Pembahasan Contoh Soal Bunga Tunggal

Summary

TLDRIn this tutorial on simple interest, the instructor explains the concept through practical examples. The first example involves Ali saving 2 million IDR in a bank with a 6% annual interest rate, and the instructor calculates the duration of his savings. The second and third examples focus on loan repayment calculations, one with a 2% monthly interest rate and the other with a 1.5% rate, explaining how to determine monthly installments. Throughout, the lesson emphasizes understanding interest calculation formulas and applying them to real-life financial scenarios.

Takeaways

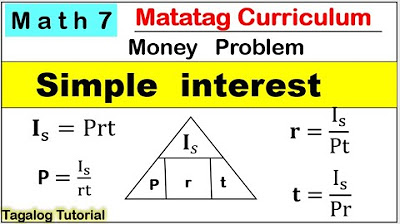

- 😀 Simple interest is calculated using the formula: Interest = Principal × Rate × Time.

- 😀 In Example 1, Ali deposits 2 million with a 6% annual interest rate, and the time for the deposit to grow to 2,080,000 is calculated as 8 months.

- 😀 Interest is the difference between the final amount and the initial deposit, helping to calculate how much extra money is earned over time.

- 😀 In Example 2, Pak Alan borrows 2 million with a 2% monthly interest rate, and the total monthly repayment is calculated by adding the interest to the principal.

- 😀 Monthly repayments can be calculated by dividing the loan amount by the loan duration and then adding the interest.

- 😀 In Example 3, a cooperative loan of 6 million is taken with a 1.5% monthly interest rate, and the monthly repayment is calculated by adding the interest to the principal.

- 😀 The rate of interest is crucial in determining how much extra money is added to the loan or deposit over time.

- 😀 To calculate monthly repayments, divide the total principal by the loan duration (in months), then add the monthly interest to the repayment amount.

- 😀 Simple interest involves straightforward calculations with fixed interest percentages, which make it easy to calculate the interest amount and the time required for a specific growth of the investment.

- 😀 The calculations in the examples demonstrate the basic concept of interest over time, both for savings and loans, and how different rates and durations affect the final amounts.

Q & A

What is the formula used to calculate simple interest?

-The formula for simple interest is: Interest = Principal × Rate × Time.

How is the total interest amount calculated in the first example?

-In the first example, the total interest is calculated by subtracting the initial deposit (2 million Rupiah) from the final amount (2.08 million Rupiah). The interest is therefore 80,000 Rupiah.

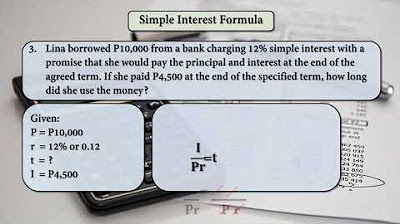

How do you determine the time for which Ali deposited his money in the first example?

-To determine the time, the formula used is: Interest = Principal × Rate × Time. By rearranging, we get Time = Interest / (Principal × Rate). Using the values, we find that the time is 8 months.

Why is the percentage rate for interest in the first example represented as 6/100?

-The percentage rate is expressed as a decimal in the calculation, so 6% becomes 6/100 (which equals 0.06) to be used in the formula.

In the second example, how is the monthly interest calculated?

-The monthly interest is calculated by multiplying the principal (2 million Rupiah) by the monthly interest rate (2%), resulting in a monthly interest of 40,000 Rupiah.

How is the monthly installment calculated in the second example?

-The monthly installment is calculated by dividing the total loan amount (2 million Rupiah) by the number of months (5 months), which results in an installment of 400,000 Rupiah.

What is the total monthly installment to be paid in the second example, and how is it calculated?

-The total monthly installment is the sum of the principal installment (400,000 Rupiah) and the interest (40,000 Rupiah), resulting in a total monthly payment of 440,000 Rupiah.

In the third example, how is the interest for the loan of 6 million Rupiah calculated?

-The interest is calculated by multiplying the principal (6 million Rupiah) by the interest rate (1.5%) per month, resulting in a monthly interest of 90,000 Rupiah.

How is the principal installment calculated in the third example?

-The principal installment is calculated by dividing the loan amount (6 million Rupiah) by the loan duration (12 months), which gives a monthly installment of 500,000 Rupiah.

What is the total monthly payment in the third example?

-The total monthly payment is the sum of the principal installment (500,000 Rupiah) and the interest (90,000 Rupiah), which results in a total of 590,000 Rupiah.

Outlines

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantMindmap

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantKeywords

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantHighlights

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantTranscripts

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantVoir Plus de Vidéos Connexes

Aula 74 - Paralisação - Juros e Juros Simples (1ª série)

JUROS SIMPLES: Teoria e Exemplos | Matemática Básica - Aula 30

MATH 7 Solving simple interest week 5 #matatag #matatagcurriculum #simpleinterest #solvinginterest

Kelas XI - Matematika Keuangan Part 1 - Bunga Tunggal dan Bunga Majemuk

Bunga Tunggal

Mathematics of Investment - Simple Interest - Simple Interest Formula (Topic 1)

5.0 / 5 (0 votes)