Bunga majemuk dan anuitas kelas XI | Matematika

Summary

TLDRThis educational video explains key financial concepts: simple interest, compound interest, and annuities. It covers how to calculate simple interest, where interest is earned only on the principal, and compound interest, where interest is earned on both principal and accumulated interest. The video also dives into annuities, highlighting regular payments of both principal and interest, commonly used in loans. Through detailed examples, viewers learn to apply formulas to solve problems involving savings, investments, and loans, providing practical insights into personal finance and lending calculations.

Takeaways

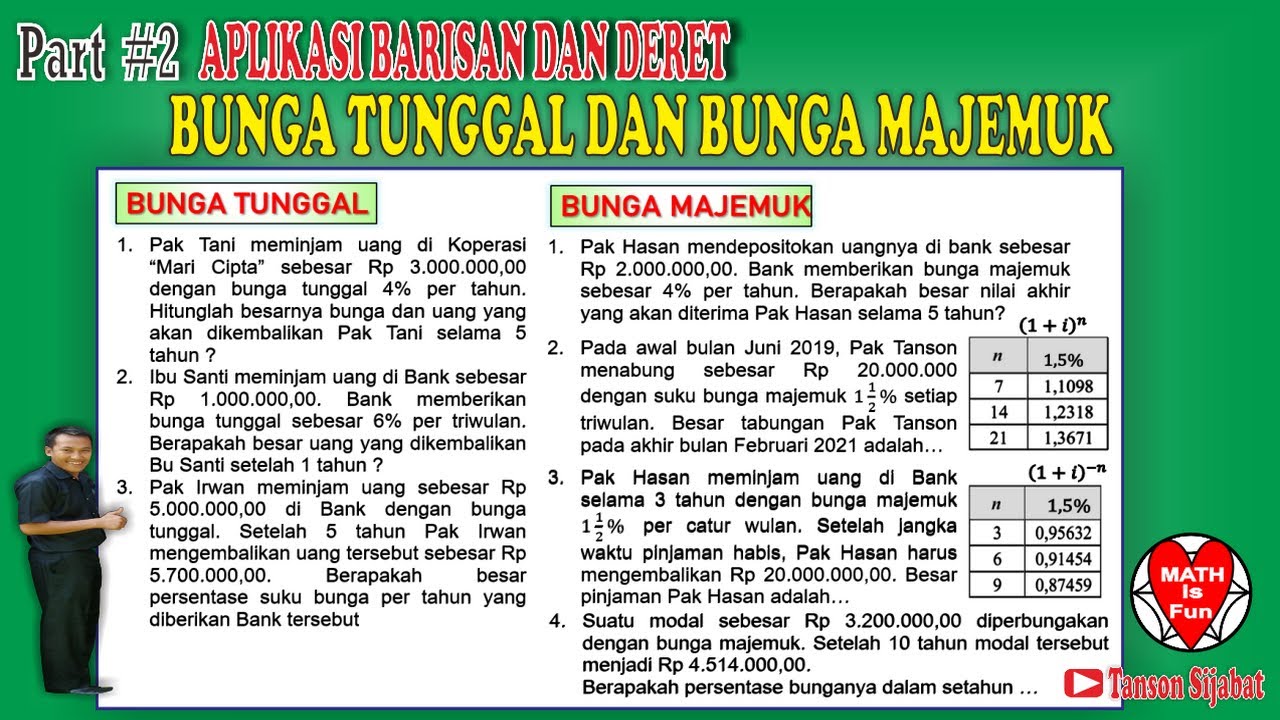

- 😀 Simple interest is calculated only on the initial principal amount, with no interest earned on interest.

- 😀 The formula for calculating simple interest is: BN = n * i * m, where BN is the interest, n is the number of periods, i is the interest rate, and m is the principal amount.

- 😀 The total amount with simple interest can be calculated as: MA = m + BN, or MA = m * (1 + n * i).

- 😀 Compound interest is calculated on both the initial principal and the accumulated interest, meaning the interest 'compounds'.

- 😀 The formula for calculating compound interest is: BN = m * (1 + i)^n - m, where BN is the interest, i is the interest rate, n is the number of periods, and m is the principal amount.

- 😀 The total amount with compound interest is calculated as: MA = m * (1 + i)^n.

- 😀 Simple interest results in a linear increase in the total amount over time, while compound interest grows exponentially.

- 😀 Annuities are equal, regular payments made over a period of time, commonly used for loans or investments.

- 😀 The formula for calculating an annuity payment is: A = m * i / (1 + i^n - 1), where A is the payment, m is the loan amount, i is the interest rate, and n is the number of periods.

- 😀 In an annuity, the principal portion of each payment increases over time, while the interest portion decreases.

- 😀 Banks and financial institutions use annuity formulas to determine monthly loan payments, like in the case of car loans and mortgages.

Q & A

What is simple interest (bunga tunggal)?

-Simple interest is the interest calculated only on the initial principal, not on the accumulated interest. The formula to calculate simple interest is BN = n * i * m, where n is the number of periods, i is the interest rate, and m is the initial amount.

How do you calculate the final amount for simple interest?

-To calculate the final amount in simple interest, use the formula: Ma = M + BN, where M is the principal amount and BN is the calculated interest. Alternatively, you can use Ma = M * (1 + n * i), where n is the number of periods, and i is the interest rate.

What is compound interest (bunga majemuk)?

-Compound interest is interest calculated on both the principal and the accumulated interest from previous periods. Unlike simple interest, compound interest 'compounds' over time, meaning the interest earned adds to the principal for the next calculation.

How do you calculate compound interest?

-To calculate compound interest, use the formula: BN = m * (1 + i)^n - 1, where m is the initial amount, i is the interest rate, and n is the number of periods. The final amount can be calculated using Ma = M * (1 + i)^n.

In the example of Agus, how is the interest calculated using simple interest?

-In Agus's case, if he deposits Rp1,000,000 at 5% simple interest for 3 years, the interest is calculated as BN = 3 * 0.05 * 1,000,000, which equals Rp150,000. The final amount is then Rp1,150,000 (1,000,000 + 150,000).

What is the main difference between simple and compound interest?

-The key difference is that in simple interest, interest is calculated only on the principal amount, while in compound interest, interest is calculated on both the principal and any accumulated interest from previous periods.

How do you calculate the final amount using compound interest?

-To calculate the final amount using compound interest, you apply the formula Ma = M * (1 + i)^n, where M is the initial deposit, i is the interest rate per period, and n is the number of periods.

In the example of Dani's deposit, how much interest does he earn after 3 years at 10% compound interest?

-Dani deposits Rp1,000,000 at 10% compound interest. After 3 years, the interest earned is calculated as BN = 1,000,000 * (1 + 0.1)^3 - 1, resulting in Rp121,000. The final amount is Rp1,331,000.

What is an annuity (anuitas) and how is it calculated?

-An annuity is a series of equal payments made at regular intervals, consisting of both principal and interest. The formula to calculate the annuity payment is A = m * i / (1 + i)^n - 1, where m is the loan amount, i is the interest rate per period, and n is the number of periods.

How do you calculate the monthly payment for an annuity loan?

-To calculate the monthly payment for an annuity, divide the annual interest rate by 12 to get the monthly interest rate. Then, use the annuity formula to calculate the fixed monthly payment, ensuring that the loan amount and interest rate are accounted for over the specified time period.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade Now5.0 / 5 (0 votes)