How to Prepare a Classified Balance Sheet

Summary

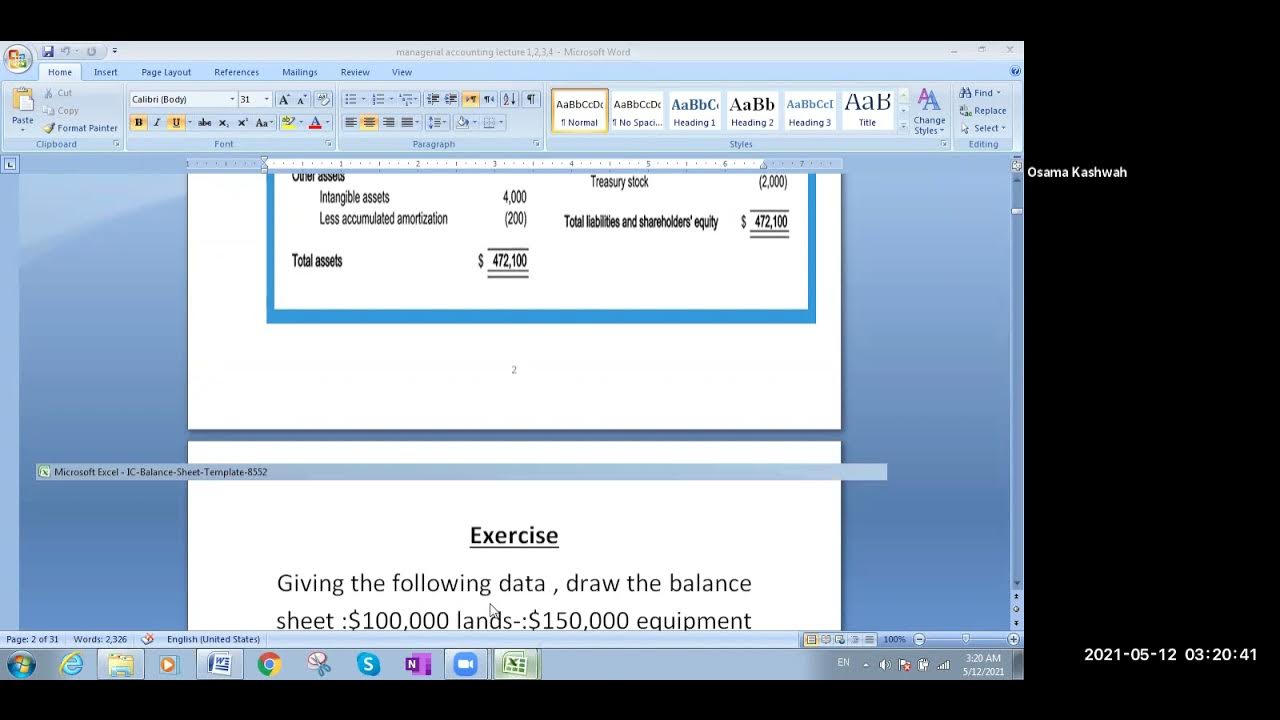

TLDRThis video provides a step-by-step guide to creating a classified balance sheet for a fictional company, Dancing Squirrel. It emphasizes the importance of identifying balance sheet accounts from an adjusted trial balance by eliminating irrelevant accounts, such as expenses and revenues. The presenter explains how to classify accounts into categories like current and non-current assets, liabilities, and equity. A critical part of the process involves calculating the ending balance of retained earnings after accounting for net income and dividends. The video concludes with a detailed presentation of the balance sheet, ensuring that total assets equal total liabilities and equity.

Takeaways

- 😀 Identify balance sheet accounts by reviewing the adjusted trial balance and excluding irrelevant accounts.

- 📊 Only include accounts that belong on the balance sheet, such as common stock, long-term debt, and retained earnings.

- 🗂 Classify balance sheet accounts into categories like current assets, non-current assets, current liabilities, non-current liabilities, and equity.

- 🛠 Common stock and retained earnings are classified as equity accounts.

- 📉 Long-term debt is classified as a non-current liability.

- 🏦 Current assets are listed in order of liquidity, starting with cash.

- 🔍 Ensure to net equipment with accumulated depreciation when presenting non-current assets.

- 📅 The balance sheet is prepared as of a specific date, showing the company's financial position at that moment.

- 🔄 Calculate ending retained earnings by adjusting the beginning balance with net income and dividends.

- ✅ Total assets must equal the total liabilities and equity, confirming the balance sheet is balanced.

Q & A

What is the first step in creating a classified balance sheet?

-The first step is to identify all the balance sheet accounts by going through the adjusted trial balance and crossing out accounts that don't belong on the balance sheet, such as expenses and revenues.

How do you classify balance sheet accounts?

-Balance sheet accounts are classified into categories such as current assets, non-current assets, current liabilities, non-current liabilities, and equity.

What types of accounts are typically crossed out when identifying balance sheet accounts?

-Accounts such as dividends, SG&A expenses, interest expenses, sales revenue, and income tax expenses are typically crossed out since they belong to the income statement, not the balance sheet.

What notation is used to indicate different types of accounts in the classification process?

-Notations such as 'E' for equity, 'NCL' for non-current liabilities, 'NCA' for non-current assets, and 'CL' for current liabilities are used to categorize the accounts.

Why can't you directly use the retained earnings balance from the adjusted trial balance?

-You cannot directly use the retained earnings balance because the temporary accounts (revenue, expense, and dividends) have not been closed out yet, which affects the ending balance of retained earnings.

What is the significance of the date on a balance sheet?

-The date on a balance sheet signifies a specific point in time, indicating that the financial position presented is accurate as of that date.

How should current assets be presented on a balance sheet?

-Current assets should be presented in order of liquidity, starting with cash, followed by accounts receivable, inventory, and so on.

How is net equipment calculated in the non-current assets section?

-Net equipment is calculated by subtracting accumulated depreciation from the total equipment value. For example, if equipment is valued at $50,000 and accumulated depreciation is $12,000, net equipment would be $38,000.

What formula is used to calculate the ending balance of retained earnings?

-The formula used is: Ending Retained Earnings = Beginning Retained Earnings + Net Income - Dividends.

What does it mean when total assets equal total liabilities and equity?

-When total assets equal total liabilities and equity, it reflects the accounting equation (Assets = Liabilities + Equity), indicating that the company's resources are financed either by debt or by the owners' equity.

Outlines

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantMindmap

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantKeywords

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantHighlights

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantTranscripts

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantVoir Plus de Vidéos Connexes

Define Company

Cara Belajar Accurate Untuk Pemula Menggunakan Persiapan Standar Dengan Mudah Dan Cepat

excell & balance sheet main one

Difference in Opening Balances in Tally - Easily Remove with Simple Steps

PART 8 PEMBUATAN APLIKASI EXCEL AKUNTANSI 2023 | NERACA - POSISI KEUANGAN

LAPORAN KEUANGAN PERUSAHAAN DAGANG

5.0 / 5 (0 votes)