover the use of two EMAs (9 and 18) on a daily time frame for a more mechanical approach, ideal for beginners. The combination of these methods, including fair value gaps, offers traders a higher probability of success in determining market direction for both intraday and longer-term trades.

Takeaways

- 😀 The Asian session's high and low are key levels to establish a bullish or bearish bias based on price displacement and sweeps.

- 😀 Sweeping the Asian session’s high or low and observing price movement afterward helps establish a direction for the entire day, particularly for London and New York sessions.

- 😀 Using higher time frame price delivery arrays (PDAs) like the 4-hour chart strengthens the bias, especially when combined with session sweeps.

- 😀 A bearish bias is confirmed when price moves below the Asian session's low, and a bullish bias is confirmed when price moves above the Asian session's high.

- 😀 Displacement in price, such as breaking structure and continuation, signals the prevailing market direction for the day or session.

- 😀 The EMA method uses two exponential moving averages (9 and 18) to identify bullish or bearish trends based on price location relative to the EMAs.

- 😀 A bullish market bias is identified when price is above both the 9 and 18 EMAs, while a bearish bias occurs when price is below both.

- 😀 Price ranging between the 9 and 18 EMAs signals market indecision or a range-bound market, suggesting no clear bias.

- 😀 Combining the EMA strategy with higher time frame concepts like fair value gaps and PDAs increases the probability of successful trades.

- 😀 The EMA method is beginner-friendly, mechanical, and easy to follow, making it an excellent starting point for traders new to market analysis.

- 😀 Traders should be flexible with timeframes, using the 1-hour or 15-minute charts to analyze the EMAs, but the daily and 4-hour timeframes offer more clarity and higher probability.

Q & A

What is the significance of the Asian session in determining a market bias?

-The Asian session is important because price sweeps in this session can establish a directional bias for the rest of the trading day. A sweep above the Asian high signals a bullish bias, while a sweep below the Asian low signals a bearish bias, especially when combined with higher timeframe points of interest like Fair Value Gaps or order blocks.

What role do liquidity sweeps play in market bias?

-Liquidity sweeps, particularly those occurring during the Asian session, are used to determine whether the market is likely to trend up or down. A sweep of liquidity from the Asian high or low provides a signal about the potential direction for the day.

How does market structure and displacement impact trading bias?

-Displacement refers to a significant price move that breaks market structure, which can confirm or shift the bias established by earlier price action. Displacement helps establish a trend and supports the directional bias, either bullish or bearish, that the trader should follow throughout the day.

Why is it important to watch for displacement during the London and New York sessions?

-Displacement during these key trading sessions, such as breaking structure or a clear shift in price direction, is essential for confirming the bias established earlier in the Asian session. The market's behavior during these sessions often dictates whether the bias will hold or change.

What is the method using the 9 and 18 EMA and how does it establish a market bias?

-The 9 and 18 EMA method uses two exponential moving averages to define a market bias. A bullish bias is signaled when the price is above both EMAs, and a bearish bias is indicated when the price is below both EMAs. If the price is fluctuating between the two, it suggests a ranging market with no clear trend.

What does it mean when the price is hovering around the 9 and 18 EMAs?

-When the price is hovering around the 9 and 18 EMAs, it indicates that the market is in a range and lacks a clear direction. This is a signal to be cautious, as price may not be expanding in either direction but instead fluctuating within a tight range.

How can the EMA method be combined with other ICT concepts to improve trading success?

-The EMA method can be enhanced by combining it with concepts like Fair Value Gaps, PDAs (Points of Interest), and market structure analysis. This provides a higher probability of success by adding more context and confirming the bias with other indicators beyond just the EMAs.

What does the term 'displacement' refer to in market analysis?

-Displacement refers to a sharp, significant price movement that breaks market structure, confirming the establishment of a trend. This can be used to validate the bias and continuation of the trend throughout the trading session.

Why is it recommended to use the 9 and 18 EMAs on a daily or 4-hour timeframe?

-The 9 and 18 EMAs are most effective on higher timeframes, such as the daily or 4-hour, because they help filter out noise and identify clearer trends. Using them on these timeframes increases the accuracy of the bias and helps traders make more informed decisions.

