Tutorial Cara Lapor SPT Masa PPN di Coretax di 2025 Status Nihil, Kurang Bayar/LB & Blling PPN

Summary

TLDRThis video tutorial guides users through the process of reporting the SPT Masa PPN using the Cortex application. It covers essential steps such as logging into the system, ensuring invoices are created and approved, verifying input and output tax, generating the SPT, and checking for underpayment or overpayment. It also walks users through payment options and finalizing the SPT submission. The video emphasizes automation within the Cortex system, aiming to simplify the process for taxpayers. The step-by-step instructions ensure a smooth and accurate SPT filing experience.

Takeaways

- 😀 Ensure to log in to the Cortex application using your PC ID and set your role to 'PKP' or the relevant entity before proceeding.

- 😀 Make sure all invoices for the reporting period (e.g., January 2025) are created and approved in the system to move forward.

- 😀 Check the status of your invoices, ensuring that each has been marked as 'approved' before continuing the process.

- 😀 For any input taxes, verify they are credited correctly in the system and ensure they align with the same tax period as the invoices.

- 😀 If there are missed credits or errors in input taxes, correct them by uploading the invoices and applying credits before proceeding.

- 😀 The system automatically generates the SPT report for the selected tax period, so you do not need to manually create it.

- 😀 Verify that all the data in the SPT report is correct, including sales, tax amounts, and credits. Double-check for completeness.

- 😀 Check the tax calculations to confirm whether you owe more (underpayment) or have paid more (overpayment) than required.

- 😀 If there is an underpayment, proceed with payment; if there's an overpayment, select the compensation or refund option in the system.

- 😀 Once you've reviewed everything, confirm and submit the SPT by filling in the director's password for final approval.

- 😀 After confirming payment, the status of the SPT will automatically update to 'SPT reported' in the system, completing the process.

Q & A

What is the first step in reporting SPT Masa PPN using the Cortex application?

-The first step is to log in to the Cortex application using your PC user ID (or the director's ID) and password. Ensure that the access role is set to 'taxable entity' (PKP) after a successful login.

When can SPT Masa PPN for January 2025 be reported in the Cortex application?

-SPT Masa PPN for January 2025 can be reported starting on February 1, 2025.

What must be done before reporting SPT Masa PPN for a specific period?

-Before reporting, taxpayers must have previously reported the SPT for the prior period, such as the SPT for December 2024, to be eligible for reporting the January 2025 period.

How can a taxpayer ensure that their invoices are ready for reporting?

-Taxpayers must ensure that all VAT output invoices (faktur pajak) for the reporting period have been created and approved. They can check this in the 'E-Faktur' menu under 'Pajak Keluaran' (Output Tax).

What should a taxpayer do if an invoice status is not 'approved'?

-If the invoice status is not 'approved', the taxpayer should select the invoice, check it, and upload it again to ensure it is approved.

What should be done if there is input tax (Pajak Masukan) to be credited?

-The taxpayer should check the 'Pajak Masukan' section, ensure all input tax invoices are listed, select the invoices, and click 'Kreditkan Faktur' (Credit Invoice). A two-way blue arrow will appear to confirm that the crediting process is complete.

How is the SPT generated for a new tax period in the Cortex application?

-The system automatically generates a draft SPT for the new tax period at the beginning of the following month. For example, for January 2025, the draft SPT is generated on February 1, 2025.

What are the key sections to verify in the SPT during the reporting process?

-Taxpayers must verify several sections, including output tax invoices (A2), input tax invoices (B2), sales figures (Item 16), and other relevant values like turnover and VAT.

How should the taxpayer handle underpayment or overpayment of tax?

-If there is underpayment (where output tax exceeds input tax), the taxpayer should check the 'Underpayment' option and proceed with payment. If there is overpayment, they should select 'Refund' or 'Compensate'.

What happens after clicking 'Bayar dan Lapor' (Pay and Report)?

-After clicking 'Bayar dan Lapor', the taxpayer will be prompted to enter the password for the authorized signatory (e.g., the director). Once the password is entered correctly, the SPT status will change to 'Waiting for Payment' or 'Reported'.

