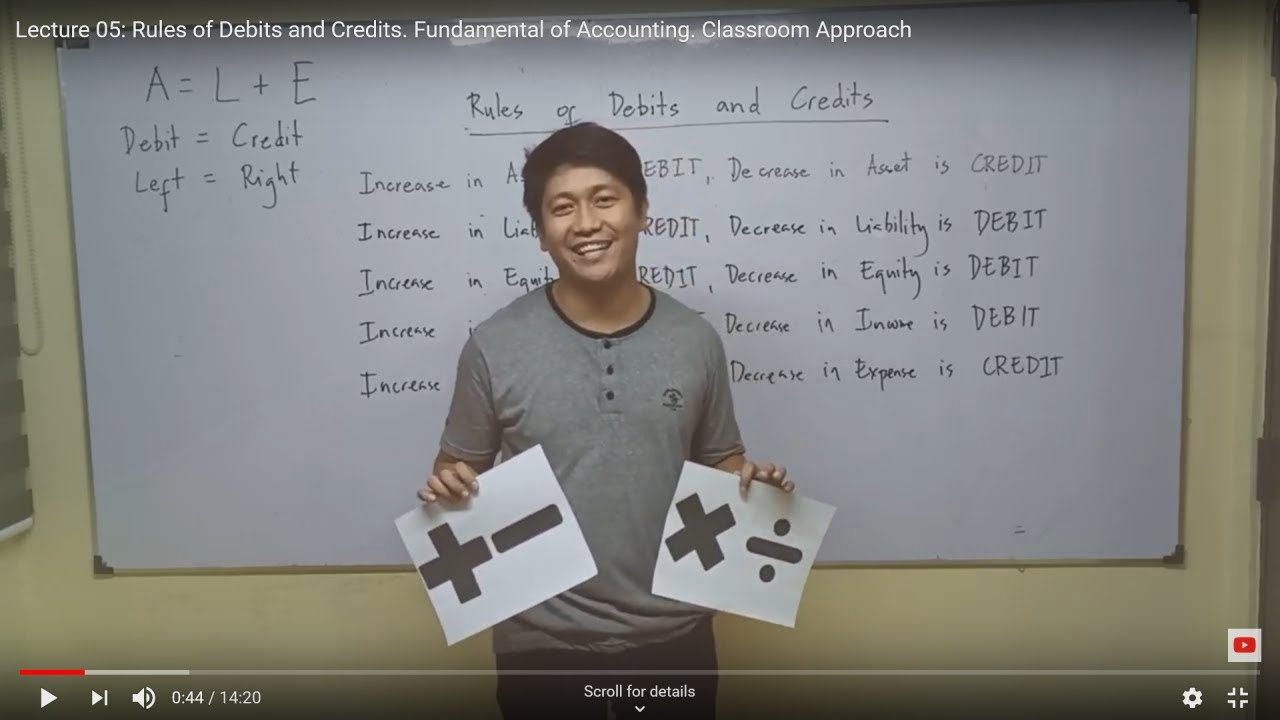

Debits and credits DC ADE LER

Summary

TLDRThis video breaks down the essential concepts of debits and credits in accounting using the mnemonic 'DC ADE LER.' It explains how to remember which accounts increase or decrease with debits or credits. Through step-by-step examples, the video clarifies how assets, liabilities, equity, revenue, and expenses are impacted by transactions. By understanding the accounting equation and journal entries, viewers will not only memorize but also truly comprehend how debits and credits shape financial statements and balance sheets.

Takeaways

- 😀 Debits are recorded on the left side, while credits are recorded on the right side of the ledger.

- 😀 The mnemonic 'DC ADE LER' helps you remember which accounts are increased by debits and credits: Assets, Dividends, Expenses (Debits), and Liabilities, Equity, Revenue (Credits).

- 😀 Assets (A) increase with debits and decrease with credits. Example: Inventory increases with a debit, and decreases with a credit when goods are shipped out.

- 😀 Liabilities (L) increase with credits and decrease with debits. Example: Accounts Payable increases with a credit and decreases with a debit when payments are made to suppliers.

- 😀 Equity (E) increases with credits and decreases with debits. Profits increase equity, and dividends or losses decrease equity.

- 😀 Revenue (R) increases with credits, reflecting the company's earnings from its core activities.

- 😀 Expenses (E) increase with debits, showing the cost incurred by the company in its operations.

- 😀 The accounting equation (Assets = Liabilities + Equity) is central to understanding debits and credits, as it shows the relationship between assets, liabilities, and equity.

- 😀 Every accounting transaction impacts at least two accounts: one is debited, and the other is credited, ensuring the accounting equation stays balanced.

- 😀 Understanding the nature of debits and credits helps avoid merely memorizing, and instead encourages a deeper understanding of how transactions affect company finances.

Q & A

What does the acronym DC ADE LER stand for in accounting?

-DC ADE LER is a mnemonic used to remember the normal balances of accounts in accounting. It stands for: Debit Credit (DC), Assets, Dividends, and Expenses (ADE) on the debit side, and Liabilities, Equity, and Revenue (LER) on the credit side.

What is the normal balance of an asset account?

-The normal balance of an asset account is a debit. Asset accounts increase with debits and decrease with credits.

How does an asset account, like inventory, increase or decrease?

-An asset account like inventory increases with a debit (e.g., when more inventory is received) and decreases with a credit (e.g., when inventory is sold or shipped).

What is the normal balance of a liability account?

-The normal balance of a liability account is a credit. Liability accounts increase with credits and decrease with debits.

Can you explain how accounts payable works with debits and credits?

-Accounts payable is a liability account. It increases with a credit (e.g., when new invoices are received) and decreases with a debit (e.g., when payments are made to suppliers).

What role does equity play in the DC ADE LER framework?

-Equity represents the ownership interest in a company. It is on the credit side of the DC ADE LER framework and increases with credits (e.g., when the company earns revenue or issues shares) and decreases with debits (e.g., when dividends are paid).

What is the normal balance for revenue accounts?

-The normal balance for revenue accounts is a credit. Revenue increases with a credit and directly impacts equity by increasing it.

How do expenses affect equity and what is their normal balance?

-Expenses have a normal balance of a debit. When expenses are incurred, they decrease equity because they reduce profits, which ultimately impacts the shareholders' capital.

What are dividends and how do they affect equity?

-Dividends are distributions of profits to shareholders. They are recorded as debits and reduce equity, as the company is paying out a portion of its earnings.

How can understanding the accounting equation help with debits and credits?

-Understanding the accounting equation (Assets = Liabilities + Equity) is essential for grasping debits and credits. It helps to clarify how transactions impact different accounts, ensuring that debits and credits are balanced in every entry.

Outlines

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードMindmap

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードKeywords

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードHighlights

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードTranscripts

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレード5.0 / 5 (0 votes)