Lesson 028 - Accounting for Merchandising Operations 2: Transportation

Summary

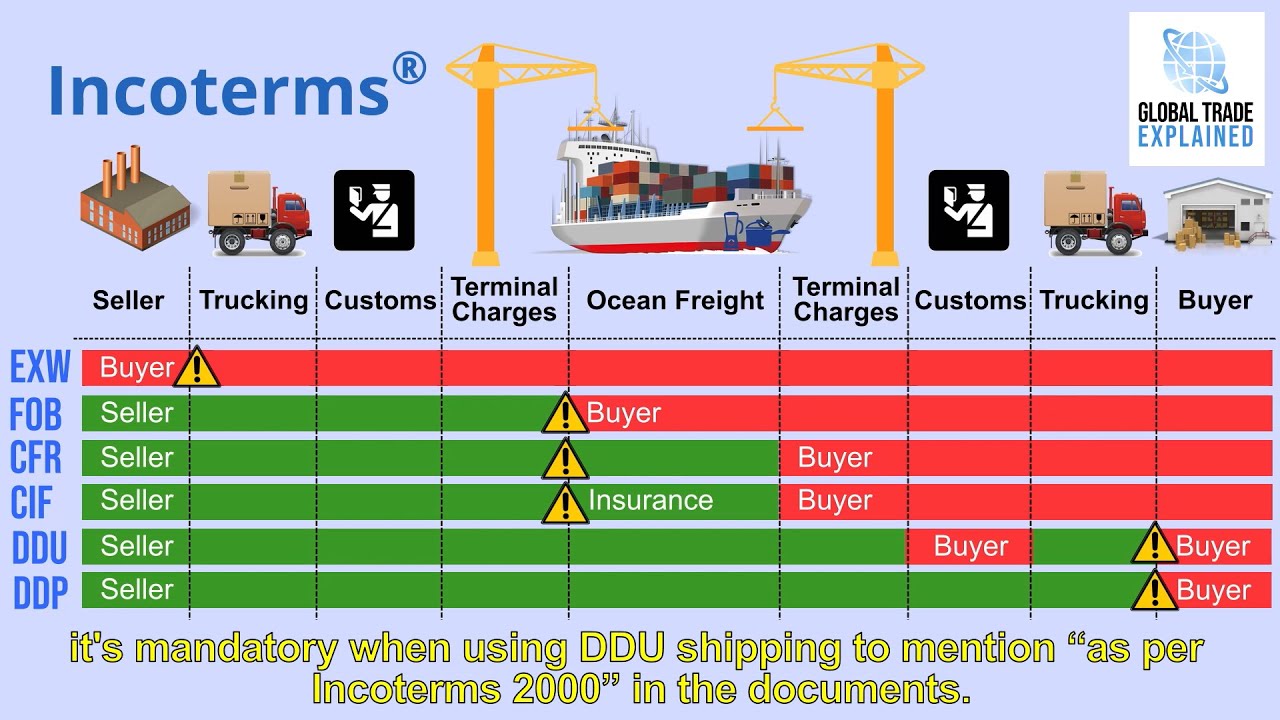

TLDRThis video script delves into the intricacies of merchandise transportation, focusing on key terminologies such as FOB (Free On Board) shipping point and FOB destination, which determine the transfer of ownership in goods. It also covers freight terms like 'freight prepaid' and 'freight collect,' explaining their impact on financial transactions. The script provides examples of accounting entries for purchases and sales, emphasizing the treatment of freight as an operating expense for sellers and an adjunct account for buyers, crucial for inventory valuation and financial reporting.

Takeaways

- 🚢 The video discusses the importance of understanding merchandise transportation in the context of buying and selling goods.

- 📦 Two key terms introduced are 'FOB (Free on Board) Shipping Point' and 'FOB Destination Point', which determine when the ownership of goods passes from seller to buyer.

- 📈 At FOB Shipping Point, the ownership of merchandise transfers to the buyer at the point of transit, while at FOB Destination, it transfers upon delivery to the buyer's doorstep.

- 📅 The script provides scenarios to illustrate the implications of these terms on financial reporting, especially regarding the year-end inventory and ownership.

- 💼 The distinction between 'Freight Prepaid' and 'Freight Collect' is clarified, with the former meaning the seller pays for shipping costs upfront, and the latter that the buyer pays upon receipt.

- 🔍 The video explains that 'Freight In' is an adjunct account to purchases, added to the cost of inventory, and is recorded as an operating expense by the seller.

- 🛒 An example is given where the buyer pays 'Freight In' charges of three thousand on a fifteen thousand purchase, affecting the accounting entries.

- 📊 Another example shows a seller's accounting entries when they sell merchandise with 'Freight Out' charges, which are paid by the seller on behalf of the buyer.

- 📝 The script emphasizes the importance of recording 'Freight In' and 'Freight Out' correctly in the seller's and buyer's financial statements.

- 📚 The video concludes by hinting at the next lesson, which will cover income statement for merchandising operations, suggesting further exploration of accounting for goods transactions.

- 🤔 The video encourages viewers to ask questions in the comments section, indicating an interactive approach to understanding these concepts.

Q & A

What is the main topic of the video transcript?

-The main topic of the video transcript is merchandise transportation, specifically discussing terminologies related to the buying and selling of goods and the recording of transactions.

What are the two key terms introduced in the script that one needs to understand in the context of merchandise transportation?

-The two key terms introduced are 'FOB Shipping Point' and 'FOB Destination Point', which determine when the ownership or title of the merchandise passes to the buyer.

What does FOB stand for and what does it signify in merchandise transactions?

-FOB stands for 'Free On Board'. It signifies the point at which the ownership or title of the merchandise passes from the seller to the buyer during transportation.

How does the ownership of merchandise change hands under FOB Shipping Point?

-Under FOB Shipping Point, the ownership or title in the merchandise passes to the buyer at the point of transit, not when the buyer physically receives the goods.

What happens to the ownership of merchandise under FOB Destination Point?

-Under FOB Destination Point, the ownership or title in the merchandise is only passed to the buyer when the buyer receives the goods at their doorstep.

What are the implications of goods shipped FOB Shipping Point on December 28th and received by the buyer on December 30th, in terms of ownership as of December 31st?

-If goods are shipped FOB Shipping Point on December 28th and received by the buyer on December 30th, the ownership of the goods would have already passed to the buyer by December 31st, regardless of when they were received.

What is the difference between 'Freight Prepaid' and 'Freight Collect' in the context of shipping?

-In 'Freight Prepaid', the seller pays for the freight charges, whereas in 'Freight Collect', the buyer pays for the freight charges.

Why is 'Freight In' considered an adjunct account to purchases?

-'Freight In' is considered an adjunct account to purchases because it represents additional costs incurred to bring the inventory to its present location and condition, and it is added to the cost of inventory.

How is 'Freight In' recorded in the financial statements by the seller?

-'Freight In' is recorded by the seller as an operating expense in the financial statements.

Can you provide an example of how to record a transaction where the buyer pays the freight charges in the seller's books?

-In the seller's books, the transaction would be recorded as a debit to Purchases for the merchandise cost, a debit to Freight In for the freight charges, and a credit to Accounts Payable for the total amount. The seller would also credit Cash for the freight charges paid by the buyer.

What is the next lesson mentioned in the transcript and what will it cover?

-The next lesson mentioned is about the income statement for merchandising operations, which will cover additional topics related to the financial aspects of buying and selling goods.

Outlines

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードMindmap

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードKeywords

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードHighlights

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードTranscripts

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレード5.0 / 5 (0 votes)