How does the method of using liquidity sweeps in the Asian session differ from other methods?

-The liquidity sweep method focuses on price action during the Asian session, specifically watching for sweeps of the high or low, which indicate potential market direction. Unlike other methods that rely on broader market patterns, this approach targets the early part of the trading day and pairs it with higher timeframe setups for confirmation.

Outlines

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифMindmap

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифKeywords

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифHighlights

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифTranscripts

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифПосмотреть больше похожих видео

How to Find the Draw on Liquidity EASILY! (DOL) - ICT Concepts

Intro to TAPDA - Time and Price Algorithmic PD Arrays | Banned video @Zeussy X RichTheBull

A+ ICT Entry Checklist - ICT Concepts

FLOD, LLOD, PD Array Matrix - A-Z Guide Episode 8

NVDA Stock - Big Day For NVIDIA Tomorrow!

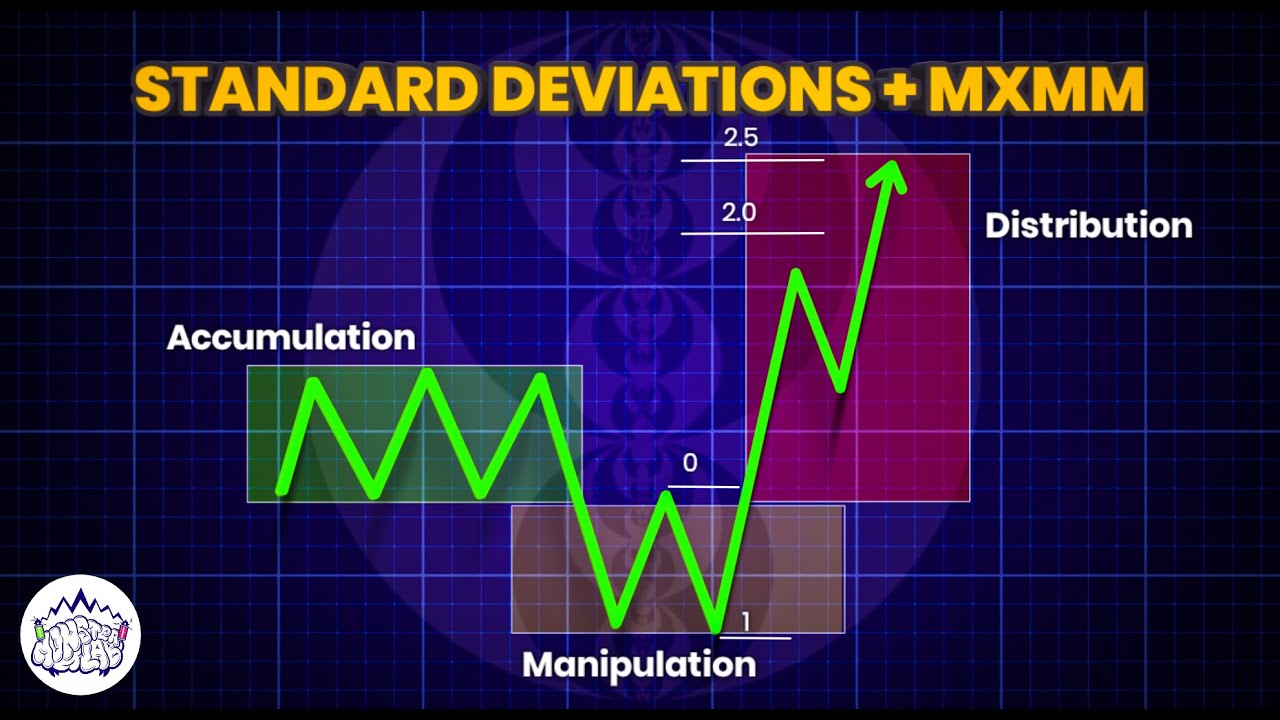

Standard Deviations + MMXM | ICT Concepts | DexterLab

5.0 / 5 (0 votes)