Insurance company

Summary

TLDRThis tutorial walks users through the process of managing insurance companies within a system. It covers adding new insurance companies, defining payment limits, handling claims, and managing approvals. The guide also explains how to generate invoices, track payments, and export data in PDF or Excel formats. Additionally, it demonstrates how to manage multiple branches, add clients, and ensure their policies are correctly handled. Users learn how to send claims and approvals to insurance companies and how to efficiently track and manage all insurance-related operations from the system.

Takeaways

- 😀 You can easily add new insurance companies by entering basic details like the company name, contact information, and coverage start date.

- 😀 The system allows you to specify claim limits and approval requirements for each insurance company, streamlining claim management.

- 😀 Claims that require prior approval can be tracked, and the system ensures that only approved claims are processed through insurance, while others are handled as cash payments.

- 😀 The system allows you to generate detailed reports, including invoices and payment summaries, which can be exported in PDF or Excel format.

- 😀 You can view all claims and payments for a specific insurance company, including outstanding claims and processed payments, from a single dashboard.

- 😀 The system allows for detailed tracking of medical procedures and related claims by categorizing them by operation type and approval status.

- 😀 You can manage multiple insurance companies and their associated claims and payments from the same platform, reducing the need for separate records.

- 😀 Users can track payment status for each claim, ensuring that payments are processed either by the insurance company or as cash payments.

- 😀 For each operation, invoices are generated based on whether the insurance company covers the cost, ensuring accurate billing.

- 😀 The mobile application offers a convenient way to capture and upload claim approvals, allowing users to manage claims while on the go.

- 😀 Monthly and yearly reports can be generated to provide an overview of payments, claims, and operations for better financial tracking.

Q & A

How can I add an insurance company to the system?

-To add an insurance company, click the 'Add Insurance Company' button. Then, enter the company's name, phone number, email address, and the starting month of the insurance policy. You can also define payment limits and set whether claims require approval.

What steps are involved in managing claims for an insurance company?

-To manage claims, access the insurance company profile, view the claims and approvals section, and track their progress. If the claims require approval, make sure to upload the approval documents to the system. You can also generate reports for claims in PDF or Excel format.

Can I handle claims that do not require approval?

-Yes, you can process claims that do not require approval. These claims will be marked as 'cash' and can be paid directly without requiring any approval documentation.

How do I create an invoice for an insurance company?

-To create an invoice, go to the 'Invoices' section, select the type of invoice (insurance or clinic-based), and enter the patient or client details along with the amount. If the invoice is for insurance, make sure to have the necessary approvals before processing the claim.

How do I generate a report for payments made by an insurance company?

-You can generate a payment report by filtering payments based on time (monthly, yearly) and reviewing the status of outstanding or completed payments. Reports can be exported in PDF or Excel format.

What should I do if the payment is processed through cash and not insurance?

-If the payment is processed as cash, you will need to mark the claim accordingly. This ensures that no approval or insurance documentation is required, and the payment is treated as a direct cash transaction.

How can I track the approval status of a claim?

-To track the approval status, visit the 'Claims' section of the insurance company profile. If the claim requires approval, the system will show whether it has been approved or if further documentation is needed.

Can I access the insurance company details and claims using a mobile app?

-Yes, you can access insurance company details, claims, and invoices using the system's mobile app. The app allows you to upload approvals and invoices by taking photos and syncing the data directly with the system.

What is the process for collecting outstanding payments from an insurance company?

-At the end of the month, review all claims and invoices. Consolidate the approvals and amounts for payment. Then, contact the insurance company to collect the outstanding amounts, and generate payment reports for confirmation.

What should I do if I need to make changes to an insurance company’s details?

-You can edit the insurance company's details by selecting the 'Edit' button. You can modify the company’s name, contact information, payment limits, and other details as required.

