Bunga Tunggal

Summary

TLDRThis educational script explains the concept of simple interest (bunga tunggal) in banking, focusing on its role in deposit and loan systems. It covers the definition, calculation formulas, and practical examples of simple interest, showing how interest is added to the principal amount over time. The script also provides examples of how interest is calculated annually and how it impacts investments. Key formulas are introduced, including the formula for calculating the final amount (M) after interest is applied. The lesson aims to help students understand how simple interest works in real-life financial scenarios.

Takeaways

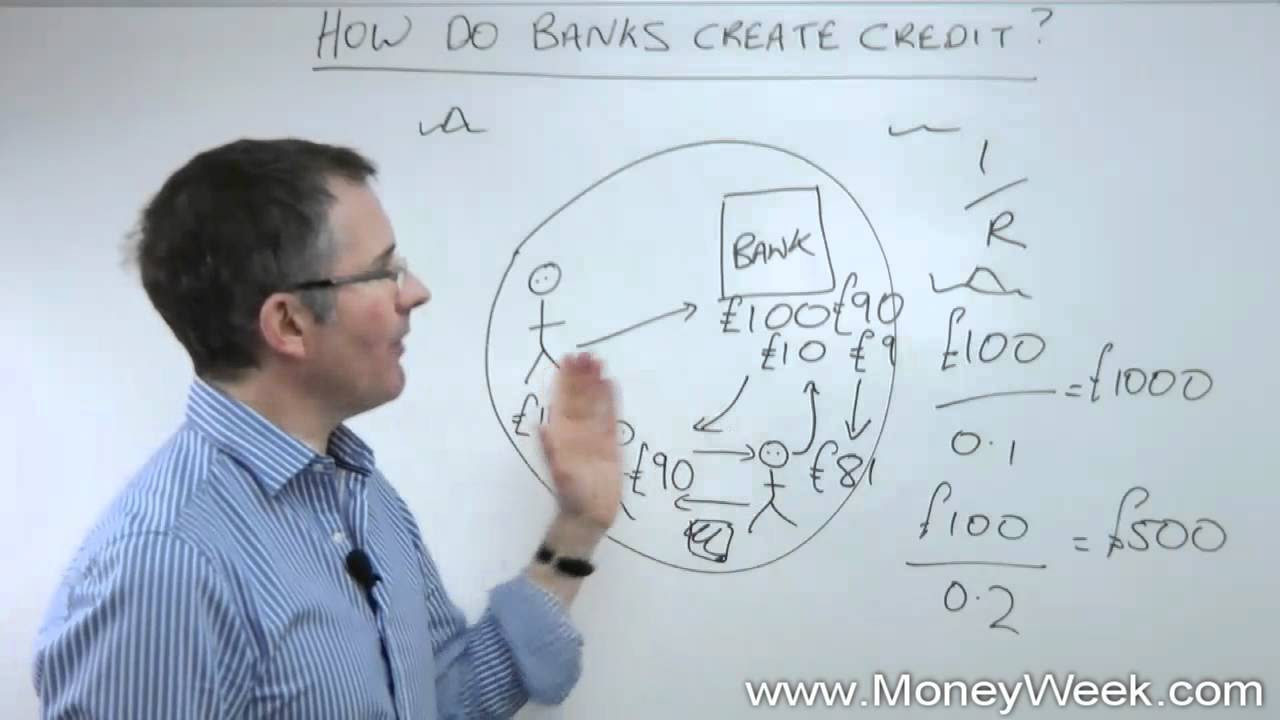

- 😀 Interest is a payment for using borrowed money or a reward for depositing money in the bank.

- 😀 Simple interest is calculated only on the initial principal amount and does not affect the principal over time.

- 😀 Deposit interest (Bunga Simpanan) is the interest paid by banks to those who deposit money.

- 😀 Loan interest (Bunga Pinjaman) is the interest charged by banks to those who borrow money.

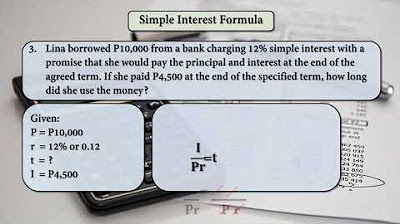

- 😀 Simple interest is calculated using the formula: Interest = Principal × Interest Rate × Time.

- 😀 The final amount after simple interest can be calculated as: Final Amount = Principal + Interest.

- 😀 The formula for simple interest can be adapted to determine the final amount after a given period.

- 😀 Simple interest calculations can be broken down into multiple periods (e.g., yearly, monthly).

- 😀 A worked example showed that a deposit of Rp1,500,000 with a 4% interest rate for 3 years results in Rp1,680,000.

- 😀 Another example illustrated calculating the interest rate when an initial investment of Rp20,000,000 grows by Rp960,000 after 4 years, resulting in a 1.2% interest rate.

- 😀 There are multiple methods to solve simple interest problems, including direct calculation or using proportional relationships.

Q & A

What is interest (bunga) in financial terms?

-Interest is the fee or payment made for borrowing money or the reward for saving money. It is calculated based on the principal amount, the interest rate, and the duration of the loan or deposit.

What is the difference between savings interest and loan interest?

-Savings interest is the reward paid by a bank to individuals who deposit their money, while loan interest is the fee charged by the bank to those who borrow money.

How is interest calculated for simple interest (bunga tunggal)?

-Simple interest is calculated using the formula: Interest = Principal × Interest Rate × Time. The final amount after interest is: Final Amount = Principal + Interest.

What does 'suku bunga' represent in the context of the lesson?

-'Suku bunga' refers to the interest rate, which is expressed as a percentage. It is used to calculate the amount of interest earned or owed based on the principal and the time period.

How can you calculate the final amount of a deposit with simple interest?

-The final amount of a deposit with simple interest can be calculated using the formula: Final Amount (MN) = Principal × (1 + n × Interest Rate), where 'n' is the number of periods (years or months).

What is the formula to calculate the interest in simple interest?

-The formula for calculating interest in simple interest is: Interest = Principal × Interest Rate × Time.

In the example with Rp1,500,000 and 4% interest for 3 years, what is the final amount after 3 years?

-The final amount after 3 years is Rp1,680,000. This is calculated as: 1,500,000 × (1 + 3 × 0.04) = 1,500,000 × 1.12 = 1,680,000.

In the example of an investment of Rp20,000,000 that grows to Rp960,000 after 4 years, how do you find the interest rate?

-The interest rate can be found by solving the equation: 960,000 = 20,000,000 × (1 + 4i). After simplifying, the interest rate is found to be 1.2%.

What is the main difference between the two methods shown for calculating the interest rate in the second example?

-The two methods are: 1) Directly solving the equation for interest, and 2) Dividing the final amount by the initial principal and subtracting 1 to find the interest rate. Both methods lead to the same result, but the approach may vary depending on the user's preference.

Why is simple interest not considered as compounding interest?

-Simple interest is not compounding because it is calculated only on the original principal amount, and does not accrue interest on the interest earned over time.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

5.0 / 5 (0 votes)