What is GST? What Are The Types Of GST? Basics Of GST Lecture 1 By CA Rachana Ranade

Summary

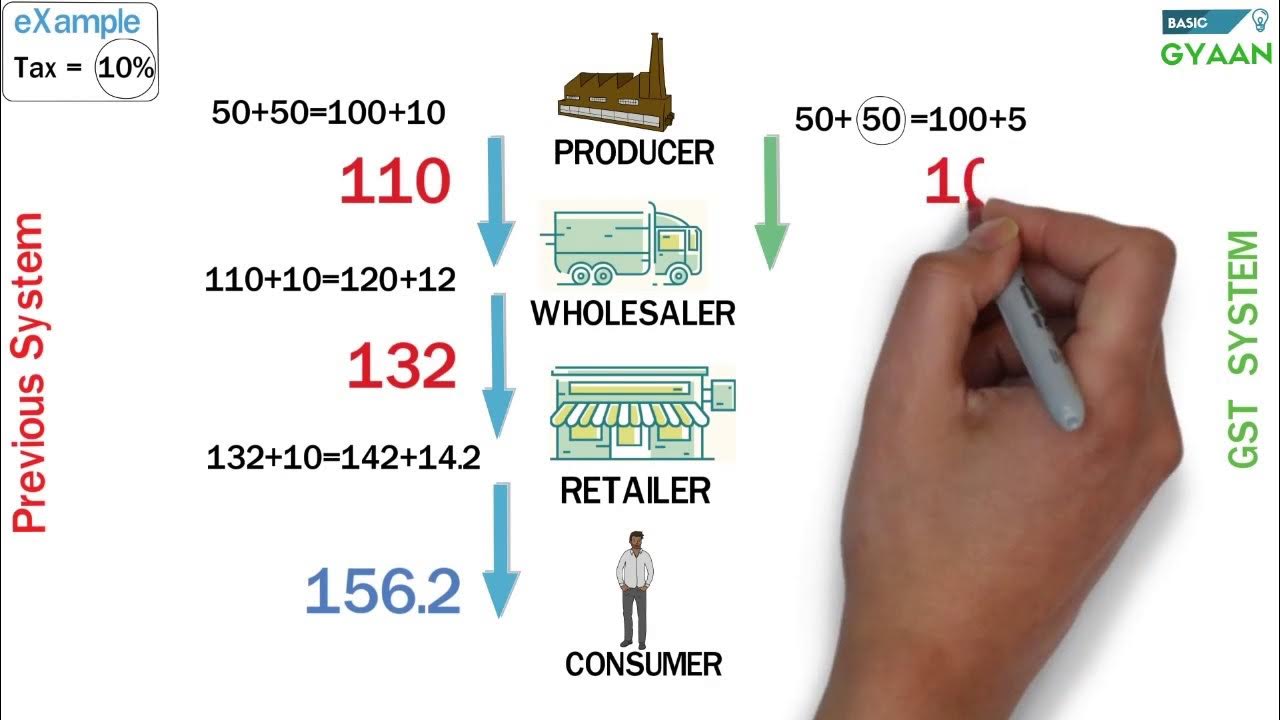

TLDRIn this video, the presenter introduces the Goods and Services Tax (GST) system, breaking down its components and how it works for both consumers and businesses. The video explains GST’s structure with Central GST (CGST), State GST (SGST), and Integrated GST (IGST), and gives practical examples of when and how these taxes apply. The presenter also covers GST registration requirements and the process of filing GST returns using QuickBooks, a tool that simplifies accounting for small businesses. The video emphasizes the importance of understanding GST basics for entrepreneurs, businesses, and students.

Takeaways

- 😀 GST (Goods and Services Tax) is a unified tax system that replaced multiple previous taxes like excise, service tax, and customs in India.

- 😀 GST is divided into three components: CGST (Central GST), SGST (State GST), and IGST (Integrated GST), each applied depending on the type of sale (within or outside the state).

- 😀 For intra-state sales (same state), both CGST and SGST are charged, while for inter-state sales (different states), IGST is applied.

- 😀 GST simplifies the tax structure and aims to promote 'One Nation, One Tax', but there are still misconceptions around it, especially regarding the multiple components.