What happens if the taxpayer does not receive the billing details for underpayment?

-If the taxpayer does not receive billing details for underpayment, they can check the 'Payments' menu to view the 'Billing Codes Not Paid' section. Afterward, they must proceed with payment as usual.

How is the SPT status updated after payment is made?

-Once the payment is made, the SPT status will automatically change from 'Waiting for Payment' to 'Reported', and the taxpayer can download the final report.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Cara Lapor SPT Masa PPN Lebih Bayar Kompensasi | Tutorial Lengkap

Cara Mudah: Buat Bukti Potong dan Lapor SPT Masa PPh 21/26 dengan e-Bupot (Tutorial Lengkap)

Cara Lapor eBupot Unifikasi Full Lengkap

Tutorial Pengisian e-SPT PPh Pasal 21/26

TERLENGKAP!! Cara Buat Kode Billing dan Lapor SPT PPN Diaplikasi Coretax || Kurang Bayar

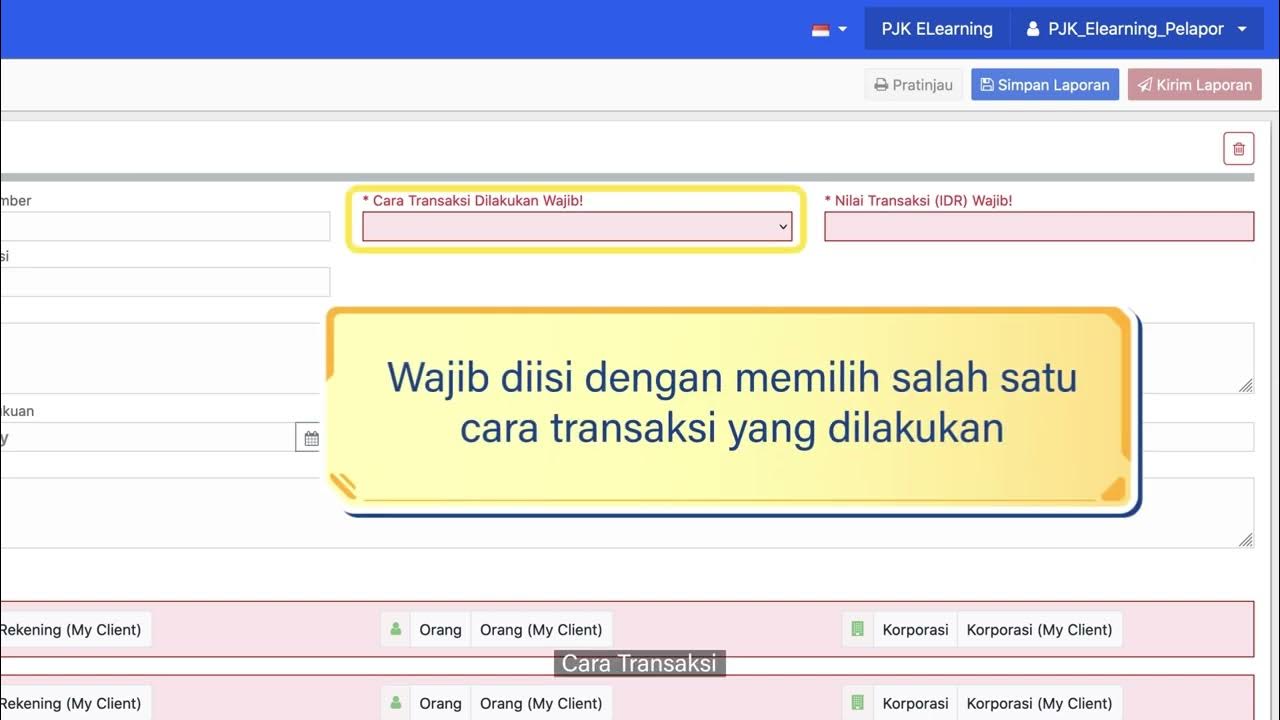

Tata Cara Penyampaian Pelaporan Transaksi Keuangan GoAML bagi Pihak Pelapor

5.0 / 5 (0 votes)