A+ ICT Entry Checklist - ICT Concepts

Summary

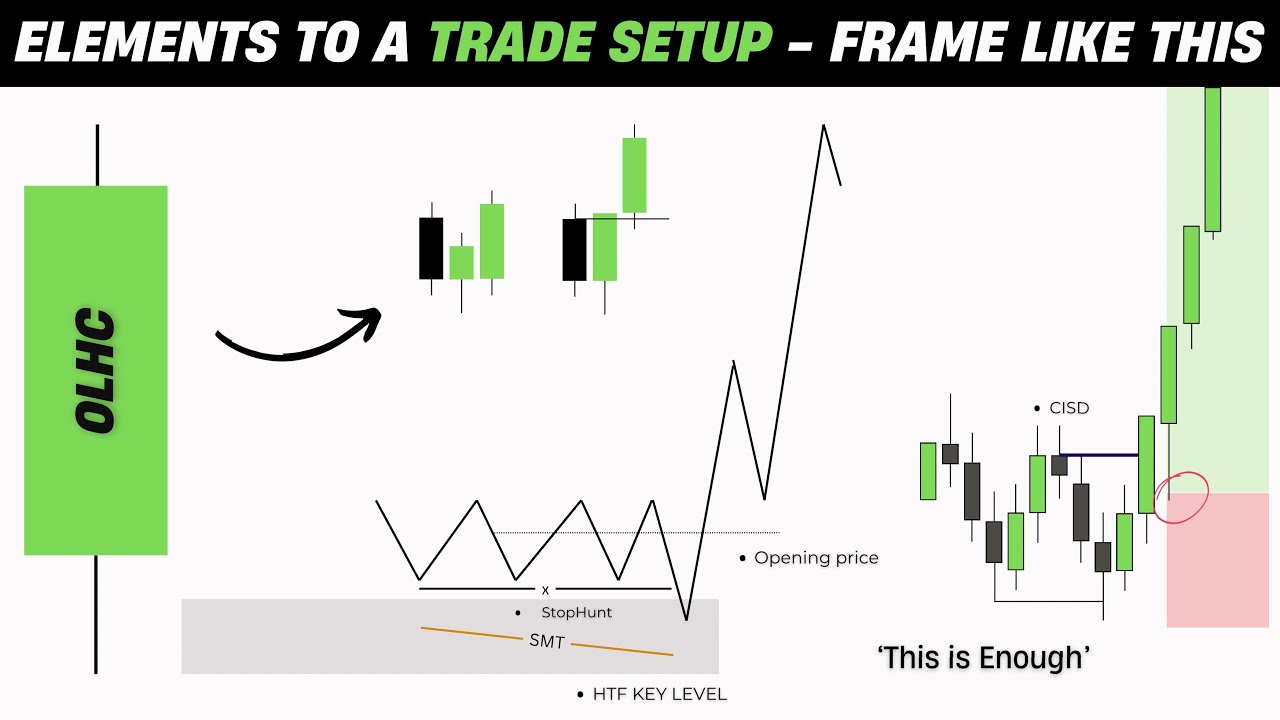

TLDRThis video outlines a personalized trading checklist for precise market entries, focusing on key elements like stop raids, market structure shifts, and various price action indicators such as PD arrays, fair value gaps, and order blocks. The narrator blends these concepts to create dynamic entry strategies, demonstrated through live trading examples across different timeframes. Emphasizing risk-to-reward management, the video teaches how to spot ideal entry zones, manage risk, and maximize returns while balancing strategic entry and trade execution.

Takeaways

- 😀 Focus on identifying a stop raid before considering an entry, where a low is broken before price moves in the intended direction.

- 😀 Market structure shifts or displacements indicate potential entry points, as they show a break in previous highs or lows.

- 😀 Use the discount zone (below 50% of the displacement range) for long trades and avoid entering in the premium zone.

- 😀 PD arrays like Fair Value Gaps, Order Blocks, and Breaker Blocks provide critical levels to consider for trade entries.

- 😀 Optimal Trade Entries (OTE) and Box setups can be blended with other concepts for a more refined strategy.

- 😀 Combining multiple entry models (e.g., Fair Value Gap + OTE) increases flexibility and enhances trade decision-making.

- 😀 Risk-to-reward balance is essential; entries closer to the stop loss offer higher risk, while entries further away risk missing the trade.

- 😀 Traders should focus on specific risk management techniques, like partial exits and adjusting stops to break even.

- 😀 Entry decisions can be influenced by various timeframes, from 1-minute to 15-minute charts, based on market conditions.

- 😀 Always consider liquidity zones (buy-side or sell-side) when analyzing potential entries to ensure market support for the trade.

Q & A

What is the purpose of the entry checklist in the trading strategy?

-The entry checklist ensures that all requirements are met before entering a trade. It helps verify that key elements like stop raids, market structure shifts, and optimal entry points are present, leading to more confident and structured trading decisions.

What is a stop raid and why is it important in this strategy?

-A stop raid occurs when a market hits a low or high, triggering stops before the price moves in the anticipated direction. It is important because it marks the point where liquidity is targeted, and understanding it helps traders anticipate the next price move and enter the market with better timing.

What is a market structure shift in trading?

-A market structure shift refers to a change in the price action, typically when a previous high or low is broken. This shift signals a potential change in market direction and is crucial for identifying when a trend is reversing or continuing.

What is the role of an optimal trade entry (OTE) in this strategy?

-The OTE is used to identify a favorable entry point in the market, typically within the discounted area of a price range. It helps refine the entry strategy by showing areas where the risk-to-reward ratio is optimal, ensuring better trade setups.

How are Fair Value Gaps (FVGs) used in this trading strategy?

-Fair Value Gaps are used as key entry points where price tends to fill the gap. Traders look for these gaps as areas of interest for potential reversals or continuations in the market. They can be combined with other models like OTE or order blocks to form a more reliable entry signal.

What is the difference between a fair value gap and an order block?

-A fair value gap is an area on the chart where there is a rapid price movement, leaving an unfilled gap. An order block, on the other hand, is a specific price area where institutional buy or sell orders have previously been placed, acting as a zone of support or resistance.

What does the Box setup refer to in this strategy?

-The Box setup involves identifying a specific price range (often drawn as a box) where the trader expects price to react. This setup is typically used to highlight areas of liquidity and price manipulation, helping traders pinpoint optimal entries when price revisits these levels.

How does the trader balance risk-to-reward in their entries?

-The trader balances risk-to-reward by adjusting their entry point closer to the stop loss, which increases the risk-to-reward ratio. However, they also need to ensure that the trade gets filled, so they aim to find a balance between optimal risk-to-reward and entering the trade in a timely manner.

How does a breaker block function in this strategy?

-A breaker block is a price area where price breaks previous highs or lows in a strong move, often indicating a shift in market sentiment. In this strategy, it’s used as a potential entry point, especially when combined with other tools like Fair Value Gaps or OTE for confirmation.

What is the significance of liquidity in this trading strategy?

-Liquidity plays a critical role in identifying stop raids and market structure shifts. The strategy looks for areas where liquidity is concentrated, such as equal highs or lows, to anticipate potential price movements. These areas often signal where the market will reverse or continue, guiding traders in their entries and exits.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

5.0 / 5 (0 votes)