- 😀 Every business with a turnover exceeding ₹40 lakh is required to register for GST, except for online sellers who must register regardless of their turnover.

- 😀 GST registration is mandatory for businesses selling online, even if they have minimal turnover (₹1 or more).

- 😀 GST R1 is the form used to report sales and the GST collected from customers, while GST R3B is used to calculate and pay tax liabilities.

- 😀 GST credit allows businesses to offset the GST paid on purchases against the GST collected from sales, reducing the overall tax burden.

- 😀 QuickBooks simplifies GST filing by automating the generation of GST R1 and R3B forms, helping businesses and accountants save time and reduce errors.

- 😀 QuickBooks provides real-time access to financial data from anywhere and helps businesses track their GST filings, manage clients, and generate various reports.

- 😀 QuickBooks also allows users to automate bank reconciliation, set permissions for staff members, and assign tasks with deadlines to improve team productivity.

Q & A

What does GST stand for, and why was it introduced in India?

-GST stands for Goods and Services Tax. It was introduced in India to simplify the complex tax structure that existed before, replacing various taxes like excise, service tax, and customs duties with a single unified tax system. The aim was to create a 'One Nation, One Tax' system to ease compliance and reduce the tax burden.

What are the three major components of GST?

-The three major components of GST are: CGST (Central Goods and Services Tax), SGST (State Goods and Services Tax), and IGST (Integrated Goods and Services Tax). CGST is collected by the central government, SGST is collected by the state government, and IGST is levied when goods and services are sold across state lines.

How is GST applied in intra-state and inter-state sales?

-In intra-state sales, GST is divided equally between CGST and SGST. For example, if a sale happens within the same state, both central and state governments receive their respective portions of the tax. In inter-state sales, IGST is charged instead of CGST and SGST, and the total tax rate is generally the same as that for intra-state sales.

What is the difference between CGST, SGST, and IGST?

-CGST and SGST apply when goods or services are sold within the same state. The tax is split between the central government (CGST) and the state government (SGST). IGST applies when goods or services are sold across state lines and is collected by the central government before being distributed to the respective state.

Is it necessary for all businesses to register under GST?

-No, not all businesses are required to register for GST. Only businesses whose turnover exceeds ₹40 lakhs (for most states) are required to register. However, businesses selling goods online must register for GST regardless of their turnover, making it mandatory for online sellers.

What happens if a person exceeds the GST registration threshold?

-Once a business exceeds the threshold turnover of ₹40 lakhs, it is required to register under GST and collect tax from customers. The business must then file GST returns regularly and pay the taxes it collects to the government.

What are GST R1 and GST R3B forms used for?

-GST R1 is used by businesses to report details of sales and services rendered, including the amount of tax collected. GST R3B is used for filing the GST return, where businesses calculate their total tax liability by subtracting the input tax credits (ITC) they are eligible for from the tax collected from customers.

What is the concept of Input Tax Credit (ITC) in GST?

-Input Tax Credit (ITC) allows businesses to offset the GST they paid on purchases against the GST they collected on sales. For example, if a business pays ₹8 GST when purchasing goods and collects ₹18 GST from customers, it only needs to pay ₹10 GST to the government, after deducting the input tax credit.

What is the turnover threshold for mandatory GST registration for online sellers?

-For online sellers, GST registration is mandatory regardless of their turnover. Even if the business has a turnover of just ₹1, selling goods or services online necessitates registration under GST.

What are some key features of QuickBooks mentioned in the video?

-Some key features of QuickBooks include real-time data access from any device, the ability to assign tasks and track deadlines for team members, seamless integration with bank accounts for automatic reconciliation, generation of customized reports like P&L and balance sheets, and easy management of multiple clients and their documents.

Outlines

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantMindmap

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantKeywords

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantHighlights

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantTranscripts

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantVoir Plus de Vidéos Connexes

Goods and Services Tax (GST) (Part-1) - Simplified | Drishti IAS English

GST Easy Explanation (Hindi)

GST Explained In Telugu - Complete Details About GST In Telugu | Advantages Of GST | @KowshikMaridi

Understand GST in 10 minutes

1. Concept of Indirect Taxes - Introduction | GST Lecture 1 | CA Raj K Agrawal

Session 5 - 08 What is a BAS

5.0 / 5 (0 votes)