Bunga Tunggal dan Bunga Majemuk

Summary

TLDRThis educational video introduces the concepts of simple and compound interest, emphasizing their relevance in financial literacy and Islamic finance. The speaker explains how simple interest is calculated solely on the principal amount, while compound interest builds on both the principal and previously accrued interest. Using a practical example involving an Islamic investment product called sukuk, the video illustrates the calculation differences over time. The importance of adhering to Sharia principles is highlighted, stressing the avoidance of riba in financial dealings. Overall, the content aims to equip viewers with essential knowledge for informed financial decision-making.

Takeaways

- 😀 Simple interest is calculated based solely on the principal amount for the entire duration of the investment.

- 😀 Compound interest takes into account both the principal and the accumulated interest from previous periods, leading to potentially higher returns.

- 📈 The formula for simple interest is A = P(1 + r * t), where A is the total amount, P is the principal, r is the interest rate, and t is the time in years.

- 💰 The compound interest formula is A = P(1 + r)^n, where n represents the number of compounding periods.

- 💡 Understanding the differences between simple and compound interest is essential for making informed investment decisions.

- 🏦 The example of sukuk (Islamic bonds) illustrates how these interest types affect the returns on an investment over time.

- ⏳ In the example, investing 10 million rupiah at a 6.05% interest rate demonstrates the advantages of compound interest over time.

- ⚖️ Islamic finance prohibits riba (usury), making it crucial for Muslims to choose financial products that comply with Sharia law.

- 🔍 The lesson emphasizes the importance of ethical compliance over simply maximizing financial returns.

- 🌟 The speaker encourages saving and prudent financial management, aligning with Islamic teachings on responsible money handling.

Q & A

What are the two types of interest discussed in the video?

-The two types of interest discussed are simple interest and compound interest. Simple interest is calculated only on the principal amount, while compound interest is calculated on the principal plus any previously earned interest.

What is the significance of sukuk in Indonesia?

-Sukuk are Islamic financial certificates issued by the government to finance the national budget (APBN) and infrastructure projects in Indonesia, such as hajj dormitories and toll roads.

How is the interest calculated for simple interest?

-For simple interest, the interest is a fixed percentage of the principal amount throughout the investment period. In the example given, an initial investment of 10 million IDR would earn 6.05% annually.

What makes compound interest more advantageous compared to simple interest?

-Compound interest is more advantageous because it earns interest on both the initial principal and the accumulated interest from previous periods, leading to potentially higher returns over time.

How does the formula for compound interest differ from that of simple interest?

-The formula for simple interest is: Final Amount = Principal x (1 + (Rate x Time)). For compound interest, it is: Final Amount = Principal x (1 + Rate)^Time, where 'Rate' is expressed as a decimal.

What is the potential risk associated with compound interest mentioned in the video?

-The video mentions that compound interest can be detrimental when it comes to debt. If someone is in debt, the amount owed can increase significantly over time due to accumulating interest.

What did the speaker emphasize regarding financial products and Sharia compliance?

-The speaker emphasized the importance of ensuring that financial products are free from 'riba' (usury) and comply with Islamic law, as it is prohibited in Islam.

What role do educational videos play according to the speaker?

-Educational videos are designed to enhance understanding of financial concepts, helping viewers identify and differentiate between various types of interest and their implications.

What advice does the speaker give regarding saving and investing?

-The speaker encourages saving a portion of one's wealth for future goodness and emphasizes the benefits of using savings for investment or future needs.

What Quranic verse is mentioned in relation to riba and zakat?

-The video references a verse from the Quran (Surah Ar-Rum, Ayat 39) discussing that increasing wealth through riba does not benefit in the eyes of Allah, while giving zakat for His pleasure multiplies rewards.

Outlines

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantMindmap

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantKeywords

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantHighlights

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantTranscripts

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantVoir Plus de Vidéos Connexes

Bunga majemuk dan anuitas kelas XI | Matematika

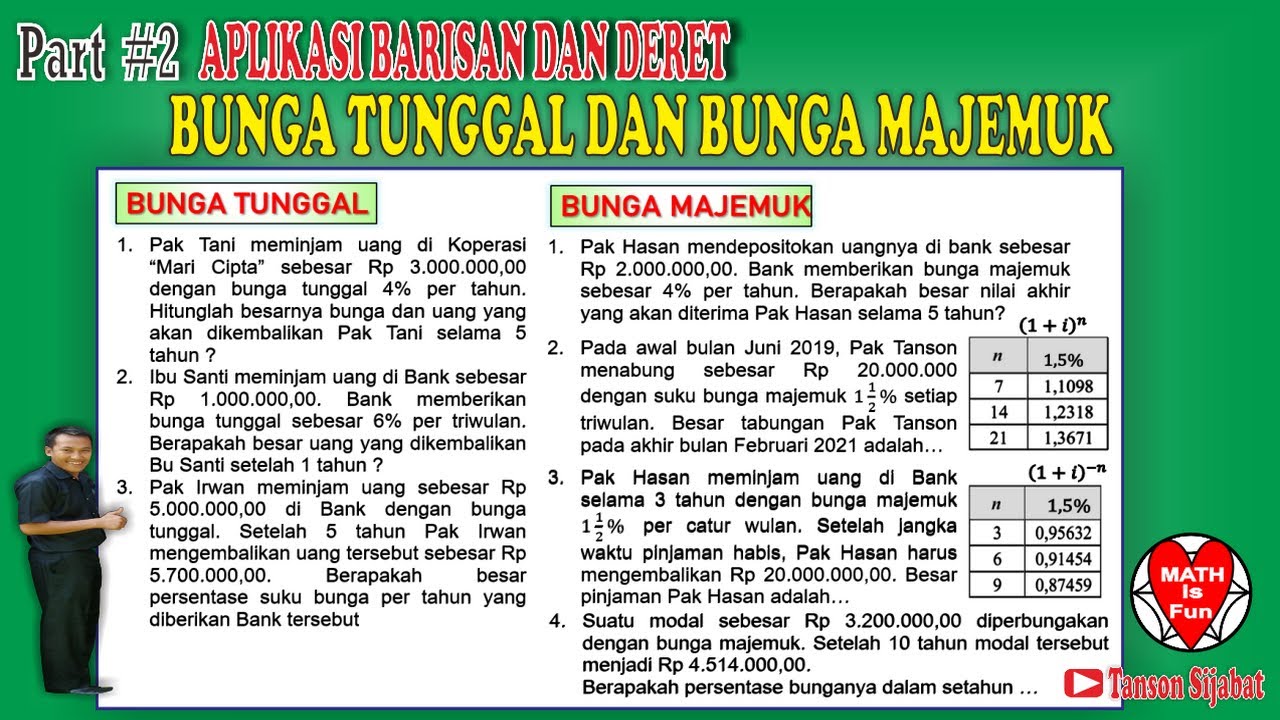

BUNGA TUNGGAL DAN BUNGA MAJEMUK

Matemática em toda parte - Matemática nas finanças

LESSON 5: Compound Interest (Finding for the Principal, Future Value, and Time)

Kelas XI - Matematika Keuangan Part 1 - Bunga Tunggal dan Bunga Majemuk

Aptitude Preparation for Campus Placements #10 | Simple Interest | Quantitative Aptitude

5.0 / 5 (0 votes)