Accounting for Merchandising operation

Summary

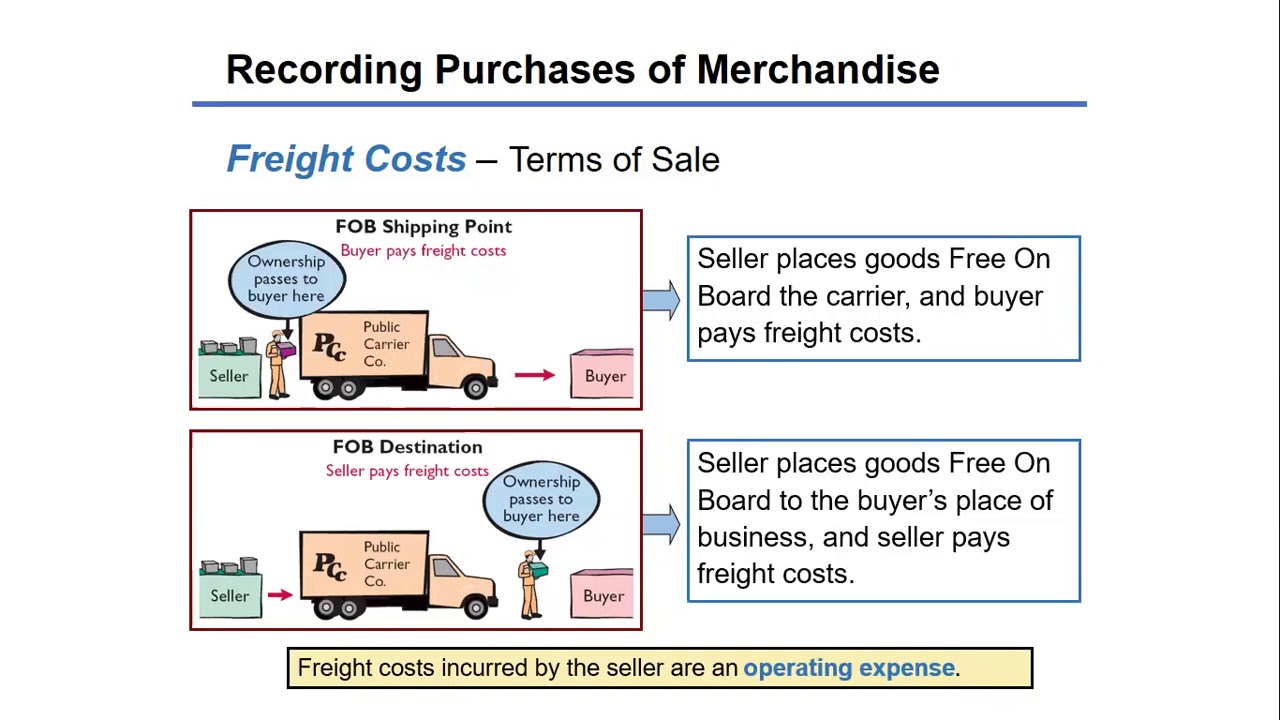

TLDRThis video explains key concepts in financial accounting, focusing on merchandising companies. It covers the differences between service and merchandising businesses, the structure of an income statement, and the operating cycle. The video delves into how inventory is tracked, with comparisons of perpetual and periodic systems, as well as the accounting for purchases, discounts, returns, and transportation costs. It emphasizes the importance of shipping terms like FOB shipping point and FOB destination, highlighting their impact on inventory and cost calculations. The content is aimed at students and professionals looking to master accounting for merchandising companies.

Takeaways

- 😀 Service companies sell their time, skills, and expertise, while merchandising companies sell physical goods like products in supermarkets and retail stores.

- 😀 Merchandising companies have different accounting practices, particularly around inventory, compared to service companies.

- 😀 The operating cycle of a merchandising company involves purchasing inventory, selling it, and collecting payments, with varying cycle lengths depending on the industry.

- 😀 The income statement for merchandising companies includes 'cost of goods sold,' which represents the direct cost of the inventory sold during a period, unlike service companies.