Outlines

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードMindmap

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードKeywords

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードHighlights

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードTranscripts

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレード関連動画をさらに表示

SAP SD | Introduction to SD module in SAP | Sales & Distribution | SAP ERP

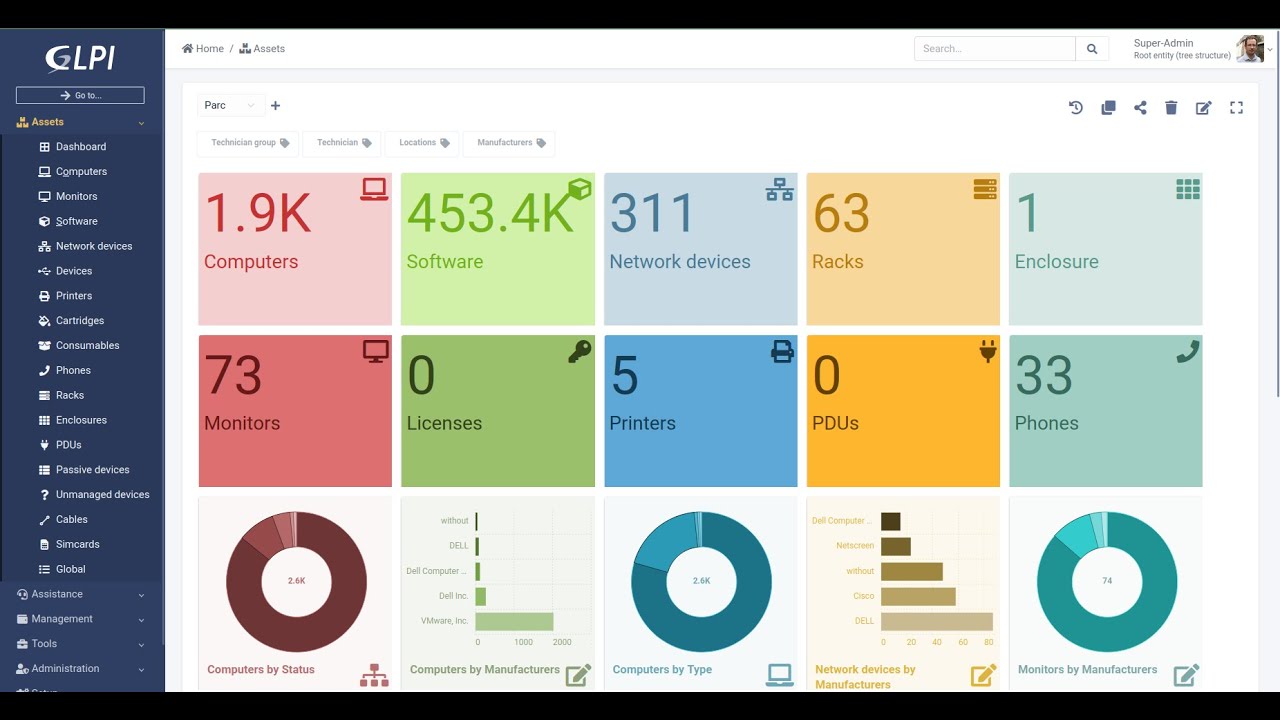

GLPI 10 - Chamados recorrentes

Tutorial Cara Lapor SPT Masa PPN di Coretax di 2025 Status Nihil, Kurang Bayar/LB & Blling PPN

Cara Menginstal Aplikasi GIMP

Shohibul Imami_2201020028 (UTS) Pemrograman Sistem Jaringan Course 10.2

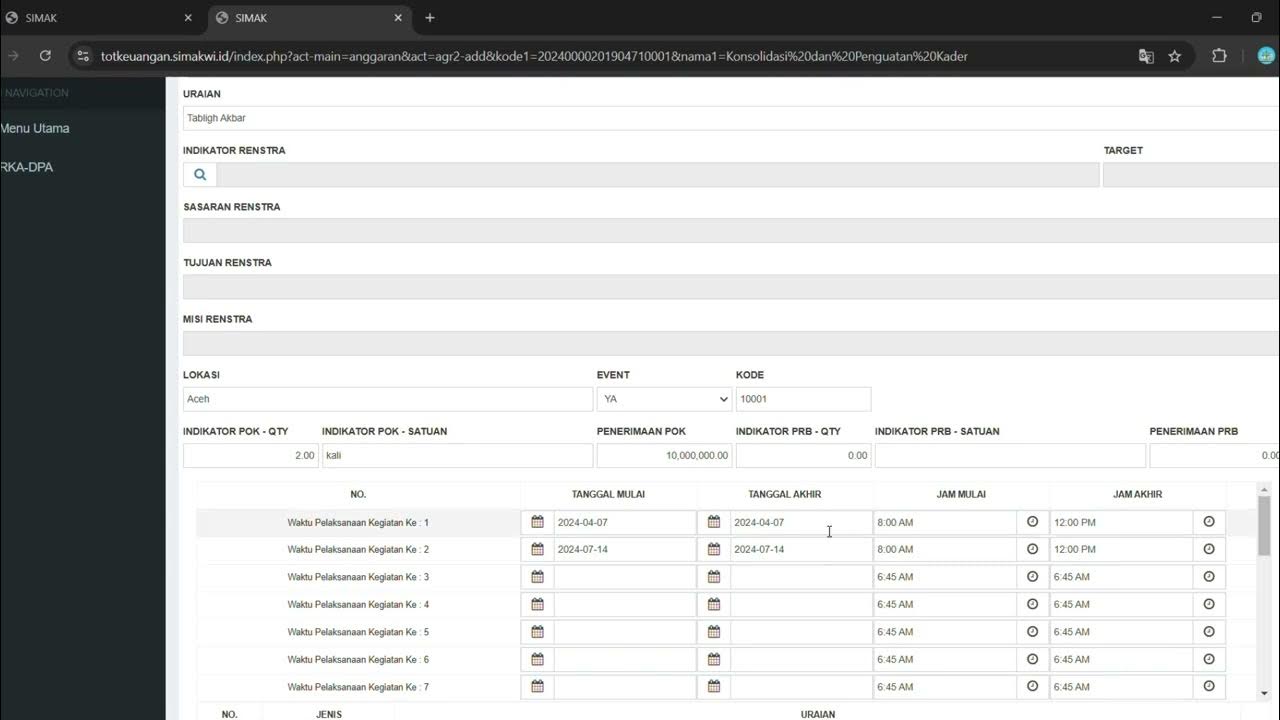

LOGIN SIMAK DAN PENGINPUTAN RKA DAERAH

5.0 / 5 (0 votes)