Noções de Contabilidade - Aula 5.1

Summary

TLDRThis video provides an introduction to accounting concepts, focusing on key financial statements like the Balance Sheet and Income Statement, as outlined in Brazilian Law 6404/76. The discussion covers the structure of these financial statements, including assets (current and non-current) and liabilities (current and non-current). It also explains important accounting principles like liquidity, exigibility, and fiscal year distinctions. Additionally, the video emphasizes the legal requirements for companies to prepare these statements and offers practical insights into how financial data should be presented, including the comparability principle.

Takeaways

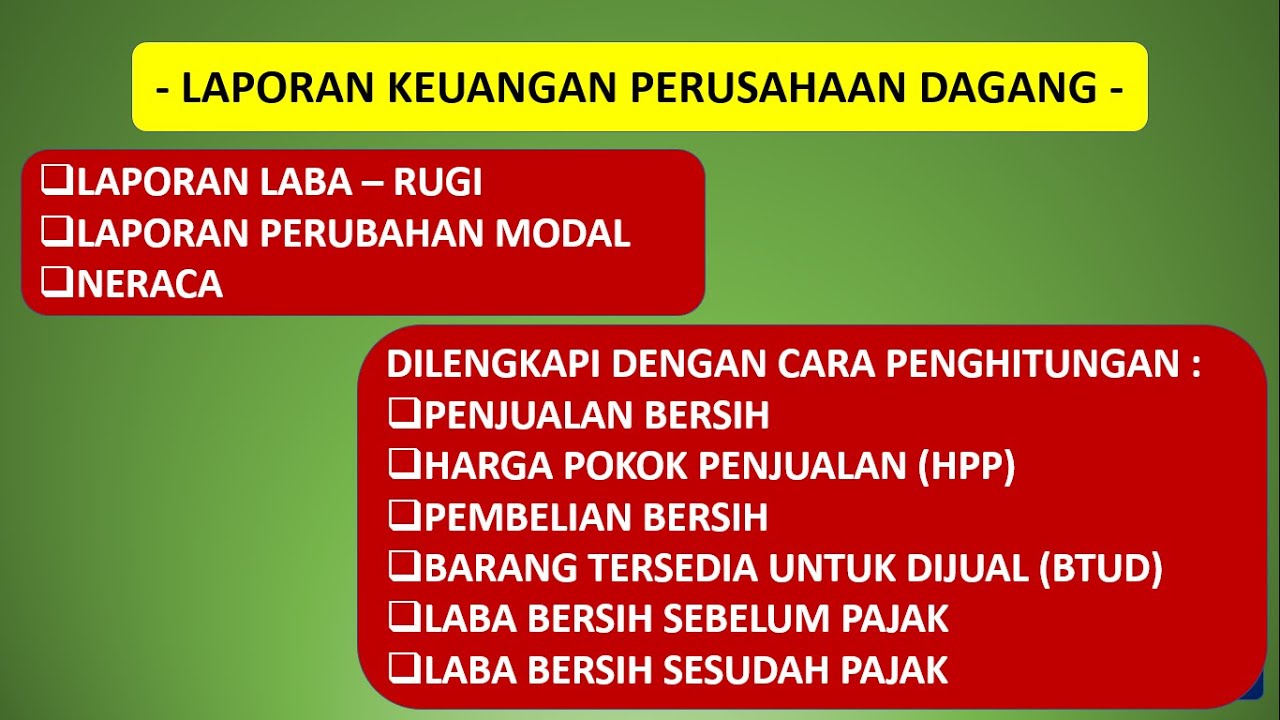

- 😀 The video introduces the subject of accounting, specifically focusing on financial statements, the balance sheet, and the statement of profit and loss (DRE).

- 😀 Key accounting documents discussed include the balance sheet (Balanço Patrimonial), the statement of profit and loss (DRE), and the statement of cash flow (DFC).

- 😀 The balance sheet is designed to show the financial and asset position of a company at a specific moment, classified into assets (active) and liabilities (passive).

- 😀 The statement of profit and loss aims to determine the economic results of a company, showing whether there was a profit or loss during a given period.

- 😀 The video highlights different types of financial statements required by corporate law, such as the balance sheet and profit and loss statement, as mandated by Law No. 6404/76.

- 😀 A company can be exempt from preparing certain statements if it prepares others like the Statement of Changes in Equity (DMPL).

- 😀 Companies with less than 2 million in equity are not required to prepare the statement of cash flow (DFC).

- 😀 Notes to the financial statements (Notas Explicativas) are essential for providing detailed clarification and enhancing understanding of the financial reports.

- 😀 Liquidity and liability are two key concepts in accounting: liquidity refers to how quickly assets can be converted into cash, while liability refers to how quickly obligations need to be paid.

- 😀 The video explains the concept of 'exercise year' (Exercício Social), which may or may not coincide with the civil year (Ano Civil), but it usually lasts for one year.

- 😀 The video provides examples of short-term and long-term financial obligations, clarifying that short-term obligations must be settled within one year, while long-term obligations extend beyond that.

Q & A

What are the main financial statements discussed in the transcript?

-The main financial statements discussed are the Balance Sheet (Balanço Patrimonial) and the Statement of Income (Demonstração do Resultado do Exercício).

What is the purpose of the Balance Sheet?

-The Balance Sheet is designed to present the financial and patrimonial position of the company at a specific point in time, representing a static snapshot of the company's financial health.

What does the Statement of Income aim to achieve?

-The Statement of Income aims to calculate the economic result of a company, showing whether it has made a profit or incurred a loss during a specific period.

What are the two major sections of the Balance Sheet?

-The two major sections of the Balance Sheet are the 'Assets' (Ativo) and the 'Liabilities and Shareholders' Equity' (Passivo e Patrimônio Líquido).

How are assets classified on the Balance Sheet?

-Assets are classified as 'Current Assets' (Ativo Circulante) and 'Non-Current Assets' (Ativo Não Circulante), with further subdivisions based on liquidity.

What is the concept of liquidity in relation to assets?

-Liquidity refers to how quickly and easily assets can be converted into cash. Assets are listed in descending order of liquidity, with cash and cash equivalents at the top and long-term investments at the bottom.

What is the significance of the 'exigibilidade' (degree of liability) in the Balance Sheet?

-Exigibilidade refers to the degree of urgency or the timeframe in which liabilities need to be settled. Like assets, liabilities are also categorized as 'Current Liabilities' (Passivo Circulante) and 'Non-Current Liabilities' (Passivo Não Circulante), based on when they need to be paid.

What are the mandatory financial statements under the Brazilian Corporate Law (Lei 6.404/76)?

-The mandatory financial statements under Brazilian Corporate Law include the Balance Sheet, the Statement of Income, and the Statement of Changes in Equity. Other statements like the Statement of Cash Flows and Statement of Value Added may also be required in certain cases.

What is the difference between the social year (exercício social) and the civil year (ano civil)?

-The social year is a 12-month period determined by the company’s bylaws, while the civil year starts on January 1st and ends on December 31st. The social year can coincide with the civil year but may differ depending on the company's chosen period.

What is the purpose of the notes to the financial statements (notas explicativas)?

-The notes to the financial statements are meant to clarify and expand upon the information presented in the financial statements, providing additional details and explanations to improve understanding.

What is the concept of the 'statement of cash flows' (Demonstração de Fluxo de Caixa), and who is required to prepare it?

-The Statement of Cash Flows provides information on the inflows and outflows of cash within a company, including operating, investing, and financing activities. It is required only for publicly traded companies or those with equity capital exceeding two million reais.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

5.0 / 5 (0 votes)