- 😀 Two common inventory systems in merchandising are the perpetual and periodic inventory systems. Perpetual systems offer real-time inventory updates, while periodic systems update records at the end of the accounting period.

- 😀 Cash discounts are provided by sellers to encourage early payment, with common terms like '2/10, net 30' offering a 2% discount if paid within 10 days.

- 😀 Purchase returns and allowances occur when merchandise is returned or a reduction in price is granted due to defective or unacceptable goods.

- 😀 In a perpetual inventory system, discounts on purchases are directly applied to reduce the inventory cost, whereas in periodic systems, the discount is accounted for separately.

- 😀 Shipping terms such as FOB (Free on Board) determine who pays for the shipping costs and bears the risk of loss during transit. FOB shipping point means the buyer takes ownership as soon as the goods are shipped.

- 😀 For FOB shipping point transactions, transportation costs are added to the inventory, while for FOB destination, the seller bears the risk and shipping costs until the goods reach the buyer.

Q & A

What is the key difference between service companies and merchandising companies?

-Service companies provide services, such as legal advice or plumbing, while merchandising companies sell physical goods. Merchandising companies need to account for inventory and its costs in their financial statements.

What is the role of Cost of Goods Sold (COGS) in a merchandising company's income statement?

-COGS represents the direct costs of goods that have been sold during a period. It is subtracted from net sales to determine gross profit. This is a key line item in the income statement for merchandising companies.

What is the difference between the perpetual and periodic inventory systems?

-The perpetual inventory system continuously updates inventory records in real time, tracking every purchase and sale. In contrast, the periodic inventory system only updates inventory at the end of an accounting period, making it less accurate and timely but cheaper to maintain.

How does the operating cycle of a merchandiser affect its financial health?

-The operating cycle involves the purchase, sale, and collection of cash from inventory. A shorter cycle can improve cash flow but may reduce profit margins if the company needs to sell goods quickly at a discount. A longer cycle can mean better profit margins but slower cash flow.

What is the significance of FOB (Free On Board) shipping terms in inventory accounting?

-FOB terms determine when ownership and risk of goods transfer between the buyer and seller. If the terms are FOB Shipping Point, the buyer assumes responsibility and ownership once the goods are shipped. If FOB Destination, the seller retains responsibility until the goods arrive at the buyer’s location.

How do shipping costs affect the cost of inventory under FOB Shipping Point terms?

-Under FOB Shipping Point, the buyer is responsible for shipping costs. These costs are added to the cost of inventory, as the buyer owns the goods once they are shipped and bears the associated risks.

How do purchase returns and allowances affect inventory accounting?

-When goods are returned or allowances are granted due to defects or pricing issues, inventory accounts are adjusted. Purchase returns and allowances reduce the inventory balance and may also affect the accounts payable.

What are the main types of discounts that affect the cost of inventory, and how are they recorded?

-Cash discounts are offered for early payment of invoices, and they reduce the amount owed. These discounts reduce the cost of inventory, and they are recorded by reducing the purchase price of the goods in the inventory account.

What is the impact of transportation costs on inventory under FOB Shipping Point terms?

-Under FOB Shipping Point, the buyer is responsible for transportation costs, which are added to the cost of inventory. This increases the total cost of the inventory purchased.

How would you calculate the total cost of an item purchased with discounts, returns, and transportation costs included?

-To calculate the total cost, you start with the purchase price, subtract any discounts, subtract any returns, and then add transportation costs. For example, if an item costs $1,000, you receive a $10 discount, return $40 worth of goods, and pay $20 in transportation, the total cost would be $870.

Outlines

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードMindmap

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードKeywords

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードHighlights

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードTranscripts

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレード関連動画をさらに表示

Accounting for Merchandising Operations Recording Purchases of Merchandise

Financial Accounting - Lesson 6.1 - Service vs Merchandisers

INVENTORY & COST OF GOODS SOLD

Noções de Contabilidade - Aula 5.1

#Part1 Ch 14 Long Term Payable (Bond Payable) - Akuntansi Keuangan Menengah 2

Materi ke 1 Akuntansi Perusahaan Jasa (Kelas XI Akuntansi)

5.0 / 5 (0 votes)